Region:Central and South America

Author(s):Dev

Product Code:KRAB4249

Pages:94

Published On:October 2025

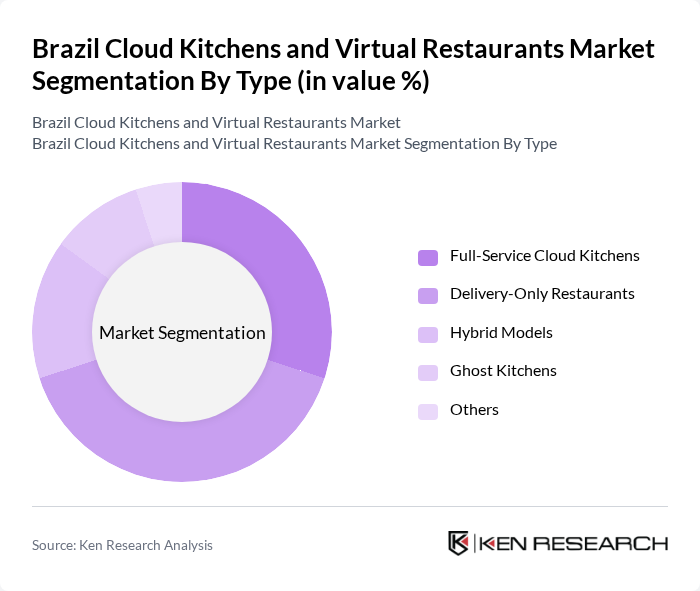

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Restaurants, Hybrid Models, Ghost Kitchens, and Others. Among these, Delivery-Only Restaurants have gained significant traction due to their low overhead costs and the increasing consumer preference for convenience. Full-Service Cloud Kitchens also play a crucial role, offering a wide range of menu options and catering to diverse customer needs.

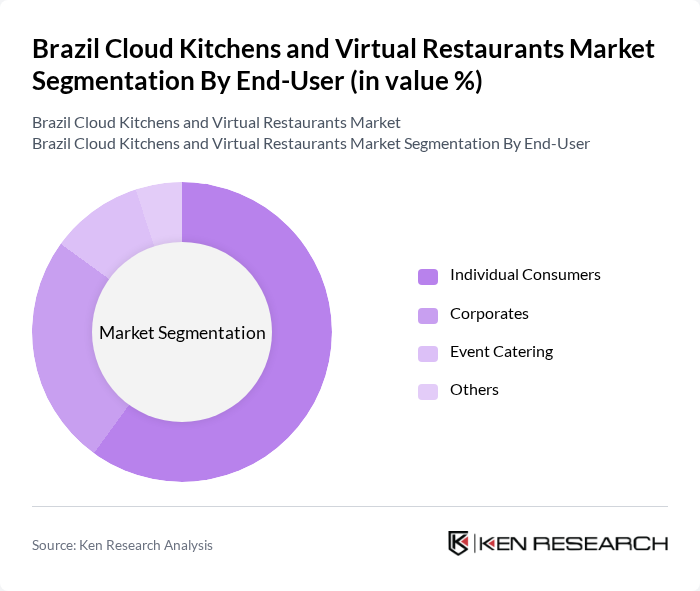

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Event Catering, and Others. Individual Consumers dominate the market, driven by the growing trend of online food ordering and the convenience it offers. Corporates also represent a significant segment, as businesses increasingly opt for catering services for meetings and events, further boosting the demand for cloud kitchens.

The Brazil Cloud Kitchens and Virtual Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as iFood, Rappi, Zaitt, Kitchen Central, CloudChef, Tasty Kitchen, Deliway, Pronto Delivery, Foodology, ChefsClub, Urban Kitchen, Food2Go, Munchery, EatStreet, CookIt contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's cloud kitchens and virtual restaurants appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for convenient dining options will likely increase, encouraging further investment in cloud kitchen infrastructure. Additionally, the integration of AI and data analytics in operations will enhance efficiency and customer engagement, positioning businesses to capitalize on emerging trends in health-conscious and sustainable dining options.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Restaurants Hybrid Models Ghost Kitchens Others |

| By End-User | Individual Consumers Corporates Event Catering Others |

| By Cuisine Type | Brazilian Cuisine International Cuisine Fast Food Healthy Options Others |

| By Delivery Model | Direct Delivery Third-Party Delivery Services Pickup Options Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Business Model | Franchise Models Independent Operators Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Service Providers | 80 | Logistics Managers, Business Development Heads |

| Consumer Preferences in Virtual Dining | 150 | Frequent Online Food Orderers, Millennials |

| Regulatory Impact on Cloud Kitchens | 60 | Food Safety Inspectors, Regulatory Affairs Managers |

| Market Trends and Innovations | 70 | Industry Analysts, Food Tech Entrepreneurs |

The Brazil Cloud Kitchens and Virtual Restaurants Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing demand for food delivery services and changing consumer preferences towards convenience, particularly in urban areas.