Region:Central and South America

Author(s):Shubham

Product Code:KRAB4432

Pages:89

Published On:October 2025

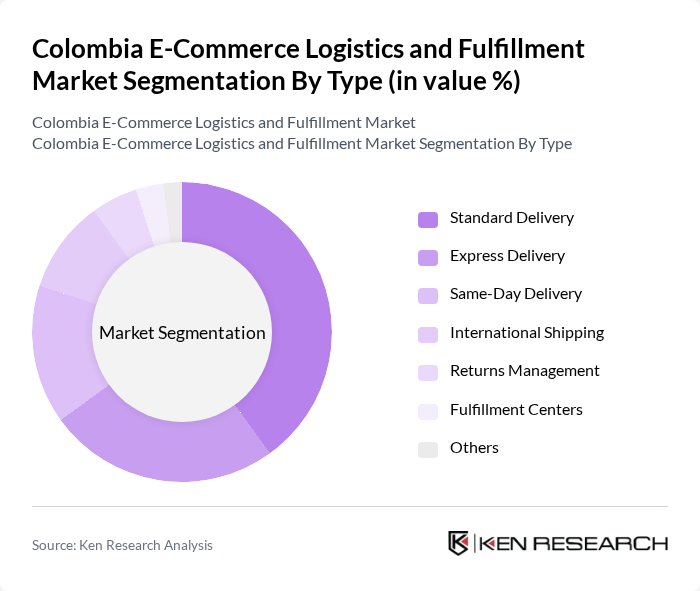

By Type:The market is segmented into various types, including Standard Delivery, Express Delivery, Same-Day Delivery, International Shipping, Returns Management, Fulfillment Centers, and Others. Among these, Standard Delivery is the most widely used due to its cost-effectiveness and reliability, catering to a broad range of consumer needs. Express Delivery is gaining traction as consumers increasingly demand faster shipping options, while Same-Day Delivery is becoming popular in urban areas where immediate access to products is a priority.

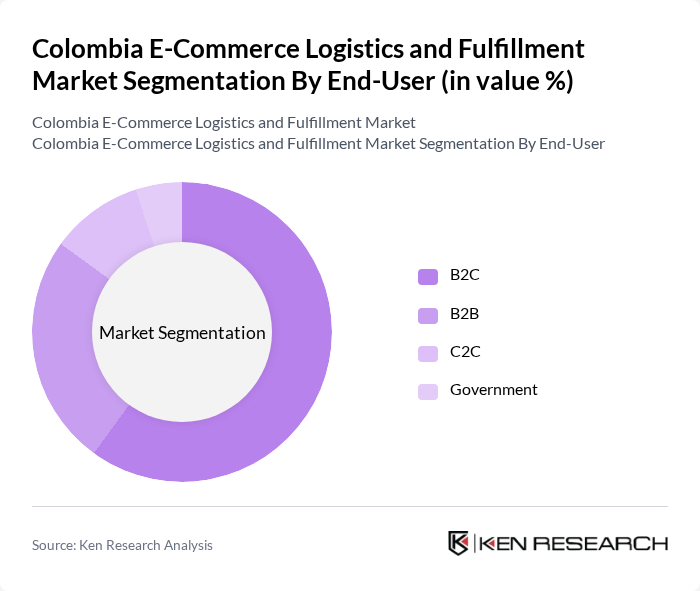

By End-User:The end-user segmentation includes B2C, B2B, C2C, and Government. The B2C segment is the largest, driven by the increasing number of consumers shopping online for convenience and variety. B2B transactions are also significant, as businesses seek efficient logistics solutions to manage their supply chains. C2C platforms are growing, particularly in urban areas, while government contracts for logistics services are becoming more prevalent as e-commerce expands.

The Colombia E-Commerce Logistics and Fulfillment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, Coordinadora, TCC, DHL Colombia, FedEx Colombia, Grupo Logístico Andreani, Envía, Rappi, Mercado Libre, J&T Express, Postobón, Alsea, Grupo Éxito, Linio, Domicilios.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of Colombia's e-commerce logistics and fulfillment market appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI-driven solutions, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely shape logistics strategies, with businesses seeking eco-friendly delivery options. The expansion of e-commerce into rural areas will further enhance market reach, creating new opportunities for logistics providers to cater to underserved populations and drive overall growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery International Shipping Returns Management Fulfillment Centers Others |

| By End-User | B2C B2B C2C Government |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Social Commerce Mobile Apps |

| By Distribution Mode | Road Transport Air Transport Rail Transport Sea Transport |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Retail Logistics | 150 | Logistics Coordinators, E-commerce Directors |

| Last-Mile Delivery Solutions | 100 | Operations Managers, Delivery Service Providers |

| Warehouse Management Systems | 80 | Warehouse Managers, IT Specialists |

| Consumer Returns Handling | 70 | Customer Service Managers, Returns Analysts |

| Logistics Technology Adoption | 90 | IT Managers, Supply Chain Analysts |

The Colombia E-Commerce Logistics and Fulfillment Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased online shopping and demand for efficient delivery services.