Region:Global

Author(s):Dev

Product Code:KRAB0380

Pages:99

Published On:August 2025

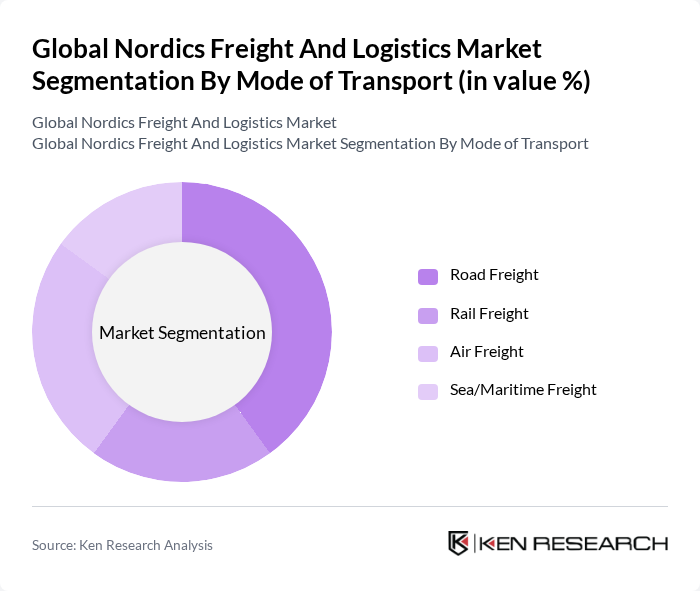

By Mode of Transport:The freight and logistics market is segmented into four primary modes of transport: Road Freight, Rail Freight, Air Freight, and Sea/Maritime Freight. Each mode serves distinct logistical needs, with road freight being the most flexible and widely used for short to medium distances, while rail freight is preferred for bulk goods over longer distances. Air freight is utilized for high-value and time-sensitive shipments, whereas sea freight is essential for international trade and large volumes of goods.

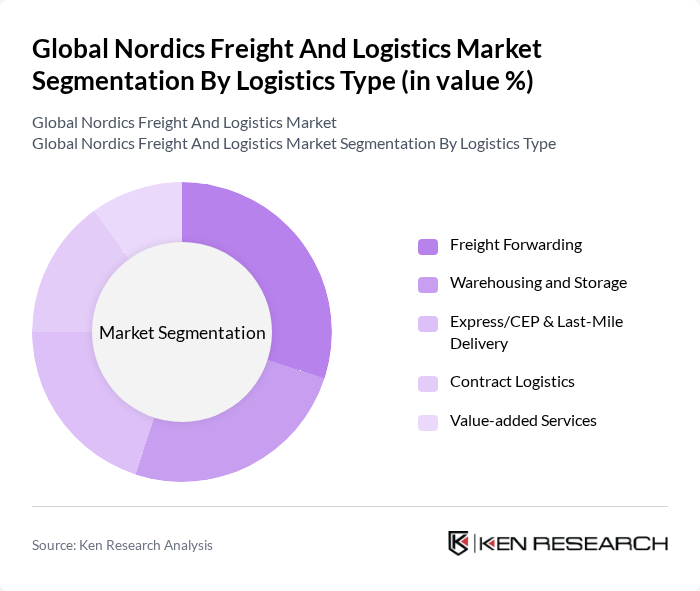

By Logistics Type:The logistics market is further categorized into Freight Forwarding, Warehousing and Storage, Express/CEP & Last-Mile Delivery, Contract Logistics, and Value-added Services. Freight forwarding is crucial for managing the transportation of goods, while warehousing and storage provide essential facilities for inventory management. Express and last-mile delivery services are increasingly important due to the rise of e-commerce, and contract logistics offers tailored solutions for specific industries, enhancing operational efficiency.

The Global Nordics Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DSV A/S, A.P. Moller – Maersk, DHL Group (DHL Supply Chain & Global Forwarding), DB Schenker (Deutsche Bahn AG), Kuehne+Nagel, PostNord AB, Bring/Posten Norge AS, DFDS A/S, Green Cargo AB, VR Transpoint (VR Group, Finland), Finnair Cargo, SAS Cargo Group A/S, ICA Gruppen (Logistics), Ahola Transport, Scan Global Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nordics freight and logistics market is poised for transformation, driven by technological advancements and a strong emphasis on sustainability. As companies increasingly adopt automation and smart logistics solutions, operational efficiencies are expected to improve significantly. Additionally, the focus on supply chain resilience will lead to enhanced adaptability in the face of disruptions. The integration of multimodal transportation options will further streamline operations, positioning the region as a leader in innovative logistics practices.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea/Maritime Freight |

| By Logistics Type | Freight Forwarding Warehousing and Storage Express/CEP & Last-Mile Delivery Contract Logistics Value-added Services |

| By End-User Industry | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Food & Beverages (incl. Cold Chain) Energy, Oil & Gas, and Mining Agriculture, Fishing & Forestry Others |

| By Service Mode | Standalone Services Managed Services Integrated/End-to-End Services |

| By Shipment Type | Domestic Cross-Border/Intra-Nordics International (Extra-EU/EEA) |

| By Temperature Control | Ambient Temperature-Controlled/Cold Chain |

| By Customer Type | B2B B2C Government & Public Sector |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 140 | Logistics Managers, Fleet Operations Directors |

| Maritime Shipping Logistics | 100 | Port Authorities, Shipping Line Executives |

| Rail Freight Services | 80 | Railway Operations Managers, Freight Coordinators |

| Air Cargo Management | 70 | Airline Cargo Managers, Airport Logistics Supervisors |

| Cold Chain Logistics | 60 | Supply Chain Managers, Temperature-Controlled Logistics Experts |

The Global Nordics Freight and Logistics Market is valued at approximately USD 76 billion, reflecting a significant growth driven by increased demand for efficient supply chain solutions, e-commerce expansion, and technological advancements in logistics operations.