Region:Asia

Author(s):Shubham

Product Code:KRAA0742

Pages:95

Published On:August 2025

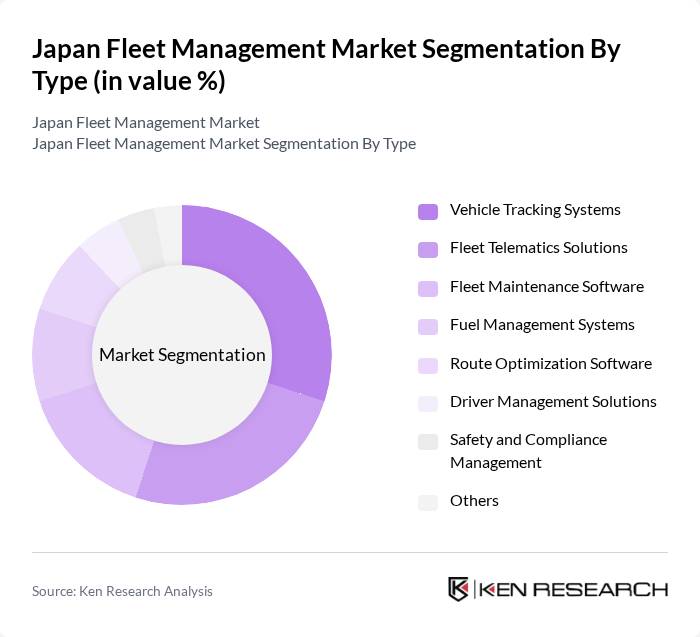

By Type:The market is segmented into various types, including Vehicle Tracking Systems, Fleet Telematics Solutions, Fleet Maintenance Software, Fuel Management Systems, Route Optimization Software, Driver Management Solutions, Safety and Compliance Management, and Others. Among these, Vehicle Tracking Systems and Fleet Telematics Solutions are leading the market due to their critical role in enhancing operational efficiency, real-time monitoring, regulatory compliance, and cost reduction. The increasing need for real-time tracking and monitoring of vehicles, as well as compliance with evolving safety standards, has made these sub-segments particularly popular among fleet operators .

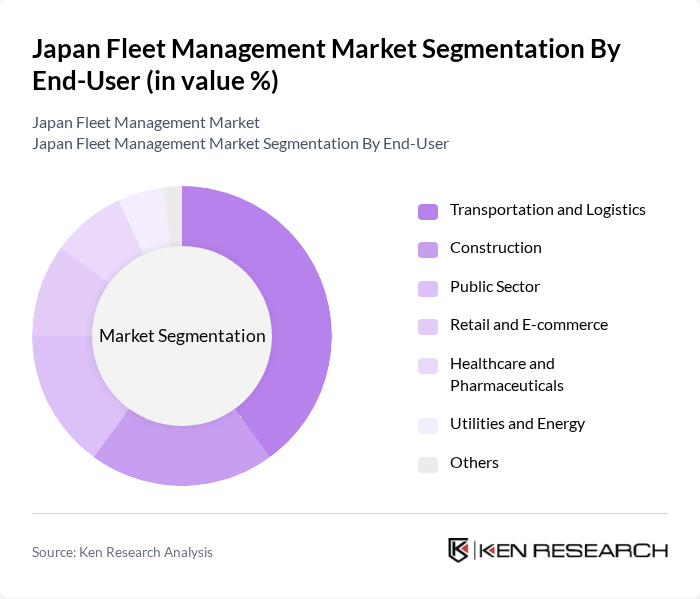

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector, Retail and E-commerce, Healthcare and Pharmaceuticals, Utilities and Energy, and Others. The Transportation and Logistics sector dominates this market segment, driven by the increasing need for efficient supply chain management, regulatory compliance, and the growing demand for timely deliveries. Companies in this sector are increasingly adopting fleet management solutions to enhance operational efficiency, ensure safety, and reduce costs .

The Japan Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Automotive Systems, Ltd., Mitsubishi Fuso Truck and Bus Corporation, Toyota Industries Corporation, Nissan Motor Co., Ltd., Honda Motor Co., Ltd., Denso Corporation, Bridgestone Corporation, SoftBank Corp. (SmartFleet), ZMP Inc., Fleet Complete Japan, Geotab Japan K.K., Omnicomm Japan, TomTom Telematics (Japan), Verizon Connect Japan, Teletrac Navman Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management market in Japan appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt electric vehicles, the demand for innovative fleet management solutions will rise. Additionally, the integration of AI and IoT technologies will enhance operational efficiency and data analytics capabilities. With the e-commerce sector continuing to expand, fleet management solutions will need to adapt to meet evolving logistics demands, ensuring a competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle Tracking Systems Fleet Telematics Solutions Fleet Maintenance Software Fuel Management Systems Route Optimization Software Driver Management Solutions Safety and Compliance Management Others |

| By End-User | Transportation and Logistics Construction Public Sector Retail and E-commerce Healthcare and Pharmaceuticals Utilities and Energy Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Service Type | Software as a Service (SaaS) On-Premise Solutions Hybrid Solutions |

| By Payment Model | Subscription-Based One-Time Purchase Pay-Per-Use |

| By Business Type | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Operations | Commercial Fleets Private Fleets |

| By Communication Range | Short Range Communication Long Range Communication |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transportation Fleet | 60 | Transport Authority Officials, Fleet Supervisors |

| Logistics and Delivery Services | 80 | Logistics Managers, Supply Chain Analysts |

| Corporate Fleet Operations | 50 | Corporate Fleet Managers, Procurement Officers |

| Technology Integration in Fleet Management | 40 | IT Managers, Fleet Technology Specialists |

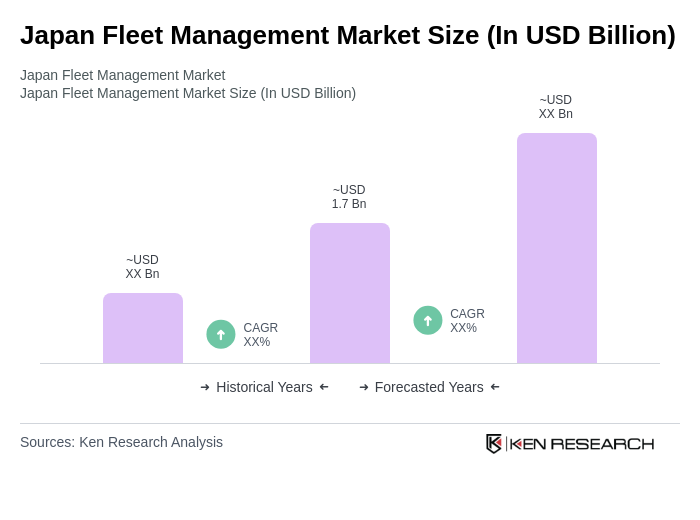

The Japan Fleet Management Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by the demand for efficient fleet operations, safety measures, and advanced telematics solutions.