Region:Asia

Author(s):Shubham

Product Code:KRAA0874

Pages:91

Published On:August 2025

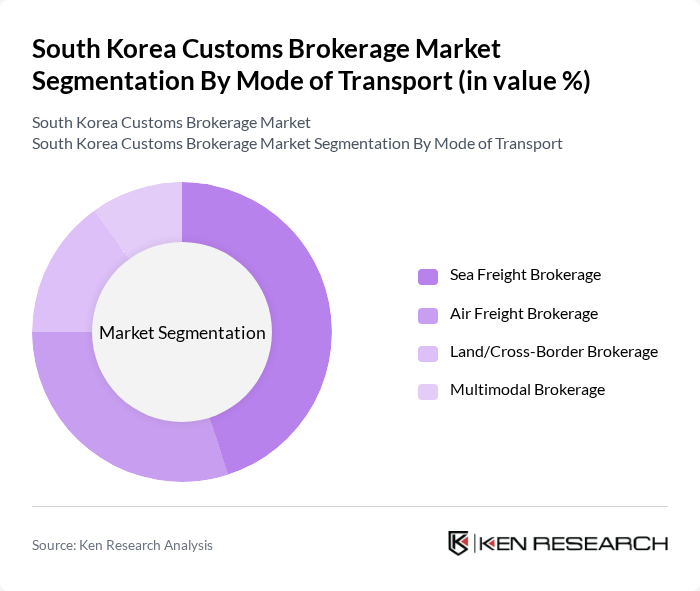

By Mode of Transport:The customs brokerage market is segmented by mode of transport, which includes various methods of shipping goods across borders. The primary modes are sea freight, air freight, land/cross-border, and multimodal brokerage. Each mode has its unique advantages and caters to different types of cargo and customer needs.

The sea freight brokerage segment dominates the market due to its cost-effectiveness for transporting large volumes of goods. This mode is particularly favored for international trade, where shipping by sea is often the most economical option. The increasing globalization of supply chains and the rise in containerized shipping have further solidified the position of sea freight brokerage as the leading segment. Air freight, while more expensive, is gaining traction for time-sensitive shipments, especially in the e-commerce sector .

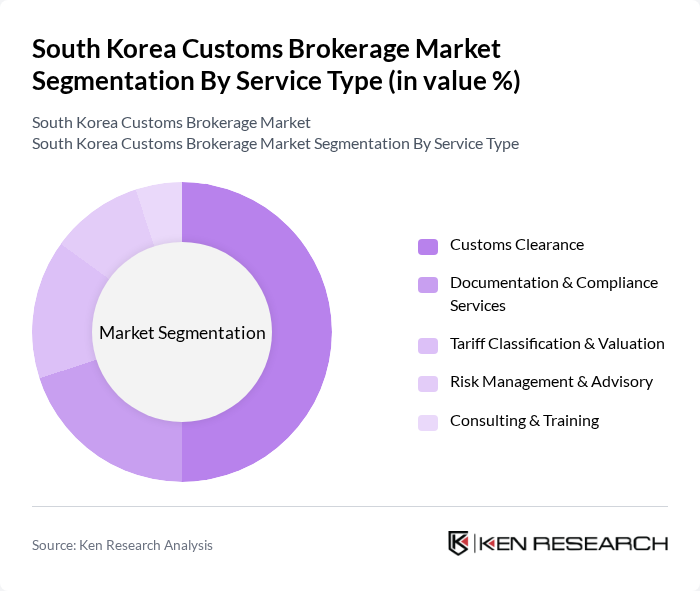

By Service Type:The customs brokerage market is also segmented by service type, which includes customs clearance, documentation and compliance services, tariff classification and valuation, risk management and advisory, and consulting and training. Each service type plays a crucial role in facilitating smooth customs operations.

Customs clearance services are the most significant segment in the market, accounting for half of the total share. This is largely due to the essential nature of these services in ensuring that goods comply with local regulations and can be imported or exported without delays. The increasing complexity of international trade regulations has heightened the demand for documentation and compliance services, while risk management and advisory services are becoming increasingly important as businesses seek to mitigate potential customs-related risks .

The South Korea Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, CJ Logistics, Hyundai Glovis, DB Schenker Korea, Kuehne + Nagel Korea, DSV Air & Sea Korea, Yusen Logistics Korea, DHL Global Forwarding Korea, Panalpina Korea (now part of DSV), Agility Logistics Korea, Expeditors Korea, Nippon Express Korea, Geodis Korea, Sinotrans Korea, Pantos Logistics (LG CNS) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean customs brokerage market is poised for significant evolution, driven by technological integration and regulatory changes. As automation and data analytics become more prevalent, brokers will enhance operational efficiencies and service offerings. Additionally, the increasing focus on sustainability will prompt brokers to adopt eco-friendly practices. These trends, coupled with the expansion of e-commerce and cross-border trade, will create a dynamic environment for customs brokerage services, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Sea Freight Brokerage Air Freight Brokerage Land/Cross-Border Brokerage Multimodal Brokerage |

| By Service Type | Customs Clearance Documentation & Compliance Services Tariff Classification & Valuation Risk Management & Advisory Consulting & Training |

| By End-User Industry | Manufacturing Retail & E-commerce Automotive Electronics Pharmaceuticals & Healthcare Food & Beverage Chemicals Others |

| By Client Type | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Others |

| By Geographic Coverage | Intra-Korea Asia-Pacific Global/International Others |

| By Pricing Model | Fixed Fee Transaction-Based Subscription/Retainer Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Import Sector Customs Brokerage | 100 | Customs Brokers, Import Managers |

| Export Sector Customs Services | 80 | Export Managers, Logistics Coordinators |

| Regulatory Compliance in Customs | 60 | Compliance Officers, Legal Advisors |

| Technology Integration in Customs Brokerage | 50 | IT Managers, Operations Directors |

| Market Trends and Challenges | 70 | Industry Analysts, Trade Experts |

The South Korea Customs Brokerage Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by increasing international trade, cross-border e-commerce, and the need for efficient customs clearance processes.