Region:Europe

Author(s):Shubham

Product Code:KRAB4424

Pages:83

Published On:October 2025

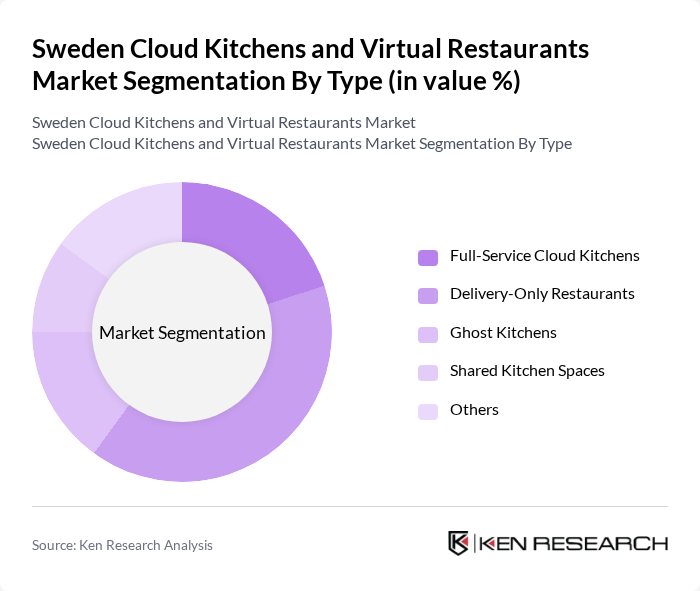

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Restaurants, Ghost Kitchens, Shared Kitchen Spaces, and Others. Among these, Delivery-Only Restaurants have gained significant traction due to the growing preference for convenience and the increasing reliance on food delivery apps. This segment caters to a wide range of consumers, from busy professionals to families, making it a dominant player in the market.

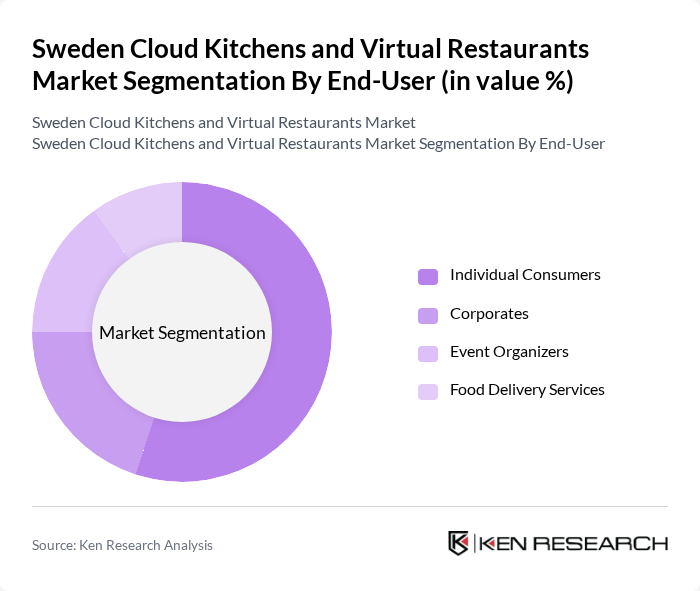

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Event Organizers, and Food Delivery Services. Individual Consumers represent the largest segment, driven by the increasing trend of online food ordering and the convenience it offers. This segment is characterized by a diverse demographic, including millennials and families, who prefer the ease of accessing a variety of cuisines from the comfort of their homes.

The Sweden Cloud Kitchens and Virtual Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Foodora AB, Delivery Hero SE, Oatly AB, Smakbox AB, Karma Food AB, Recepten AB, Vete-Katten AB, Pizzeria Vete-Katten, Tasty Box AB, MatHem i Sverige AB, Linas Matkasse AB, Urban Deli AB, Poppis AB, Bistron AB, Food & Friends AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen and virtual restaurant market in Sweden appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for convenient dining options will likely increase, encouraging further investment in cloud kitchen infrastructure. Additionally, the integration of AI and data analytics in operations will enhance efficiency and customer experience, positioning the sector for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Restaurants Ghost Kitchens Shared Kitchen Spaces Others |

| By End-User | Individual Consumers Corporates Event Organizers Food Delivery Services |

| By Cuisine Type | Fast Food Asian Cuisine Mediterranean Cuisine Vegan/Vegetarian Options Others |

| By Service Model | Subscription-Based Services Pay-Per-Order Services Meal Kits Others |

| By Distribution Channel | Online Platforms Mobile Applications Direct Orders Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Others |

| By Customer Segment | Millennials Families Professionals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Platforms | 80 | Business Development Managers, Logistics Coordinators |

| Virtual Restaurant Brands | 70 | Brand Managers, Marketing Directors |

| Food Industry Experts | 50 | Culinary Consultants, Food Technologists |

| Consumer Insights | 120 | Frequent Online Food Buyers, Delivery App Users |

The Sweden Cloud Kitchens and Virtual Restaurants Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing demand for food delivery services and changing consumer preferences towards convenience.