Region:Middle East

Author(s):Geetanshi

Product Code:KRAB3367

Pages:91

Published On:October 2025

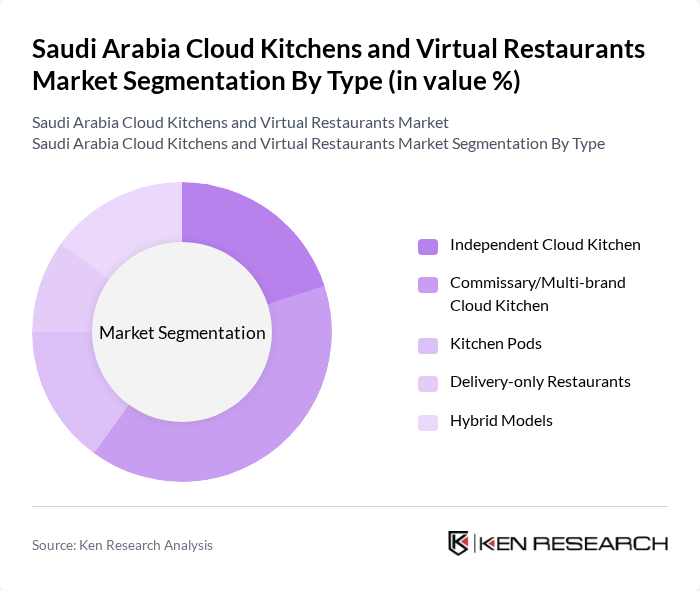

By Type:The market is segmented into various types of cloud kitchens, each catering to different operational models and consumer preferences. The dominant sub-segment is the Commissary/Multi-brand Cloud Kitchen, which allows multiple brands to operate from a single facility, optimizing costs and resources. This model is favored for its flexibility and ability to cater to diverse consumer tastes, making it a popular choice among entrepreneurs and established brands alike.

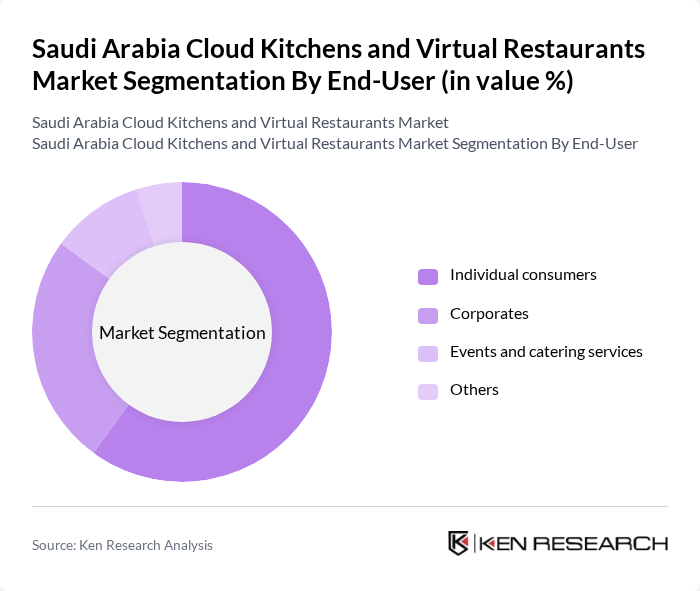

By End-User:The end-user segmentation highlights the diverse customer base for cloud kitchens, with individual consumers being the largest segment. This is driven by the increasing trend of online food ordering among consumers seeking convenience and variety. Corporates and events also contribute significantly to the market, as businesses increasingly opt for catering services from cloud kitchens for meetings and events.

The Saudi Arabia Cloud Kitchens and Virtual Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kitopi, CloudKitchens, Rebel Foods, Talabat, HungerStation, Jahez, Noon Food, Uber Eats, Deliveroo, Zomato, Foodics, Kaykroo, Kitchen Park, Matbakhi, Kook, Grubtech, IKCON, Munchbox, Fatafeat, Eat App contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, operators are likely to adopt innovative solutions such as AI-driven analytics to enhance customer experiences. Additionally, the increasing focus on sustainability will push cloud kitchens to adopt eco-friendly practices, aligning with global trends. This evolution will create a dynamic environment where adaptability and innovation are crucial for success in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Independent Cloud Kitchen Commissary/Multi-brand Cloud Kitchen Kitchen Pods Delivery-only Restaurants Hybrid Models |

| By End-User | Individual consumers Corporates Events and catering services Others |

| By Cuisine Type | Middle Eastern Asian Western Others |

| By Delivery Channel | Third-party delivery services (e.g., Talabat, Uber Eats, HungerStation, Jahez, Noon Food) In-house delivery Pickup options Others |

| By Pricing Model | Fixed pricing Dynamic pricing Subscription models Others |

| By Location | Urban areas Suburban areas Rural areas Others |

| By Business Model | Franchise Independent Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 60 | Founders, Operations Managers |

| Consumers of Food Delivery Services | 100 | Frequent Users, Occasional Users |

| Food Service Consultants | 40 | Industry Experts, Market Analysts |

| Investors in Food Tech | 30 | Venture Capitalists, Angel Investors |

| Regulatory Authorities | 20 | Policy Makers, Compliance Officers |

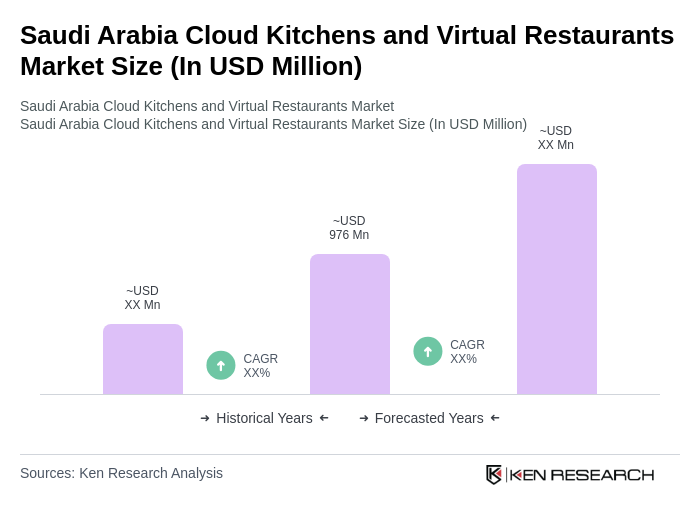

The Saudi Arabia Cloud Kitchens and Virtual Restaurants Market is valued at approximately USD 976 million, reflecting significant growth driven by increasing demand for food delivery services and changing consumer preferences towards convenience.