Region:Europe

Author(s):Dev

Product Code:KRAA1573

Pages:88

Published On:August 2025

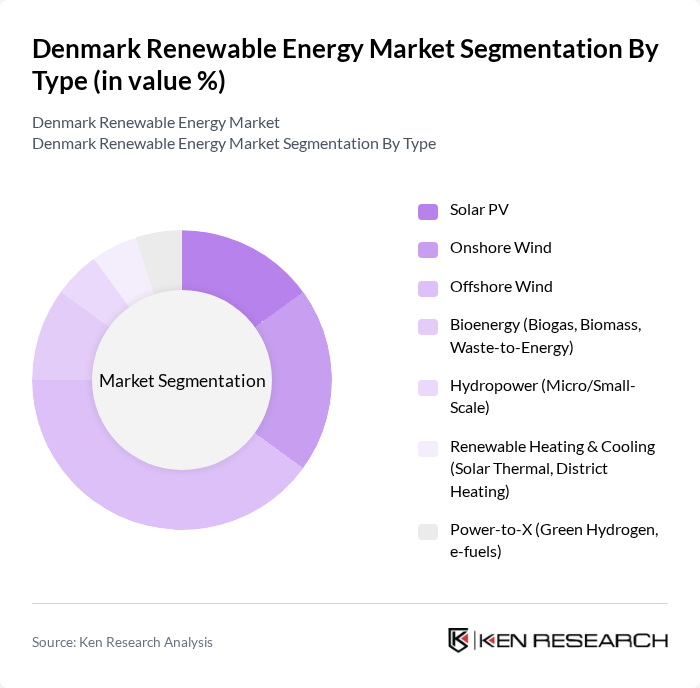

By Type:The renewable energy market in Denmark is segmented into various types, including Solar PV, Onshore Wind, Offshore Wind, Bioenergy (Biogas, Biomass, Waste-to-Energy), Hydropower (Micro/Small-Scale), Renewable Heating & Cooling (Solar Thermal, District Heating), and Power-to-X (Green Hydrogen, e-fuels). Among these, Offshore Wind is the leading segment due to Denmark’s favorable wind conditions and established infrastructure, contributing significantly to the country’s energy mix.

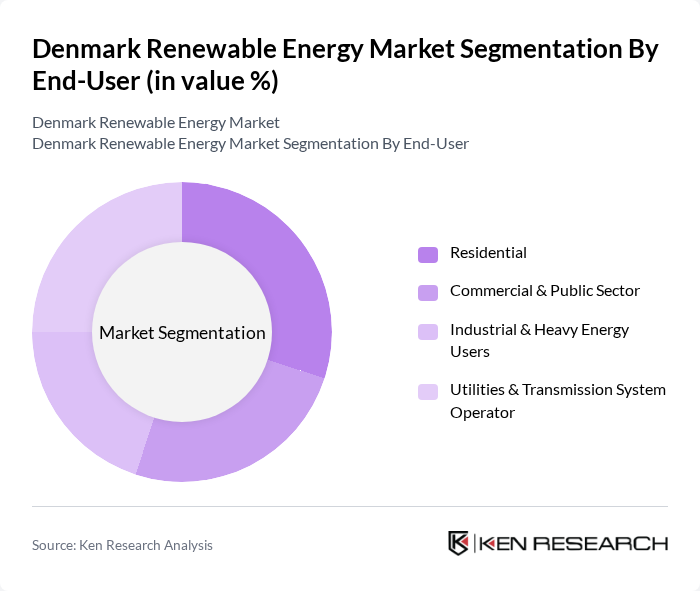

By End-User:The end-user segmentation of the renewable energy market in Denmark includes Residential, Commercial & Public Sector, Industrial & Heavy Energy Users, and Utilities & Transmission System Operators. The Residential segment is currently the most significant, driven by increasing consumer awareness and incentives for renewable heating (e.g., district heating integration, heat pumps) and rooftop solar uptake.

The Denmark Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ørsted A/S, Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., Nordex SE, Vattenfall A/S, Energinet (TSO), Copenhagen Infrastructure Partners (CIP), Better Energy A/S, European Energy A/S, HOFOR A/S (Greater Copenhagen Utility), Andel (formerly SEAS-NVE), Bioenergy & Biogas: Nature Energy Biogas A/S, Arcon-Sunmark A/S (solar thermal), NRGi A.M.B.A., Aker Offshore Wind/ Mainstream Renewable Power Denmark ApS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Denmark renewable energy market appears promising, driven by a combination of government support, technological advancements, and increasing consumer demand. By future, the country aims to have 80% of its electricity generated from renewable sources, with significant investments in offshore wind and solar energy. Additionally, the integration of smart grid technologies is expected to enhance energy efficiency and reliability, paving the way for a more sustainable energy landscape. Continued collaboration between public and private sectors will be crucial for achieving these ambitious goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar PV Onshore Wind Offshore Wind Bioenergy (Biogas, Biomass, Waste-to-Energy) Hydropower (Micro/Small-Scale) Renewable Heating & Cooling (Solar Thermal, District Heating) Power-to-X (Green Hydrogen, e-fuels) |

| By End-User | Residential Commercial & Public Sector Industrial & Heavy Energy Users Utilities & Transmission System Operator |

| By Application | Grid-Connected Off-Grid & Islanded Microgrids Rooftop and Distributed Generation Utility-Scale Projects |

| By Investment Source | Domestic (Utilities, Co-ops, Pension Funds) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs & Tenders |

| By Policy Support | Auctions/Contracts for Difference (CfD) Tax Incentives & Depreciation Guarantees of Origin (GoO) & Renewable Energy Certificates |

| By Distribution Mode | Direct Power Purchase Agreements (PPAs) Retail Suppliers & Utilities Energy Communities & Cooperatives |

| By Price Range | Low LCOE Medium LCOE High LCOE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Energy Project Developers | 100 | Project Managers, Business Development Executives |

| Solar Energy Installers | 80 | Operations Managers, Sales Directors |

| Biomass Energy Producers | 60 | Technical Directors, Environmental Compliance Officers |

| Energy Policy Experts | 50 | Regulatory Affairs Specialists, Policy Analysts |

| Renewable Energy Equipment Manufacturers | 70 | Product Managers, R&D Engineers |

The Denmark Renewable Energy Market is valued at approximately USD 22 billion, reflecting significant investments in wind, bioenergy, and solar PV, supported by strong government policies aimed at phasing out fossil fuels and achieving climate neutrality by 2050.