Region:Africa

Author(s):Shubham

Product Code:KRAA0883

Pages:92

Published On:August 2025

By Service Type:The service type segmentation includes Import Customs Brokerage, Export Customs Brokerage, Customs Clearance Services, Consulting & Compliance Services, Documentation & Filing Services, Risk Assessment & Tariff Calculation, and Others. Among these, Import Customs Brokerage is the leading sub-segment, driven by the increasing volume of imports into Egypt, particularly in consumer goods and raw materials. The demand for efficient customs clearance processes has led to a rise in specialized services that address the complexities of import regulations and compliance requirements .

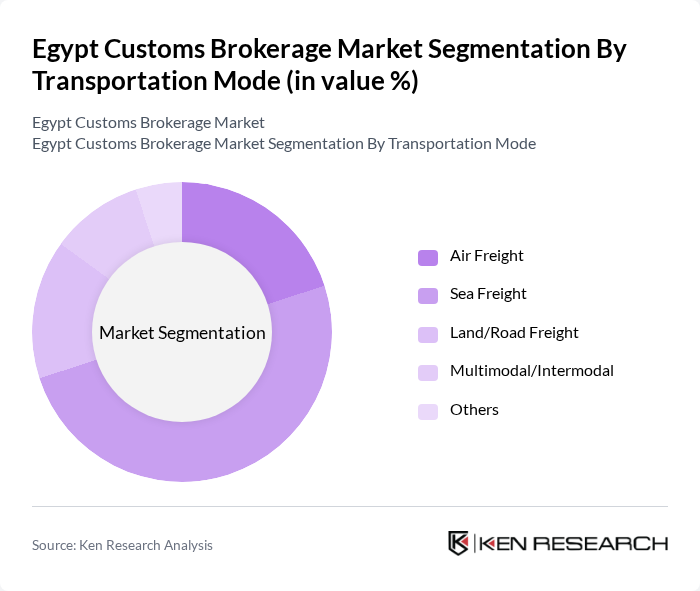

By Transportation Mode:The transportation mode segmentation includes Air Freight, Sea Freight, Land/Road Freight, Multimodal/Intermodal, and Others. Sea Freight is the dominant mode due to Egypt's extensive coastline and major ports, which facilitate bulk shipping of goods. The growth of international trade and the need for cost-effective shipping solutions have further solidified the position of sea freight as the preferred transportation method for customs brokerage services. Air freight is also gaining traction for high-value and time-sensitive shipments, while land and multimodal options support regional connectivity .

The Egypt Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egytrans (Egyptian Transport & Logistics Co.), Khedivial Marine Logistics (KML), DB Schenker Egypt, DHL Global Forwarding Egypt, Agility Logistics Egypt, Kuehne + Nagel Egypt, Expeditors International Egypt, CEVA Logistics Egypt, Panalpina Egypt (now DSV Panalpina), Geodis Egypt, UPS Supply Chain Solutions Egypt, FedEx Trade Networks Egypt, Maersk Egypt, and Mediterranean Shipping Company (MSC) Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt customs brokerage market appears promising, driven by ongoing government reforms and technological advancements. As trade volumes continue to rise, the demand for efficient customs clearance services will increase. The integration of digital technologies is expected to enhance operational efficiency, while government initiatives will likely simplify regulatory processes. These factors will create a more conducive environment for businesses, fostering growth and attracting foreign investment in the customs brokerage sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Import Customs Brokerage Export Customs Brokerage Customs Clearance Services Consulting & Compliance Services Documentation & Filing Services Risk Assessment & Tariff Calculation Others |

| By Transportation Mode | Air Freight Sea Freight Land/Road Freight Multimodal/Intermodal Others |

| By End-User Industry | Manufacturing Retail & E-commerce Automotive & Aerospace Chemicals & Petrochemicals Food & Beverage Pharmaceuticals & Healthcare Consumer Electronics Textiles & Apparel Agriculture & Agro-exports Others |

| By Client Type | Individual Importers/Exporters SMEs Large Enterprises Government Agencies Others |

| By Geographic Coverage | Alexandria Port Region Port Said & Suez Canal Zone Cairo & Urban Centers Upper Egypt Others |

| By Pricing Model | Fixed Fee Transaction-Based Subscription/Retainer Value-Added Service Bundling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Customs Brokerage Services | 100 | Customs Brokers, Freight Forwarders |

| Import/Export Compliance | 60 | Compliance Officers, Trade Managers |

| Logistics and Supply Chain Management | 50 | Logistics Managers, Supply Chain Directors |

| Sector-Specific Customs Challenges | 40 | Industry Experts, Regulatory Affairs Specialists |

| Technology Adoption in Customs Processes | 40 | IT Managers, Operations Managers |

The Egypt Customs Brokerage Market is valued at approximately USD 1.1 billion, reflecting growth driven by increased trade activities, government initiatives to streamline customs processes, and the expansion of logistics infrastructure in the region.