Region:Central and South America

Author(s):Shubham

Product Code:KRAA0788

Pages:80

Published On:August 2025

Market.png)

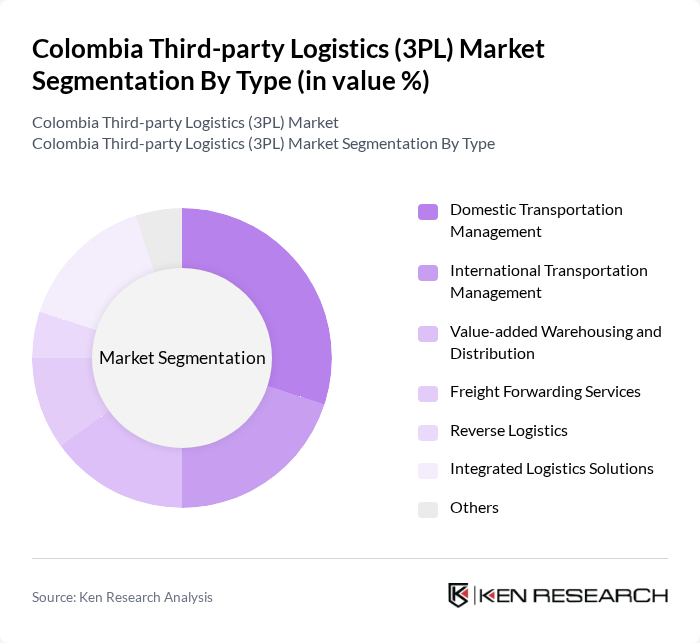

By Type:The market is segmented into various types of services that cater to different logistics needs. The subsegments include Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution, Freight Forwarding Services, Reverse Logistics, Integrated Logistics Solutions, and Others. Among these, Domestic Transportation Management remains the leading subsegment, driven by the increasing demand for efficient local delivery services and the growth of e-commerce. The rise in consumer expectations for faster delivery times has led to a surge in domestic logistics operations, making this segment crucial for 3PL providers. Value-added warehousing and distribution, as well as international transportation management, are also experiencing notable growth due to the increasing complexity of supply chains and Colombia's expanding participation in global trade .

By End-User:The end-user segmentation includes Automotive, FMCG (Fast-Moving Consumer Goods), Retail, Healthcare & Pharmaceuticals, Technology & Electronics, Food and Beverage, Fashion & Lifestyle, and Others. The FMCG sector is the dominant end-user, driven by the need for rapid distribution and inventory management. The increasing consumer demand for fast-moving products has led to a greater reliance on 3PL services to ensure timely delivery and efficient supply chain management. The automotive and retail sectors also contribute significantly to market demand, reflecting the importance of reliable logistics infrastructure for these industries .

The Colombia Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coordinadora Mercantil SA, TCC S.A., Servientrega S.A., DHL Supply Chain Colombia, Kuehne + Nagel Colombia, FedEx Express Colombia, UPS Colombia, XPO Logistics, Aramex Colombia, Logística de Colombia S.A.S., Interrapidísimo S.A., Deprisa (Avianca Cargo), Blu Logistics, Grupo Logístico Andreani, OPL Carga S.A.S. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Colombian 3PL market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt automation and data analytics, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics practices will likely shape the industry, as companies seek to reduce their carbon footprint. The integration of innovative delivery solutions will further enhance service offerings, positioning 3PL providers to meet the dynamic needs of the market effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Management International Transportation Management Value-added Warehousing and Distribution Freight Forwarding Services Reverse Logistics Integrated Logistics Solutions Others |

| By End-User | Automotive FMCG (Fast-Moving Consumer Goods) Retail Healthcare & Pharmaceuticals Technology & Electronics Food and Beverage Fashion & Lifestyle Others |

| By Service Model | Asset-Based 3PL Non-Asset-Based 3PL Hybrid 3PL Others |

| By Distribution Mode | Road Transportation Rail Transportation Air Cargo Ocean Shipping Multimodal Transportation Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C C2C Others |

| By Technology Utilization | Traditional Logistics Digital Logistics Automated Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain | 80 | Production Managers, Procurement Specialists |

| Food and Beverage Distribution | 70 | Warehouse Supervisors, Quality Control Managers |

| Pharmaceutical Logistics | 60 | Regulatory Affairs Managers, Distribution Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Analysts |

The Colombia Third-party Logistics (3PL) Market is valued at approximately USD 4.1 billion, reflecting a significant growth trend driven by the increasing demand for efficient supply chain solutions and the rapid expansion of e-commerce in the region.