Egypt Luxury Fashion & Jewelry Market Overview

- The Egypt Luxury Fashion & Jewelry Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a burgeoning middle class, and a growing appetite for luxury goods among consumers. The market has seen a significant rise in demand for high-end fashion and jewelry, reflecting changing consumer preferences and lifestyle aspirations.

- Cairo and Alexandria are the dominant cities in the Egypt Luxury Fashion & Jewelry Market due to their status as cultural and economic hubs. Cairo, being the capital, hosts numerous luxury boutiques and international brands, while Alexandria's rich history and tourism contribute to its market presence. The concentration of affluent consumers and a vibrant retail environment in these cities further solidify their dominance.

- In recent years, the Egyptian government has implemented regulations to promote the luxury fashion and jewelry sector, including tax incentives for local manufacturers and importers. This initiative aims to enhance the competitiveness of domestic brands and attract foreign investment, fostering a more robust luxury market landscape.

Egypt Luxury Fashion & Jewelry Market Segmentation

By Type:The market is segmented into various types, including Apparel, Footwear, Handbags, Jewelry, Accessories, Watches, and Others. Among these, Jewelry has emerged as the leading sub-segment, driven by cultural significance and consumer preference for gold and diamond pieces. The demand for unique and personalized jewelry items has surged, reflecting a trend towards individual expression and luxury investment.

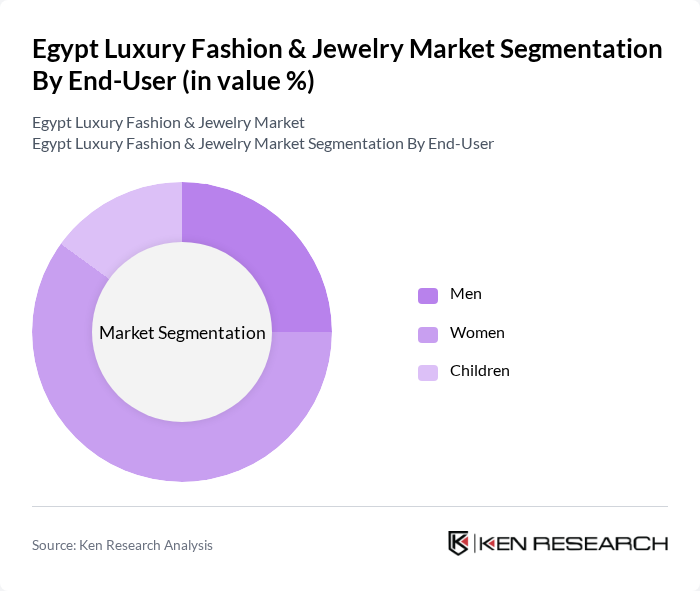

By End-User:The market is categorized into Men, Women, and Children. The Women segment dominates the market, driven by a higher inclination towards luxury fashion and jewelry. Women are increasingly investing in high-end apparel and accessories, influenced by fashion trends and social media, which showcase luxury lifestyles and brands.

Egypt Luxury Fashion & Jewelry Market Competitive Landscape

The Egypt Luxury Fashion & Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ezzat Fashion, Amina K. Jewelry, Kamelia Couture, Al Haramain, Hossam El Sayed, Zainab Fashion House, El Masrya, Ranya Jewelry, Cairo Couture, Alia Fashion, Noor Jewelry, Farah Fashion, Samira's Boutique, Luxury by Design, The Goldsmiths contribute to innovation, geographic expansion, and service delivery in this space.

Egypt Luxury Fashion & Jewelry Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Egypt is projected to reach approximately EGP 55,000 per capita in future, reflecting a significant increase from EGP 50,000 in the previous year. This rise in disposable income enables consumers to allocate more funds towards luxury fashion and jewelry, driving demand. As the middle and upper classes expand, the purchasing power for high-end products is expected to grow, fostering a more vibrant luxury market.

- Rising Tourism and Expatriate Population:Egypt's tourism sector is anticipated to welcome over 18 million visitors in future, contributing approximately EGP 120 billion to the economy. This influx of tourists, alongside a growing expatriate community, enhances the demand for luxury goods. Tourists often seek unique luxury items as souvenirs, while expatriates contribute to a stable consumer base, further stimulating the luxury fashion and jewelry market.

- Growing Online Retail Presence:E-commerce in Egypt is expected to reach EGP 35 billion in future, driven by increased internet penetration, projected at 75% of the population. This growth in online retail provides luxury brands with a broader platform to reach consumers. Enhanced digital marketing strategies and user-friendly online shopping experiences are likely to attract a younger demographic, further expanding the luxury market's reach and accessibility.

Market Challenges

- Economic Fluctuations:Egypt's economy faces volatility, with inflation rates projected to hover around 12% in future. Such economic instability can lead to reduced consumer spending on luxury items, as individuals prioritize essential goods. The fluctuating exchange rates also impact the pricing of imported luxury goods, making them less accessible to the average consumer and potentially stifling market growth.

- High Import Tariffs on Luxury Goods:The Egyptian government imposes import tariffs averaging 35% on luxury goods, significantly increasing retail prices. This high tariff structure discourages foreign luxury brands from entering the market and limits the availability of diverse products. Consequently, consumers may turn to local alternatives or counterfeit products, undermining the growth potential of the legitimate luxury market.

Egypt Luxury Fashion & Jewelry Market Future Outlook

The Egypt luxury fashion and jewelry market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical production is likely to shape brand strategies, appealing to environmentally conscious consumers. Additionally, the integration of augmented reality in online shopping experiences may enhance customer engagement, making luxury products more accessible. As the market adapts to these trends, it is expected to attract a broader audience, fostering growth and innovation in the sector.

Market Opportunities

- Expansion of E-commerce Platforms:The rise of e-commerce presents a significant opportunity for luxury brands to reach a wider audience. With online sales projected to grow by 30% annually, brands can leverage digital platforms to enhance visibility and accessibility, catering to tech-savvy consumers seeking luxury products from the comfort of their homes.

- Collaborations with Local Artisans:Partnering with local artisans can create unique luxury offerings that resonate with consumers seeking authenticity. Such collaborations not only support local economies but also enhance brand storytelling, appealing to consumers' desire for personalized and culturally rich luxury products, thereby driving sales and brand loyalty.