Region:Asia

Author(s):Geetanshi

Product Code:KRAD0122

Pages:84

Published On:August 2025

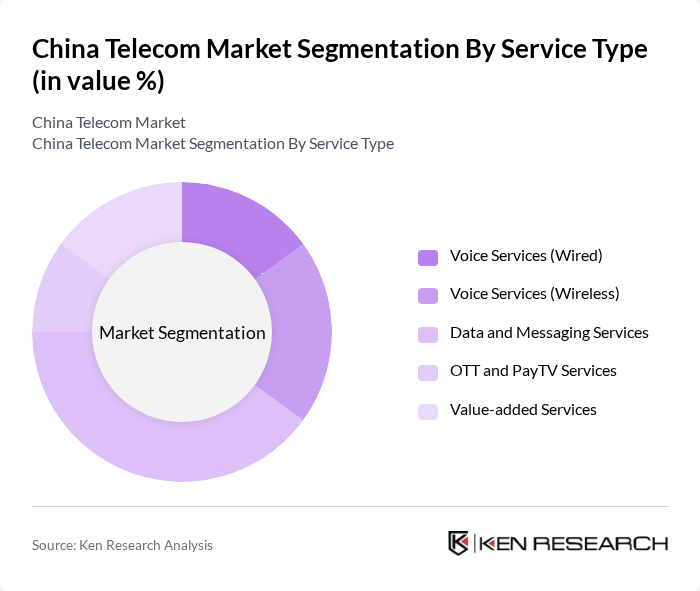

By Service Type:The service type segmentation includes offerings such as voice services (wired and wireless), data services, over-the-top (OTT) and PayTV services, and value-added services. Among these, data and messaging services are currently dominating the market due to the increasing reliance on mobile data for communication, entertainment, and business applications. The proliferation of smartphones, the rollout of 5G, and the demand for high-speed internet have led to a surge in data consumption, making this segment a critical driver of revenue growth .

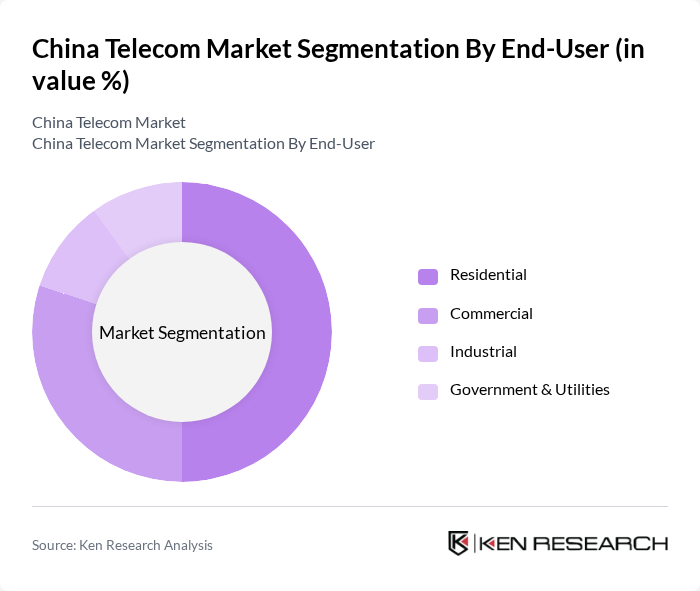

By End-User:The end-user segmentation encompasses residential, commercial, industrial, and government sectors. The residential segment is leading the market, driven by the increasing number of households adopting broadband and mobile services. The shift towards remote work, online education, and digital entertainment has further accelerated the demand for reliable internet connectivity in homes, making this segment pivotal for service providers .

The China Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Mobile Limited, China Unicom (Hong Kong) Limited, China Telecom Corporation Limited, Huawei Technologies Co., Ltd., ZTE Corporation, China Broadcasting Network Corporation Limited, China Tower Corporation Limited, Tencent Holdings Limited, Alibaba Group Holding Limited, Xiaomi Corporation, Baidu, Inc., JD.com, Inc., Meituan Dianping, Didi Chuxing Technology Co., ByteDance Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China telecom market appears promising, driven by technological advancements and evolving consumer preferences. The ongoing rollout of 5G technology is expected to facilitate the growth of smart applications, enhancing user experiences. Additionally, the increasing integration of artificial intelligence in customer service and network management will likely improve operational efficiency. As rural connectivity initiatives gain momentum, telecom operators will have opportunities to expand their customer base and service offerings, ensuring sustained growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Voice Services (Wired) Voice Services (Wireless) Data and Messaging Services OTT and PayTV Services Value-added Services |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North China South China East China West China |

| By Technology | G Technology G Technology Fiber Optic Technology Satellite Communication |

| By Application | Personal Communication Business Communication Emergency Services Entertainment Services |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Research Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse income levels |

| Broadband Subscribers | 90 | Household decision-makers, IT professionals |

| Enterprise Telecom Solutions | 60 | IT Managers, Procurement Officers in SMEs |

| Rural Telecom Access | 50 | Community leaders, Local business owners |

| 5G Technology Adoption | 70 | Tech-savvy consumers, Industry experts |

The China Telecom Market is valued at approximately USD 490 billion, driven by the rapid expansion of digital infrastructure, increased mobile penetration, and the rising demand for high-speed internet services, particularly in urban and rural areas.