Region:Africa

Author(s):Rebecca

Product Code:KRAB5253

Pages:89

Published On:October 2025

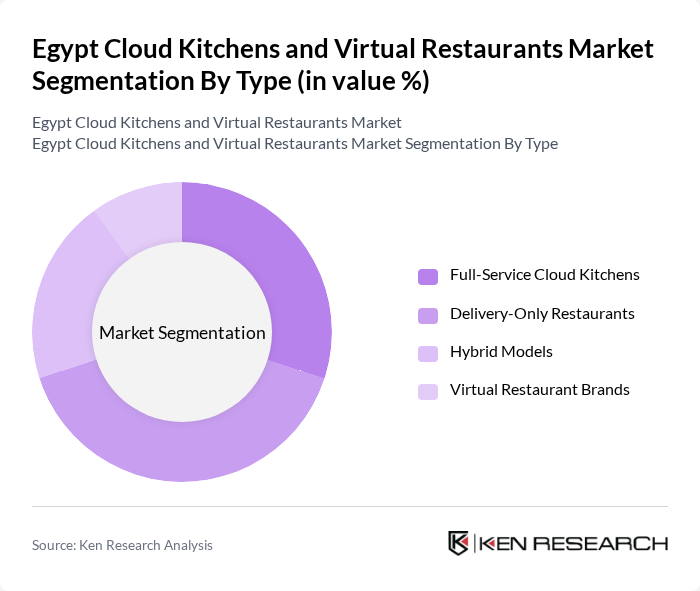

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Restaurants, Hybrid Models, and Virtual Restaurant Brands. Each of these segments caters to different consumer needs and preferences. Full-Service Cloud Kitchens offer a comprehensive dining experience with multiple cuisine options and centralized operations. Delivery-Only Restaurants focus exclusively on takeout and delivery, optimizing for speed and efficiency. Hybrid Models combine dine-in and delivery services, providing flexibility to operators. Virtual Restaurant Brands operate without a physical storefront, relying entirely on digital platforms and online orders to reach customers .

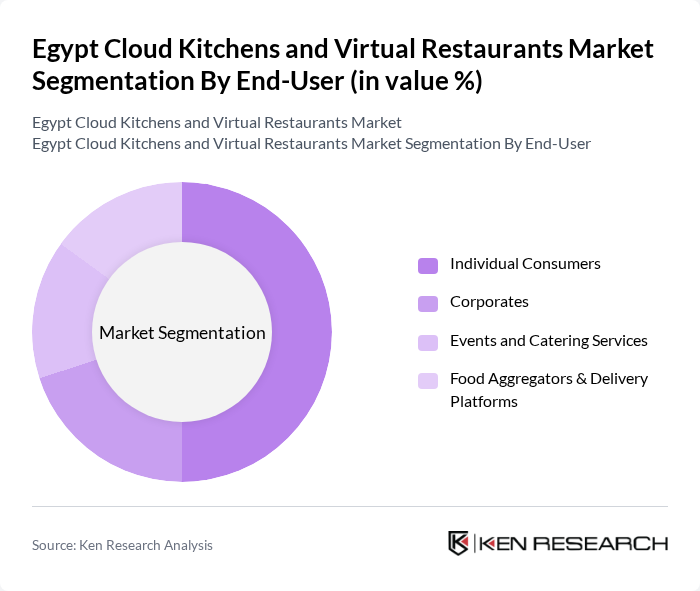

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Events and Catering Services, and Food Aggregators & Delivery Platforms. Individual Consumers represent the largest segment, driven by the growing trend of online food ordering for convenience and the proliferation of mobile ordering apps. Corporates utilize cloud kitchens for catering services and employee meals, while Events and Catering Services leverage these kitchens for large gatherings and functions. Food Aggregators & Delivery Platforms play a crucial role in connecting consumers with various cloud kitchen offerings, enabling market access and driving order volume .

The Egypt Cloud Kitchens and Virtual Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Elmenus, Kitch, Kitopi, The Food Lab, Zomato, Talabat, Uber Eats, GrubTech, Fawry, Otlob, CloudEats, Yummy, Avane Cloud Kitchen, Deliveroo, Foorera contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen and virtual restaurant market in Egypt appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for convenient dining options will likely increase. Additionally, the integration of artificial intelligence in operations is expected to enhance efficiency and customer engagement, allowing businesses to tailor their offerings. The focus on sustainability and health-conscious menus will also shape the market, aligning with global trends and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Restaurants Hybrid Models Virtual Restaurant Brands |

| By End-User | Individual Consumers Corporates Events and Catering Services Food Aggregators & Delivery Platforms |

| By Cuisine Type | Fast Food Asian Cuisine Mediterranean Cuisine Vegan and Vegetarian Options Local Egyptian Cuisine Others |

| By Delivery Model | Third-Party Delivery Services In-House Delivery Pickup Options Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Dynamic Pricing Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Marketing Channel | Social Media Marketing Influencer Partnerships Traditional Advertising Food Delivery App Promotions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 60 | Founders, Operations Managers |

| Virtual Restaurant Brands | 50 | Brand Managers, Marketing Directors |

| Food Delivery Service Providers | 40 | Logistics Managers, Partnership Coordinators |

| Consumer Insights | 100 | Frequent Online Food Buyers, General Consumers |

| Industry Experts | 40 | Market Analysts, Food Service Consultants |

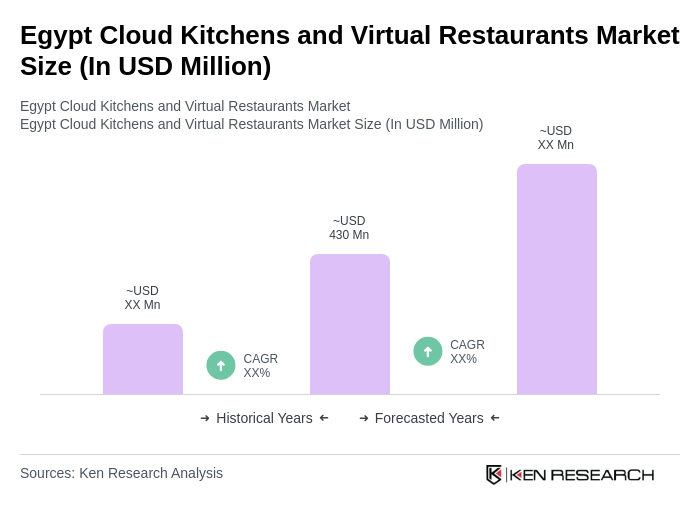

The Egypt Cloud Kitchens and Virtual Restaurants Market is valued at approximately USD 430 million, reflecting significant growth driven by increased demand for food delivery services and changing consumer preferences towards convenience, particularly during the pandemic.