Region:Asia

Author(s):Geetanshi

Product Code:KRAA8097

Pages:93

Published On:September 2025

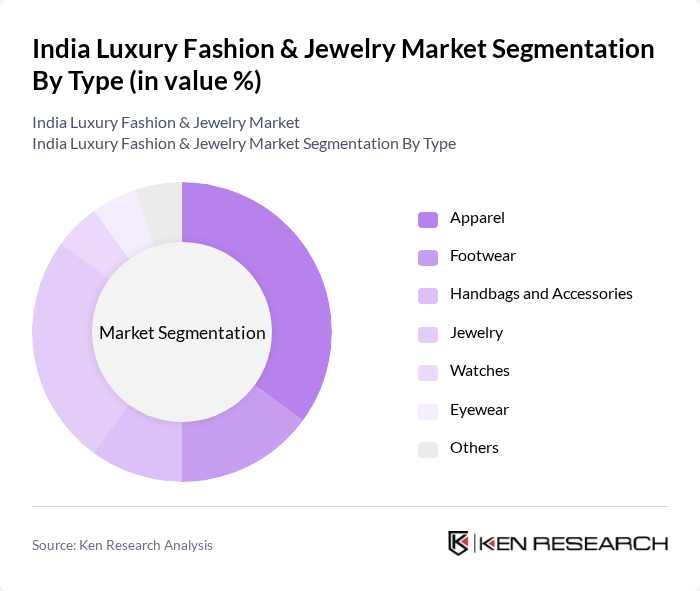

By Type:The luxury fashion and jewelry market is segmented into various types, including apparel, footwear, handbags and accessories, jewelry, watches, eyewear, and others. Among these, apparel and jewelry are the most dominant segments. The apparel segment is driven by the increasing demand for designer clothing and high-end fashion brands, while the jewelry segment benefits from cultural significance and rising disposable incomes, leading to increased spending on luxury items.

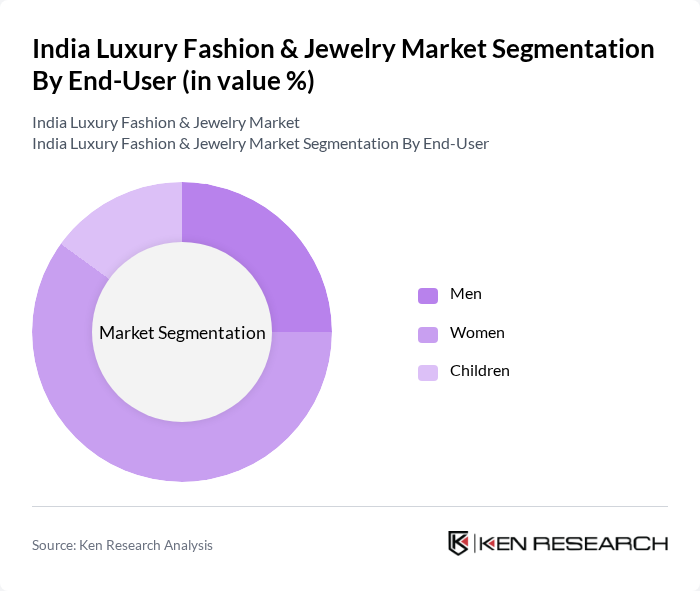

By End-User:The market is also segmented by end-user, which includes men, women, and children. The women’s segment is the most significant, driven by a higher propensity to spend on luxury fashion and jewelry. Women are increasingly seeking unique and high-quality products, which has led to a surge in demand for luxury apparel and jewelry tailored specifically for them. The men’s segment is also growing, albeit at a slower pace, as more men are becoming interested in luxury fashion.

The India Luxury Fashion & Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Group, Aditya Birla Group, Reliance Brands Limited, Kalyan Jewellers, Titan Company Limited, Malabar Gold & Diamonds, Fabindia, Hidesign, Sabyasachi Mukherjee, Ritu Kumar, Shree Raj Mahal Jewellers, Poonam Sethi, Anita Dongre, House of Masaba, Tarun Tahiliani contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury fashion and jewelry market in India appears promising, driven by evolving consumer preferences and technological advancements. As more consumers prioritize sustainability, brands that adopt eco-friendly practices are likely to gain traction. Additionally, the integration of augmented reality and virtual try-ons in e-commerce platforms is expected to enhance the shopping experience, attracting tech-savvy consumers. The market is poised for growth as these trends reshape consumer engagement and brand loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Handbags and Accessories Jewelry Watches Eyewear Others |

| By End-User | Men Women Children |

| By Region | North India South India East India West India |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Premium Super Premium Luxury |

| By Material | Leather Fabric Metal Gemstones |

| By Occasion | Casual Wear Formal Wear Festive Wear Wedding Wear |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Jewelry Buying Trends | 100 | Jewelry Buyers, Luxury Retail Managers |

| Luxury Footwear Market Insights | 80 | Shoe Retailers, Fashion Influencers |

| Consumer Preferences in Luxury Accessories | 120 | Accessory Designers, Brand Managers |

| Online Luxury Shopping Behavior | 90 | E-commerce Managers, Digital Marketing Experts |

The India Luxury Fashion & Jewelry Market is valued at approximately USD 30 billion, reflecting significant growth driven by rising disposable incomes and changing consumer preferences towards luxury goods.