Region:North America

Author(s):Shubham

Product Code:KRAA0970

Pages:100

Published On:August 2025

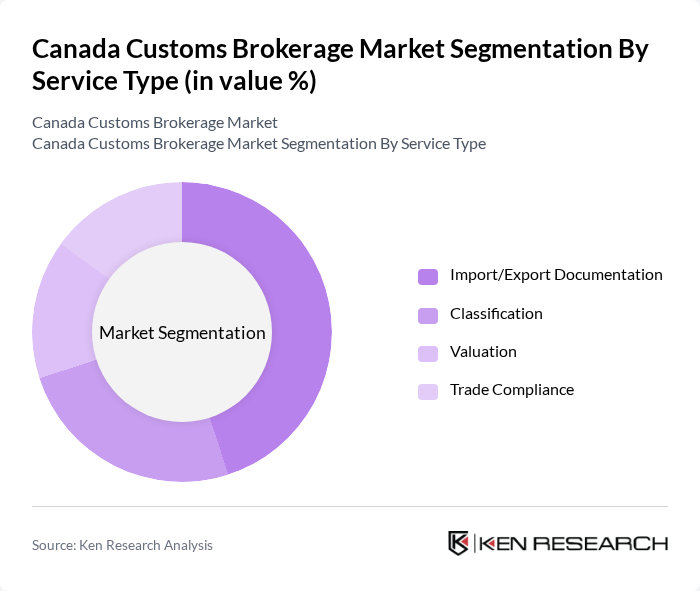

By Service Type:

The service type segmentation includes Import/Export Documentation, Classification, Valuation, and Trade Compliance. Among these, Import/Export Documentation is the leading sub-segment, driven by the increasing complexity of international trade regulations and the need for accurate documentation to avoid delays and penalties. Businesses are prioritizing compliance and efficiency, leading to a higher demand for comprehensive documentation services. The growing e-commerce sector also contributes to this trend, as online retailers require robust customs documentation to facilitate smooth cross-border transactions .

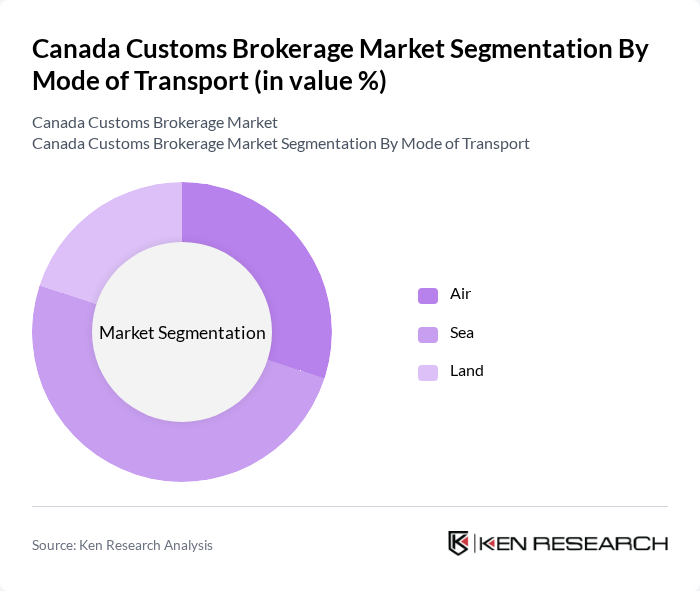

By Mode of Transport:

This segmentation includes Air, Sea, and Land transport modes. The Sea transport mode dominates the market, primarily due to its cost-effectiveness for bulk shipments and the increasing volume of goods transported internationally. The growth of global trade and the expansion of shipping routes have made sea transport a preferred choice for many businesses. Additionally, the rise of e-commerce has led to an increase in containerized shipping, further solidifying the dominance of this mode in the customs brokerage market .

The Canada Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Livingston International, Kuehne + Nagel, DB Schenker, Expeditors International, UPS Supply Chain Solutions, FedEx Trade Networks, DHL Global Forwarding, C.H. Robinson, A.N. Deringer, Farrow, Russell A. Farrow Limited, Cole International, Pacific Customs Brokers, Thompson Ahern International, GEODIS contribute to innovation, geographic expansion, and service delivery in this space .

The Canada customs brokerage market is poised for significant transformation as technological advancements and regulatory reforms continue to shape the industry. The integration of automation and artificial intelligence in customs processes is expected to enhance efficiency and accuracy, reducing clearance times. Additionally, the growing emphasis on sustainability in logistics will drive demand for eco-friendly practices. As businesses increasingly seek compliance and efficiency, customs brokers will need to adapt to these trends to remain competitive and meet evolving client needs.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Import/Export Documentation Classification Valuation Trade Compliance |

| By Mode of Transport | Air Sea Land |

| By End User | Personal Enterprise |

| By Industry Vertical | Retail Manufacturing E-commerce Automotive Pharmaceuticals Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage |

| By Client Type | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Customs Brokerage Services | 60 | Customs Brokers, Compliance Managers |

| Import/Export Operations | 50 | Logistics Coordinators, Supply Chain Managers |

| Regulatory Compliance | 40 | Legal Advisors, Regulatory Affairs Specialists |

| Trade Policy Impact | 40 | Policy Analysts, Trade Economists |

| E-commerce Logistics | 45 | eCommerce Managers, Operations Directors |

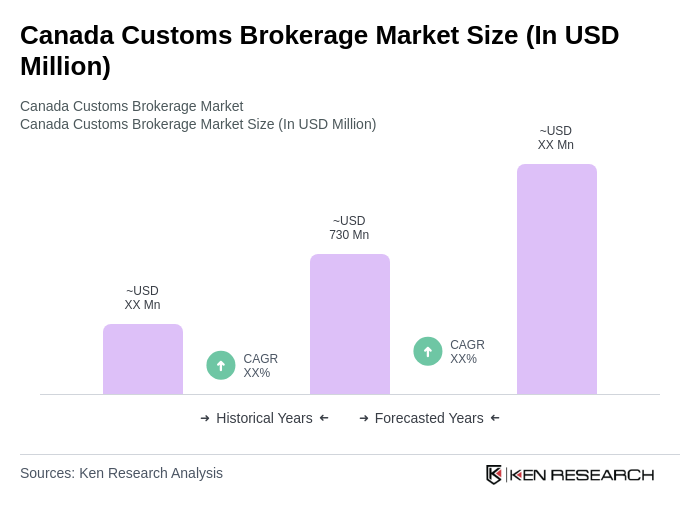

The Canada Customs Brokerage Market is valued at approximately USD 730 million, reflecting growth driven by increasing international trade, complex customs regulations, and the rising demand for efficient logistics solutions, particularly in e-commerce and cross-border transactions.