Region:Africa

Author(s):Rebecca

Product Code:KRAA0345

Pages:80

Published On:August 2025

By Type:The market is segmented into various types of organic waste management methods, including composting, anaerobic digestion, incineration, landfilling, waste-to-energy, mechanical biological treatment, and others. Among these, composting and waste-to-energy technologies are gaining traction due to their environmental benefits and efficiency in waste processing. Composting is particularly popular in residential and agricultural areas, while waste-to-energy solutions are increasingly adopted by municipalities to generate energy from waste and reduce landfill dependency .

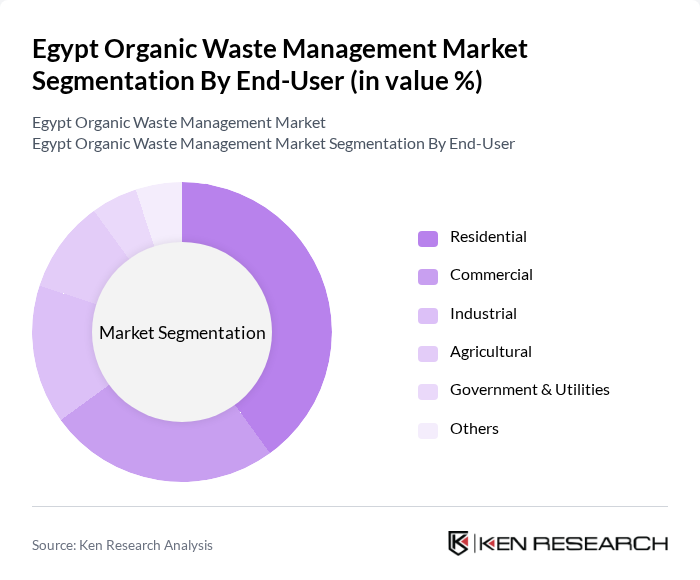

By End-User:The end-user segmentation includes residential, commercial, industrial, agricultural, government & utilities, and others. The residential segment is the largest due to the high volume of organic waste generated in households. Additionally, the commercial and industrial sectors are increasingly adopting sustainable waste management practices, driven by regulatory compliance, corporate social responsibility initiatives, and the need to reduce disposal costs and environmental impact .

The Egypt Organic Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Egypt, EnviroTaqa, ECARU (Engineering Company for the Development of Arab Resources), Nahdet Misr for Environmental Services, Giza Systems (Waste Management Division), BariQ (Recycling and Waste Management), Empower (Empower Energy Solutions), Environ Adapt, Chemonics Egypt, Green Tech Egypt, RecycloBekia, Green Pan, EgyWaste, Baramoda, Biogas People Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's organic waste management market appears promising, driven by increasing urbanization and government support for sustainable practices. As the population grows, the demand for efficient waste management solutions will intensify. Innovations in waste processing technologies and community engagement initiatives are expected to play a crucial role in addressing current challenges. Furthermore, the integration of smart technologies will enhance operational efficiency, paving the way for a more sustainable waste management landscape in Egypt.

| Segment | Sub-Segments |

|---|---|

| By Type | Composting Anaerobic Digestion Incineration Landfilling Waste-to-Energy Mechanical Biological Treatment Others |

| By End-User | Residential Commercial Industrial Agricultural Government & Utilities Others |

| By Region | Cairo Alexandria Giza Delta Region Upper Egypt Others |

| By Technology | Mechanical Biological Treatment Thermal Treatment Biological Treatment Waste-to-Energy Technologies Others |

| By Application | Municipal Waste Management Agricultural Waste Management Industrial Waste Management Food Waste Management Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes International Development Funding Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Feed-in Tariff Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Authorities | 60 | City Managers, Waste Management Directors |

| Organic Waste Processing Facilities | 50 | Facility Managers, Operations Supervisors |

| Environmental NGOs and Advocacy Groups | 40 | Program Directors, Policy Analysts |

| Community-Based Waste Management Initiatives | 45 | Community Leaders, Project Coordinators |

| Private Sector Waste Management Companies | 55 | Business Development Managers, Sustainability Officers |

The Egypt Organic Waste Management Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by urbanization, government initiatives, and increased public awareness regarding sustainable waste management practices.