Region:Europe

Author(s):Rebecca

Product Code:KRAA2424

Pages:82

Published On:August 2025

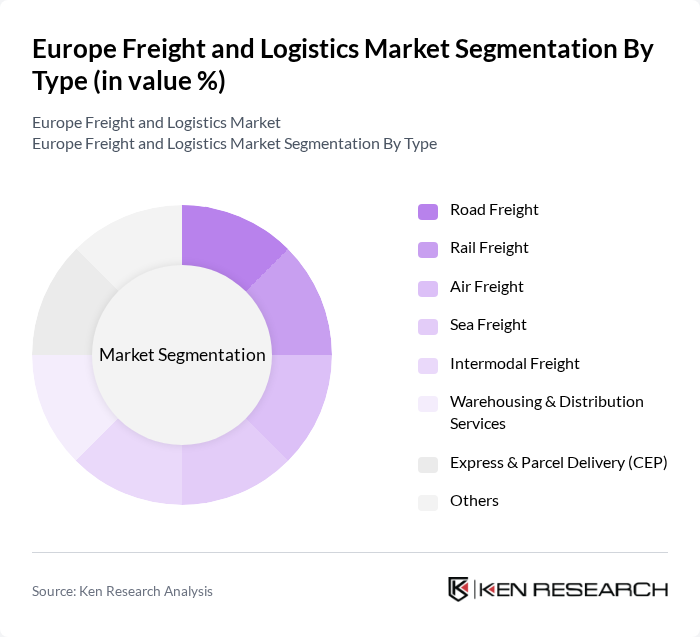

By Type:The market can be segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Warehousing & Distribution Services, Express & Parcel Delivery (CEP), and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and customer preferences.Road freightremains the largest segment due to its flexibility and extensive European road network, whilesea and rail freightare vital for international and bulk cargo.Air freightis essential for high-value, time-sensitive shipments, andintermodal solutionsare gaining traction for their efficiency and sustainability .

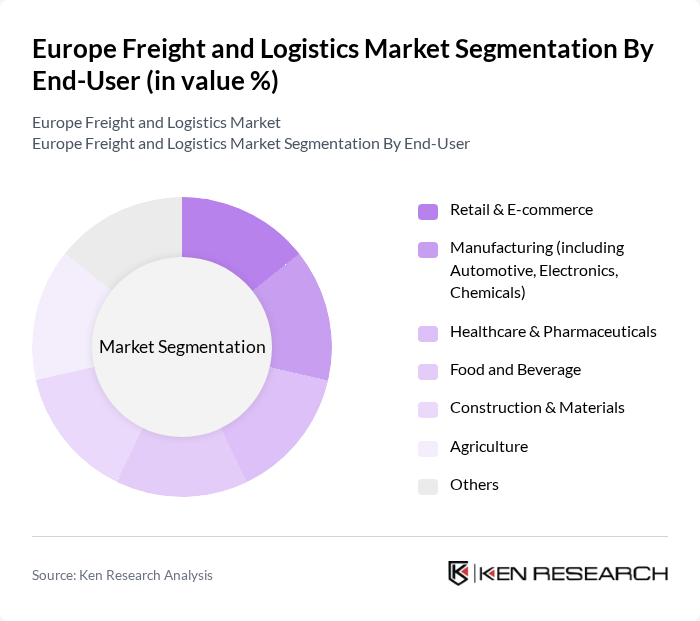

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing (including Automotive, Electronics, Chemicals), Healthcare & Pharmaceuticals, Food and Beverage, Construction & Materials, Agriculture, and Others. Each sector has unique logistics requirements, influencing demand for specific freight services.Retail & e-commerceis the fastest-growing segment due to the surge in online shopping and consumer expectations for rapid delivery.Manufacturingandautomotivesectors remain major contributors, whilehealthcare & pharmaceuticalsdemand specialized, temperature-controlled logistics solutions .

The Europe Freight and Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post AG), Kuehne + Nagel International AG, DB Schenker (Deutsche Bahn AG), XPO Logistics Europe (XPO, Inc.), DSV A/S, CEVA Logistics SA, UPS Supply Chain Solutions, FedEx Logistics (FedEx Corp.), GEODIS SA, SNCF Logistics (SNCF Group), Bolloré Logistics, Yusen Logistics Co., Ltd., Rhenus SE & Co. KG, Hellmann Worldwide Logistics SE & Co. KG, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe freight and logistics market is poised for transformation, driven by technological integration and sustainability initiatives. As companies increasingly adopt digital solutions, the logistics landscape will become more efficient and transparent. Additionally, the focus on reducing carbon footprints will lead to innovative practices, such as electric vehicle adoption and green supply chain strategies. These trends will not only enhance operational efficiency but also align with consumer preferences for environmentally responsible logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Warehousing & Distribution Services Express & Parcel Delivery (CEP) Others |

| By End-User | Retail & E-commerce Manufacturing (including Automotive, Electronics, Chemicals) Healthcare & Pharmaceuticals Food and Beverage Construction & Materials Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Forwarding Contract Logistics Courier, Express & Parcel (CEP) Others |

| By Service Type | Freight Transportation Freight Brokerage Supply Chain Management Customs Brokerage Value-Added Services (e.g., packaging, labeling) Others |

| By Payload Capacity | Less than 1 Ton 5 Tons 10 Tons More than 10 Tons |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Central Europe Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Managers, Fleet Operations Directors |

| Air Cargo Services | 60 | Air Freight Managers, Cargo Operations Supervisors |

| Maritime Logistics | 50 | Port Operations Managers, Shipping Line Executives |

| Warehouse Management Solutions | 40 | Warehouse Managers, IT Solutions Architects |

| Last-Mile Delivery Services | 60 | Last-Mile Operations Managers, E-commerce Logistics Coordinators |

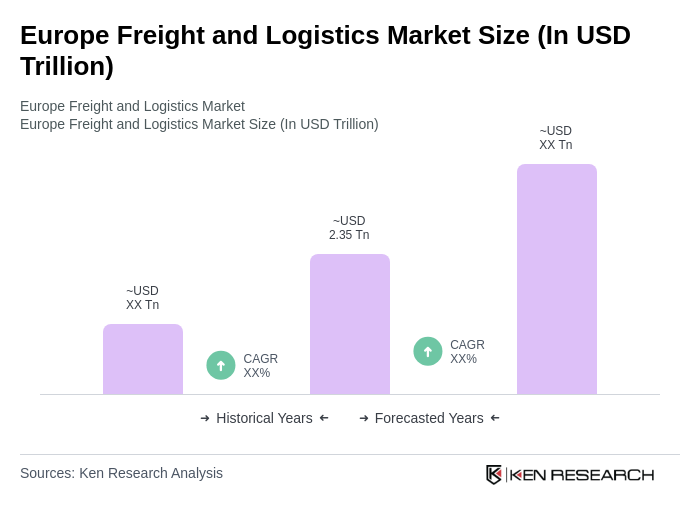

The Europe Freight and Logistics Market is valued at approximately USD 2.35 trillion, driven by the increasing demand for efficient supply chain solutions, e-commerce growth, and technological advancements in logistics management.