Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0372

Pages:83

Published On:August 2025

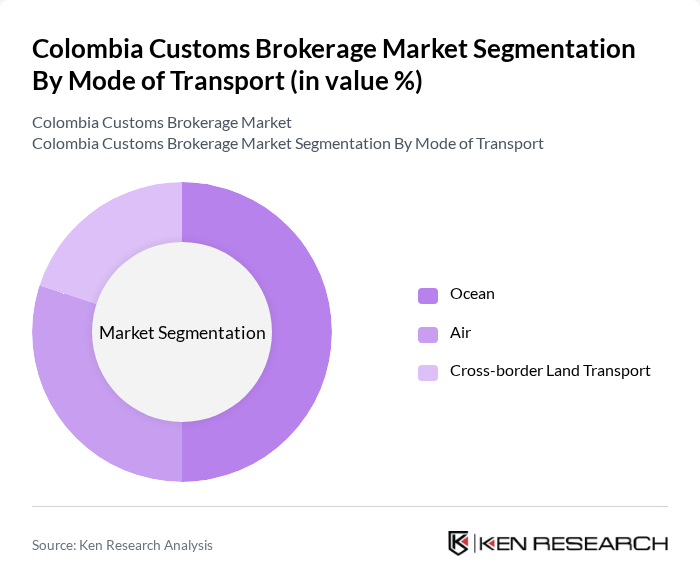

By Mode of Transport:The customs brokerage market is segmented by mode of transport, which includes ocean, air, and cross-border land transport. Each mode serves different logistical needs and is influenced by factors such as cost, speed, and the nature of the goods being transported. Ocean transport is typically preferred for bulk and containerized goods due to cost-effectiveness, while air transport is favored for high-value or time-sensitive shipments. Cross-border land transport is essential for trade with neighboring countries, particularly for regional distribution and perishable goods .

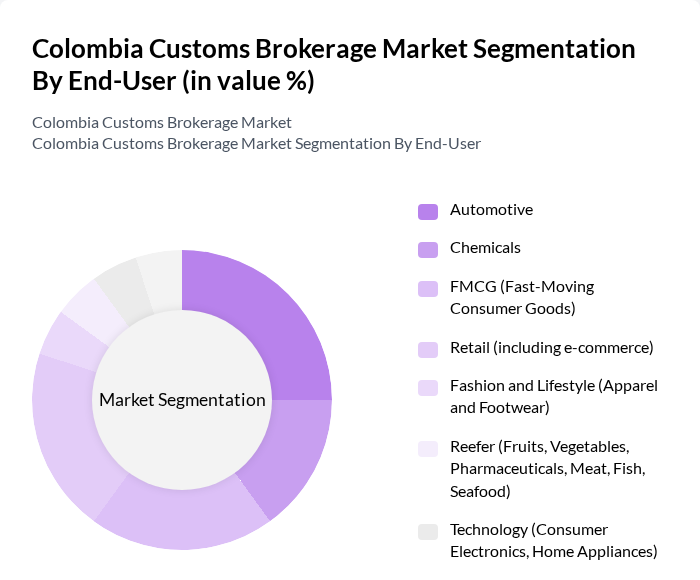

By End-User:The end-user segmentation includes industries such as automotive, chemicals, FMCG, retail (including e-commerce), fashion and lifestyle, reefer (fruits, vegetables, pharmaceuticals, meat, fish, seafood), technology, and other end users. The automotive and FMCG sectors are particularly significant, driven by high demand for imported components and finished goods, as well as the need for efficient supply chain management. The rapid growth of e-commerce has also increased demand for customs brokerage services in the retail sector, especially for cross-border shipments and last-mile delivery .

The Colombia Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding Colombia, Kuehne + Nagel Colombia, DB Schenker Colombia, Agencia de Aduanas Siaco S.A. Nivel 1, and Agencia de Aduanas Gama S.A. Nivel 1 contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Colombia customs brokerage market appears promising, driven by ongoing digital transformation and increasing global trade dynamics. As e-commerce continues to expand, customs brokers will play a pivotal role in facilitating cross-border transactions. Furthermore, the government's commitment to improving trade facilitation measures will likely enhance operational efficiencies. With a focus on sustainability and automation, the industry is poised for significant advancements, positioning itself as a key player in the logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Ocean Air Cross-border Land Transport |

| By End-User | Automotive Chemicals FMCG (Fast-Moving Consumer Goods) Retail (including e-commerce) Fashion and Lifestyle (Apparel and Footwear) Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, Seafood) Technology (Consumer Electronics, Home Appliances) Other End Users |

| By Service Type | Customs Clearance Customs Consulting Services Freight Forwarding Warehousing Other Services |

| By Industry Vertical | Automotive Pharmaceuticals Electronics Chemicals Retail Others |

| By Geographic Coverage | Major Ports (e.g., Cartagena, Buenaventura, Barranquilla) Inland Cities (e.g., Bogotá, Medellín, Cali) Border Crossings Others |

| By Customer Type | B2B B2C Government Others |

| By Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Customs Brokerage Services | 100 | Customs Brokers, Freight Forwarders |

| Import/Export Compliance | 80 | Compliance Officers, Trade Managers |

| Logistics and Supply Chain Management | 70 | Logistics Managers, Supply Chain Directors |

| Industry-Specific Brokerage Needs | 60 | Procurement Officers, Operations Managers |

| Impact of Trade Policies | 50 | Policy Analysts, Economic Advisors |

The Colombia Customs Brokerage Market is valued at approximately USD 320 million, driven by increasing international trade, e-commerce growth, and the need for efficient logistics solutions. This valuation reflects a five-year historical analysis and proportional allocation from the Latin America market.