Region:Asia

Author(s):Geetanshi

Product Code:KRAA0252

Pages:84

Published On:August 2025

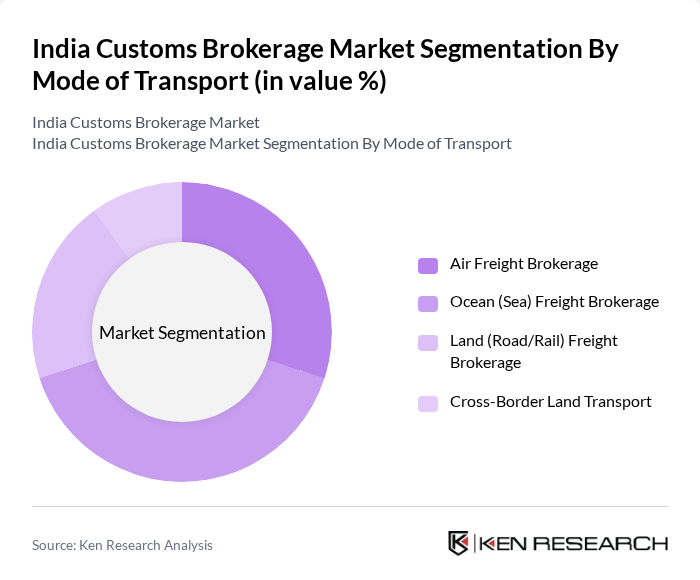

By Mode of Transport:The customs brokerage market is segmented by mode of transport, which includes various methods of shipping goods across borders. The primary modes are air freight, ocean freight, land transport, and cross-border land transport. Each mode has distinct advantages and is selected based on factors such as cost, speed, and the nature of the goods. Air freight is typically preferred for high-value and time-sensitive shipments, while ocean freight is favored for bulk and heavy goods due to its cost-effectiveness. Land and cross-border land transport are essential for regional trade and last-mile connectivity .

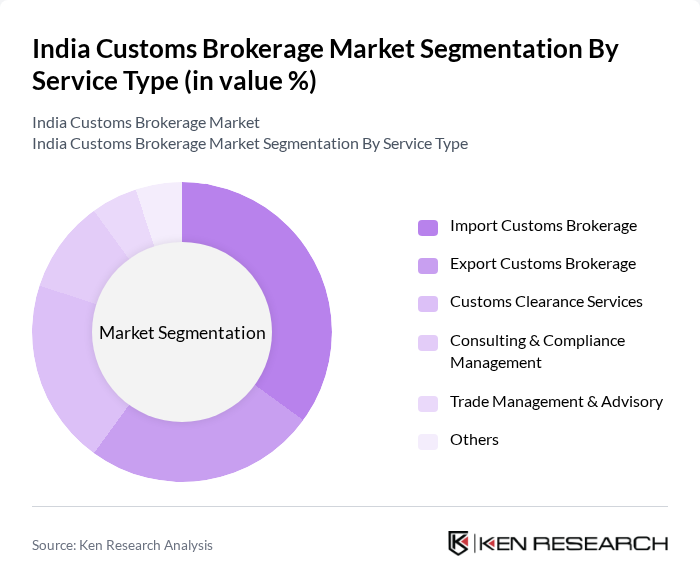

By Service Type:The customs brokerage market is also segmented by service type, which includes a range of offerings to facilitate customs clearance. These include import and export customs brokerage, customs clearance services, consulting and compliance management, trade management, and advisory services. Customs clearance services remain the most critical for ensuring regulatory compliance and timely movement of goods, while consulting and advisory services are increasingly sought after for navigating evolving trade policies and digital compliance requirements .

The India Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding India, Blue Dart Express Ltd., DB Schenker India, Kuehne + Nagel India, Agility Logistics Pvt. Ltd., C.H. Robinson Worldwide Freight India Pvt. Ltd., Allcargo Logistics Ltd., Gati Ltd., Xpressbees, TCI Freight (Transport Corporation of India Ltd.), Safexpress Pvt. Ltd., FedEx Express TSCS (India) Pvt. Ltd., Maersk India Pvt. Ltd., Jeena & Company, Total Transport Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India customs brokerage market appears promising, driven by ongoing government reforms and technological advancements. As the trade volume continues to rise, customs brokers will play a crucial role in facilitating smooth cross-border transactions. The integration of AI and data analytics is expected to enhance operational efficiency, while the focus on sustainability will shape service offerings. Overall, the market is poised for growth, adapting to evolving trade dynamics and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Air Freight Brokerage Ocean (Sea) Freight Brokerage Land (Road/Rail) Freight Brokerage Cross-Border Land Transport |

| By Service Type | Import Customs Brokerage Export Customs Brokerage Customs Clearance Services Consulting & Compliance Management Trade Management & Advisory Others |

| By End-User Industry | Manufacturing Retail & E-commerce Automotive & Aerospace Pharmaceuticals & Healthcare Chemicals & Petrochemicals Food & Beverage Consumer Electronics Textiles & Apparel Others |

| By Region | North India South India East India West India |

| By Customer Type | SMEs Large Enterprises Government Agencies Individuals Others |

| By Technology Utilization | Manual Processes Semi-Automated Processes Fully Automated Processes Cloud-Based Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Customs Brokerage Services for Textiles | 60 | Customs Brokers, Import Managers |

| Pharmaceutical Import Compliance | 50 | Regulatory Affairs Managers, Supply Chain Directors |

| Electronics Export Documentation | 45 | Export Managers, Logistics Coordinators |

| Automotive Parts Customs Clearance | 40 | Procurement Managers, Customs Compliance Officers |

| Food and Beverage Import Regulations | 55 | Quality Assurance Managers, Import Compliance Specialists |

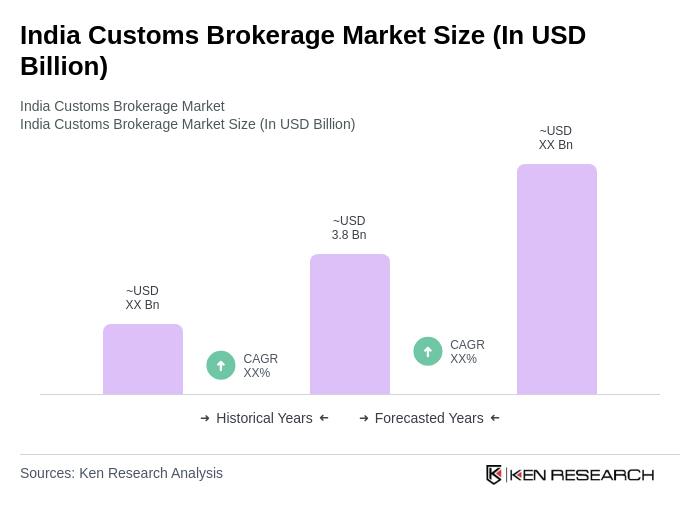

The India Customs Brokerage Market is valued at approximately USD 3.8 billion, driven by increasing international trade, e-commerce expansion, and the need for efficient customs clearance processes.