Region:Asia

Author(s):Rebecca

Product Code:KRAB4133

Pages:99

Published On:October 2025

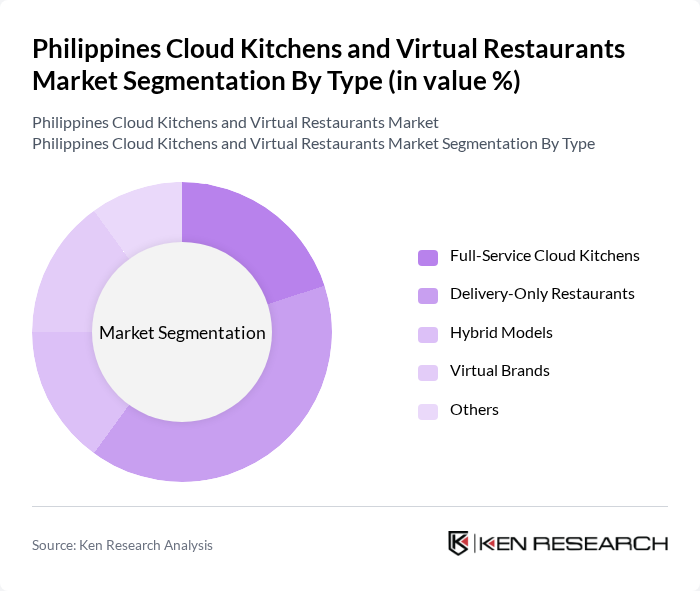

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Restaurants, Hybrid Models, Virtual Brands, and Others. Among these, Delivery-Only Restaurants have gained significant traction due to their low overhead costs and the increasing consumer preference for convenience. The rise of food delivery apps has further propelled this segment, making it a dominant player in the market.

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Event Organizers, and Others. Individual Consumers dominate the market, driven by the growing trend of online food ordering and the convenience it offers. The increasing number of working professionals and busy lifestyles contribute to the preference for food delivery services among this demographic.

The Philippines Cloud Kitchens and Virtual Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as CloudEats, Kitchen City, Foodpanda, GrabFood, Jollibee Foods Corporation, Max's Group, Inc., and Kraver's Canteen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen and virtual restaurant market in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace digital platforms for food ordering, operators are likely to invest in innovative solutions such as AI-driven delivery systems and enhanced menu customization. Additionally, the focus on sustainability will shape operational practices, with an increasing number of businesses adopting eco-friendly packaging and sourcing local ingredients to meet consumer demand for responsible dining options.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Restaurants Hybrid Models Virtual Brands Others |

| By End-User | Individual Consumers Corporates Event Organizers Others |

| By Cuisine Type | Asian Cuisine Western Cuisine Fast Food Healthy Options Others |

| By Sales Channel | Online Platforms (e.g., Foodpanda, GrabFood) Mobile Applications Direct Orders Others |

| By Delivery Model | Third-Party Delivery Services In-House Delivery Pickup Options Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Others |

| By Market Maturity | Emerging Market Growth Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 70 | Founders, Operations Managers |

| Food Delivery Service Providers | 50 | Logistics Coordinators, Business Development Managers |

| Consumers of Virtual Restaurants | 100 | Frequent Users, Occasional Diners |

| Food Industry Experts | 40 | Culinary Consultants, Market Analysts |

| Regulatory Authorities | 20 | Food Safety Inspectors, Policy Makers |

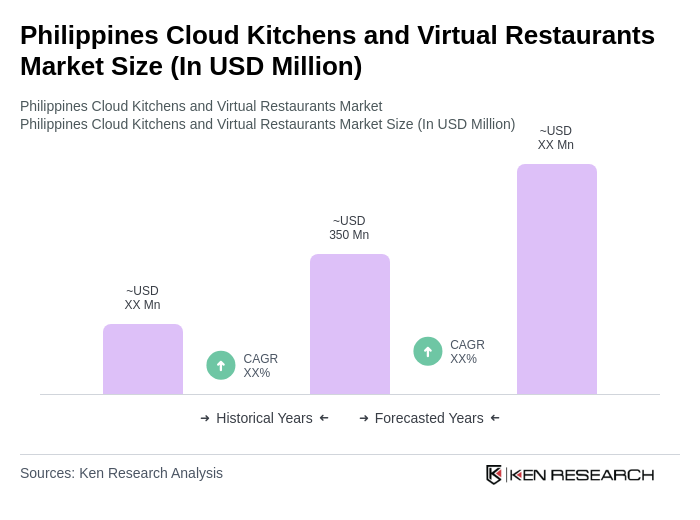

The Philippines Cloud Kitchens and Virtual Restaurants Market is valued at approximately USD 350 million, reflecting significant growth driven by increasing demand for food delivery services and the rise of digital platforms facilitating online orders.