Region:Europe

Author(s):Dev

Product Code:KRAA0481

Pages:93

Published On:August 2025

Market.png)

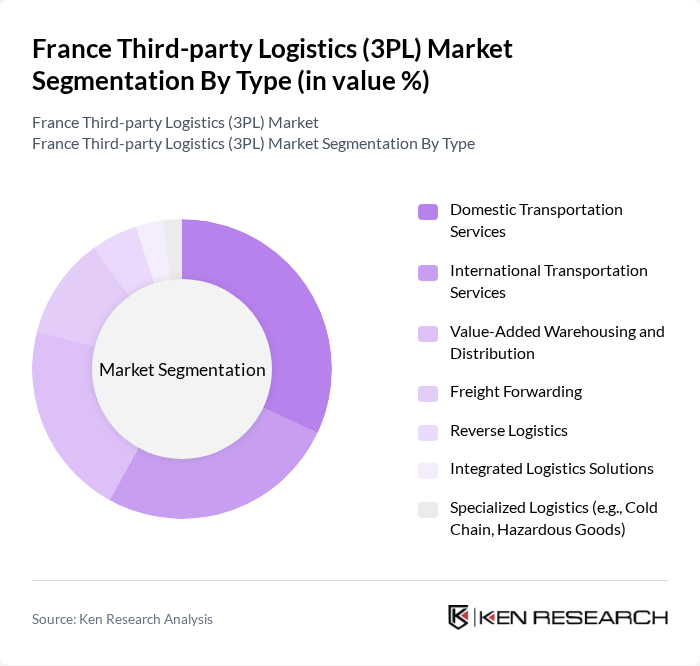

By Type:The market is segmented into various types of services that cater to different logistics needs. The dominant sub-segment is Domestic Transportation Services, which is essential for local distribution and has seen increased demand due to the growth of e-commerce and last-mile delivery. International Transportation Services also play a significant role, driven by globalization and the need for cross-border trade. Value-Added Warehousing and Distribution services are gaining traction as companies seek to enhance their supply chain efficiency through inventory management, packaging, and order fulfillment .

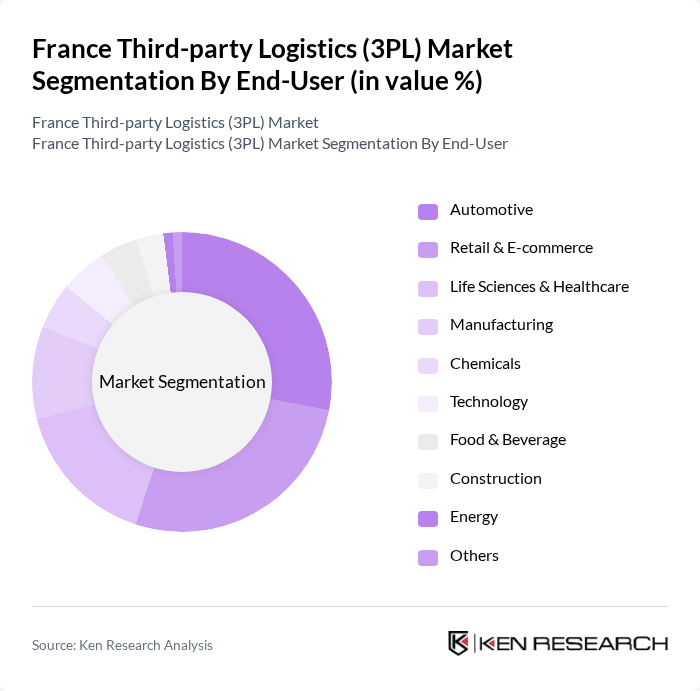

By End-User:The end-user segmentation reveals that the Automotive and Retail & E-commerce sectors are the largest consumers of 3PL services. The Automotive sector relies heavily on logistics for just-in-time delivery and supply chain management, while Retail & E-commerce has surged due to the online shopping boom and demand for rapid fulfillment. Other sectors like Life Sciences & Healthcare and Manufacturing are also significant, driven by the need for specialized logistics solutions such as temperature-controlled transport and compliance with regulatory requirements .

The France Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, XPO Logistics, DB Schenker, Kuehne + Nagel, DPDgroup, DHL Supply Chain, CEVA Logistics, Bolloré Logistics, Groupe CAT, Rhenus Logistics, ID Logistics, FM Logistic, Stef, Groupe Charles André, Heppner contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France 3PL market appears promising, driven by the ongoing digital transformation and the integration of advanced technologies. As companies increasingly prioritize efficiency and sustainability, 3PL providers are expected to innovate their service offerings. The focus on omnichannel logistics will also reshape the landscape, enabling businesses to meet diverse consumer demands. Overall, the market is poised for growth, with significant investments in technology and infrastructure anticipated in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Services International Transportation Services Value-Added Warehousing and Distribution Freight Forwarding Reverse Logistics Integrated Logistics Solutions Specialized Logistics (e.g., Cold Chain, Hazardous Goods) |

| By End-User | Automotive Retail & E-commerce Life Sciences & Healthcare Manufacturing Chemicals Technology Food & Beverage Construction Energy Others |

| By Service Model | Asset-Based 3PL Non-Asset-Based 3PL Hybrid 3PL Others |

| By Technology Adoption | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Internet of Things (IoT) Automation & Robotics Blockchain Technology Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Cross-Border Coverage Others |

| By Delivery Mode | Road Transport Rail Transport Air Transport Sea Transport Multimodal Transport Others |

| By Customer Type | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 60 | Logistics Directors, Supply Chain Managers |

| Pharmaceutical Distribution | 40 | Operations Managers, Compliance Officers |

| Automotive Supply Chain Solutions | 45 | Procurement Managers, Logistics Coordinators |

| Food and Beverage Logistics | 50 | Warehouse Managers, Quality Assurance Leads |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Customer Experience Managers |

The France Third-party Logistics (3PL) Market is valued at approximately USD 35 billion, reflecting significant growth driven by the demand for efficient supply chain management and the expansion of e-commerce.