Region:Middle East

Author(s):Rebecca

Product Code:KRAA5101

Pages:94

Published On:September 2025

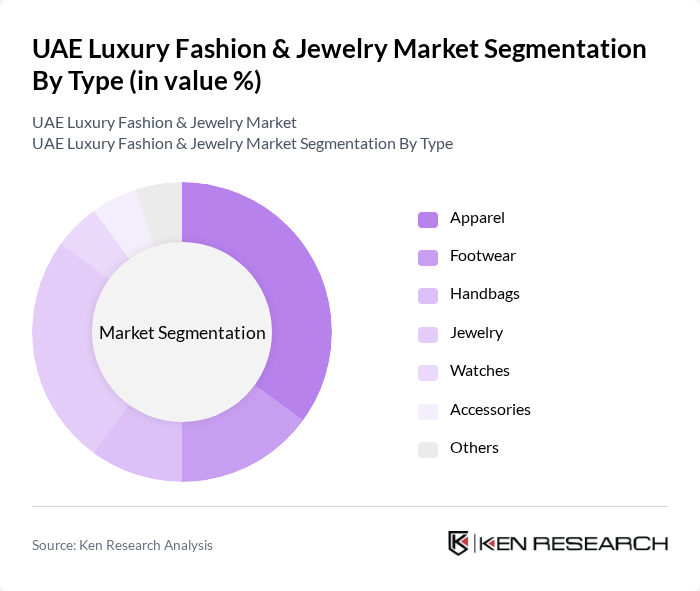

By Type:The luxury fashion and jewelry market can be segmented into various types, including apparel, footwear, handbags, jewelry, watches, accessories, and others. Among these, apparel and jewelry are the most significant segments, driven by consumer preferences for high-quality materials and exclusive designs. The demand for luxury apparel has surged due to fashion trends and the influence of social media, while jewelry remains a staple for gifting and personal adornment.

By End-User:The market can also be segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on luxury fashion and jewelry. The increasing focus on gender-neutral fashion has also led to a rise in luxury offerings for men, while children's luxury fashion is gaining traction as parents seek high-quality products for their kids.

The UAE Luxury Fashion & Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Al Tayer Group, Chalhoub Group, Dubai Duty Free, Jashanmal Group, Majid Al Futtaim, Paris Gallery, Rivoli Group, Tamani Hotels, The Luxury Closet, WatchBox, YOOX Net-a-Porter Group, Zahrat Al Khaleej, Al Futtaim Group, Bvlgari contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury fashion and jewelry market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As digital platforms become increasingly integral to shopping experiences, brands will need to enhance their online presence. Additionally, sustainability will play a crucial role, with consumers favoring brands that prioritize ethical practices. The market is expected to adapt to these trends, fostering innovation and collaboration, ultimately leading to a more dynamic and responsive luxury landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Handbags Jewelry Watches Accessories Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Local Brands International Brands |

| By Occasion | Casual Wear Formal Wear Special Events |

| By Material | Leather Fabric Metal Gemstones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retailers | 150 | Store Managers, Brand Executives |

| Jewelry Manufacturers | 100 | Production Managers, Sales Directors |

| Affluent Consumer Insights | 200 | High Net-Worth Individuals, Luxury Shoppers |

| Online Luxury Marketplaces | 80 | E-commerce Managers, Digital Marketing Heads |

| Fashion Influencers and Stylists | 60 | Fashion Bloggers, Social Media Influencers |

The UAE Luxury Fashion & Jewelry Market is valued at approximately USD 15 billion, driven by increasing disposable income, a growing tourism sector, and rising demand for high-end products among affluent residents and expatriates.