Region:Africa

Author(s):Dev

Product Code:KRAA1582

Pages:87

Published On:August 2025

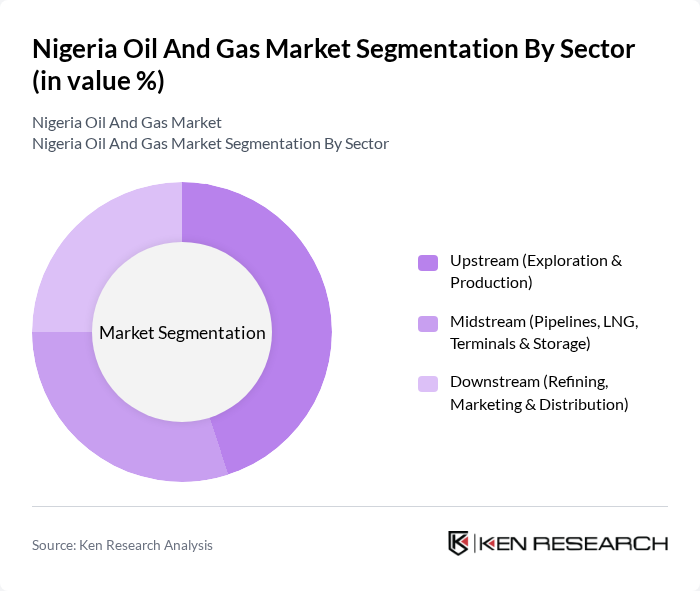

By Sector:The market is segmented into three main sectors: Upstream (Exploration & Production), Midstream (Pipelines, LNG, Terminals & Storage), and Downstream (Refining, Marketing & Distribution). The Upstream sector covers exploration and extraction of oil and gas resources; the Midstream sector focuses on gathering, processing, transportation, and storage (including LNG value chains); and the Downstream sector involves refining, product imports/exports, and marketing/distribution to end users .

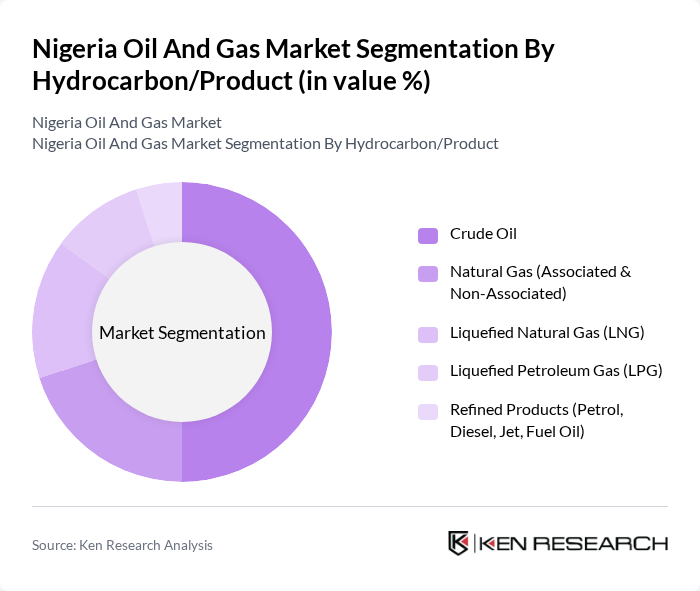

By Hydrocarbon/Product:The market is further segmented by hydrocarbon types, including Crude Oil, Natural Gas (Associated & Non-Associated), Liquefied Natural Gas (LNG), Liquefied Petroleum Gas (LPG), and Refined Products (Petrol, Diesel, Jet, Fuel Oil). Crude oil production remains the core export earner; domestic and associated gas development is expanding for power and industry; LNG is a key export via Nigeria LNG; LPG demand is growing for household and commercial uses; refined products supply has relied on imports but is shifting with new domestic refining capacity .

The Nigeria Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as NNPC Limited (Nigerian National Petroleum Company Limited), Shell Petroleum Development Company of Nigeria Ltd. (SPDC) and Shell Nigeria Exploration & Production Company (SNEPCo), ExxonMobil Nigeria (Mobil Producing Nigeria Unlimited), Chevron Nigeria Limited, TotalEnergies EP Nigeria Limited, Eni Nigeria (NAOC/Agip), Oando PLC, Seplat Energy PLC, Conoil PLC, Aiteo Eastern E&P Company Limited, FIRST E&P (First Exploration & Petroleum Development Company Limited), Midwestern Oil & Gas Company Limited, Waltersmith Petroman Oil Limited, Nigeria LNG Limited (NLNG), Dangote Petroleum Refinery & Petrochemicals contribute to innovation, geographic expansion, and service delivery in this space .

The future of Nigeria's oil and gas market appears promising, driven by a combination of increased domestic consumption and strategic government initiatives aimed at enhancing local production capabilities. As the country seeks to diversify its energy portfolio, investments in renewable energy and natural gas infrastructure are expected to gain momentum. Furthermore, the integration of advanced technologies will likely improve operational efficiencies, positioning Nigeria as a competitive player in the global energy landscape while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Pipelines, LNG, Terminals & Storage) Downstream (Refining, Marketing & Distribution) |

| By Hydrocarbon/Product | Crude Oil Natural Gas (Associated & Non-Associated) Liquefied Natural Gas (LNG) Liquefied Petroleum Gas (LPG) Refined Products (Petrol, Diesel, Jet, Fuel Oil) |

| By Application | Power Generation Transportation Fuels Industrial & Petrochemical Feedstock Residential/Commercial (Cooking Gas, Heating) Export |

| By Asset Type | Onshore Shallow Offshore Deepwater/Ultra-Deepwater |

| By Ownership | NOC/JV (NNPC Limited & JV Partners) PSC/Deepwater (IOC-led) Independent/Indigenous E&P Marginal Field Operators |

| By Midstream Infrastructure | Gas Processing & Gathering Pipelines & Gas Distribution LNG Liquefaction & Export Storage & Terminals Refineries (Public & Private) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Exploration | 100 | Geologists, Exploration Managers |

| Midstream Transportation and Storage | 80 | Logistics Coordinators, Operations Managers |

| Downstream Refining and Distribution | 120 | Refinery Managers, Supply Chain Directors |

| Regulatory Compliance and Environmental Impact | 60 | Compliance Officers, Environmental Managers |

| Local Community Engagement and CSR | 70 | Community Relations Officers, NGO Representatives |

The Nigeria Oil and Gas Market is valued at approximately USD 34 billion, reflecting Nigeria's position as one of Africa's largest oil producers and its significant gas reserves, bolstered by ongoing investments and policy reforms aimed at enhancing production efficiency.