Commercial Real Estate Market Overview

- The Commercial Real Estate Market is valued at USD 650 billion, based on a five-year historical analysis of global transaction volumes and sector performance. This valuation reflects recent market corrections and the impact of rising interest rates, with growth primarily driven by increasing urbanization, sustained demand for logistics and warehousing facilities due to e-commerce expansion, and ongoing investments in multifamily residential and mixed-use developments. The post-pandemic environment has also accelerated the adoption of flexible workspace solutions and digital transformation across the sector, while industrial and multifamily segments remain particularly resilient.

- Key players in this market include the United States, China, and Germany, which dominate due to their robust economic frameworks, high levels of foreign direct investment, and significant urban populations. The United States remains a leader in office and retail spaces, while China is rapidly expanding its industrial and logistics sectors. Germany's strong economy and strategic location in Europe further enhance its market position.

- The Opportunity Zones program, established under the Tax Cuts and Jobs Act, 2017 and administered by the U.S. Department of the Treasury, continues to incentivize long-term investments in low-income communities. This initiative offers tax benefits for investors who develop properties in designated areas, stimulating economic growth and revitalizing neighborhoods, with ongoing impact on the commercial real estate landscape.

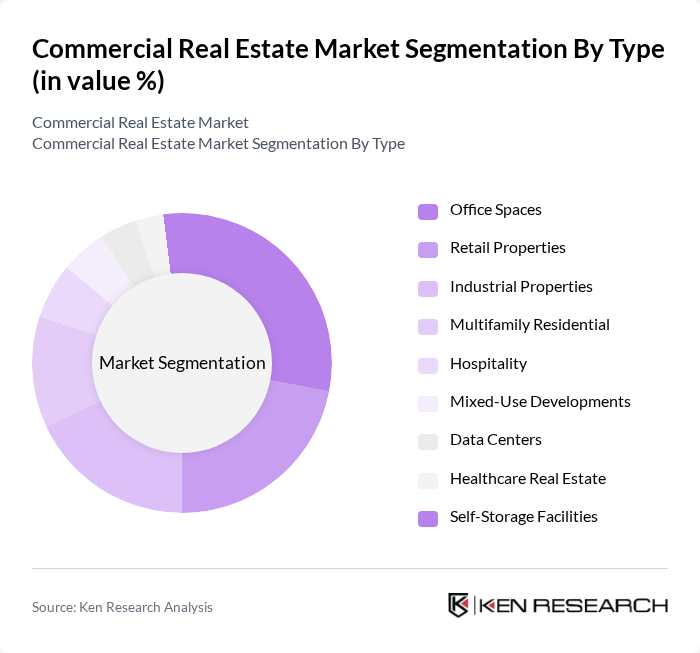

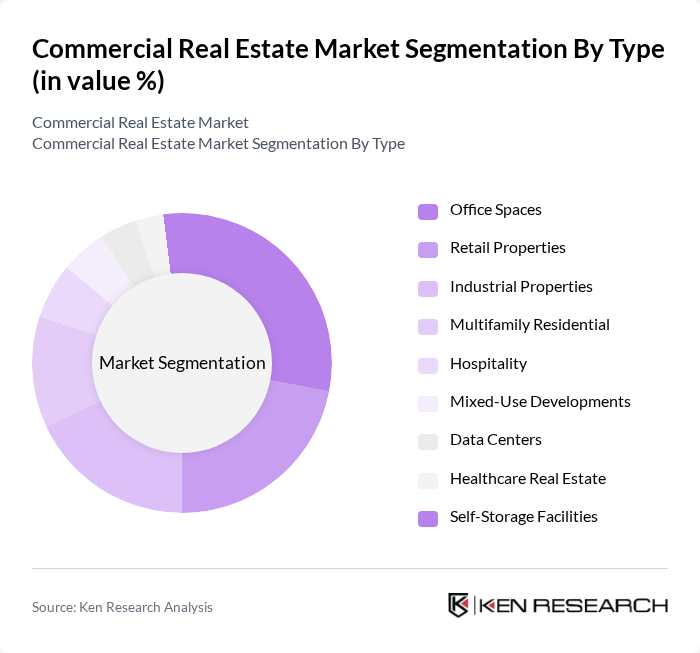

Commercial Real Estate Market Segmentation

By Type:The commercial real estate market is segmented into office spaces, retail properties, industrial properties, multifamily residential, hospitality, mixed-use developments, data centers, healthcare real estate, and self-storage facilities. Office spaces and retail properties have traditionally led the market, but recent trends show accelerated growth in industrial, logistics, and multifamily segments, driven by e-commerce, supply chain optimization, and changing consumer preferences. Data centers and healthcare real estate are also emerging as high-growth segments due to digitalization and demographic shifts.

By End-User:The end-user segmentation of the commercial real estate market includes corporations, government entities, non-profit organizations, institutional investors, and real estate investment trusts (REITs). Corporations and institutional investors remain the most significant players, leveraging substantial capital and long-term investment strategies. REITs are increasingly active in logistics, multifamily, and data center assets, while government entities focus on public infrastructure and urban renewal projects.

Commercial Real Estate Market Competitive Landscape

The Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle Incorporated), Colliers International Group Inc., Cushman & Wakefield plc, Knight Frank LLP, Savills plc, Hines Interests Limited Partnership, Prologis, Inc., Brookfield Properties, Blackstone Inc., Related Companies, Tishman Speyer, AvalonBay Communities, Inc., Equity Residential, and Vornado Realty Trust contribute to innovation, geographic expansion, and service delivery in this space.

Commercial Real Estate Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization continues to drive demand for commercial real estate, with the United Nations projecting that in future, approximately 56% of the global population will reside in urban areas. This shift translates to an increased need for office spaces, retail outlets, and mixed-use developments. In None, urban centers are experiencing a population growth rate of 1.2 million annually, necessitating the expansion of commercial properties to accommodate this influx and support local economies.

- Rising Demand for Office Spaces:The demand for office spaces in None is projected to reach 15 million square feet in future, driven by a robust job market and a surge in professional services. According to the Bureau of Labor Statistics, employment in professional and business services is expected to grow by 7% in future, further fueling the need for modern office environments. This trend is particularly evident in tech hubs, where companies seek flexible and collaborative workspaces to attract talent.

- Growth in E-commerce and Logistics:The e-commerce sector in None is anticipated to grow by USD 10 billion in future, leading to increased demand for logistics and warehousing spaces. As online retail sales continue to rise, companies are investing in distribution centers to enhance supply chain efficiency. The National Retail Federation reports that e-commerce sales accounted for 14% of total retail sales in future, underscoring the critical need for commercial real estate that supports this booming industry.

Market Challenges

- Economic Uncertainty:Economic uncertainty poses a significant challenge to the commercial real estate market in None. The IMF forecasts a global economic growth rate of approximately 3% in future, which may lead to cautious investment behavior. Local businesses are hesitant to commit to long-term leases amid fluctuating market conditions, resulting in increased vacancy rates. This uncertainty can hinder new developments and impact overall market stability, making it difficult for investors to gauge future returns.

- Regulatory Hurdles:Navigating regulatory hurdles remains a challenge for commercial real estate developers in None. The average time to obtain necessary permits and approvals can exceed 12 months, according to local government reports. This lengthy process can delay project timelines and increase costs, discouraging potential investors. Additionally, stringent zoning laws and land use regulations can limit development opportunities, particularly in high-demand urban areas, further complicating market dynamics.

Commercial Real Estate Market Future Outlook

The commercial real estate market in None is poised for transformation as urbanization and technological advancements reshape the landscape. In future, the integration of smart technologies in buildings is expected to enhance operational efficiency and tenant satisfaction. Additionally, the rise of hybrid work models will drive demand for flexible office spaces, prompting developers to adapt their offerings. As sustainability becomes a priority, investments in green buildings will likely increase, aligning with global trends toward environmentally responsible practices.

Market Opportunities

- Development of Smart Cities:The push for smart city initiatives presents a significant opportunity for commercial real estate in None. Investments in infrastructure and technology can enhance urban living, attracting businesses and residents alike. In future, smart city projects are expected to generate USD 1.5 billion in economic activity, creating demand for innovative commercial spaces that integrate technology and sustainability.

- Sustainable Building Practices:The growing emphasis on sustainability offers a lucrative opportunity for developers in None. With 70% of consumers prioritizing eco-friendly practices, buildings that meet green certification standards are increasingly sought after. In future, the market for sustainable commercial properties is projected to grow by USD 500 million, driven by demand for energy-efficient designs and environmentally responsible materials, positioning developers for long-term success.