Region:Africa

Author(s):Rebecca

Product Code:KRAA4873

Pages:80

Published On:September 2025

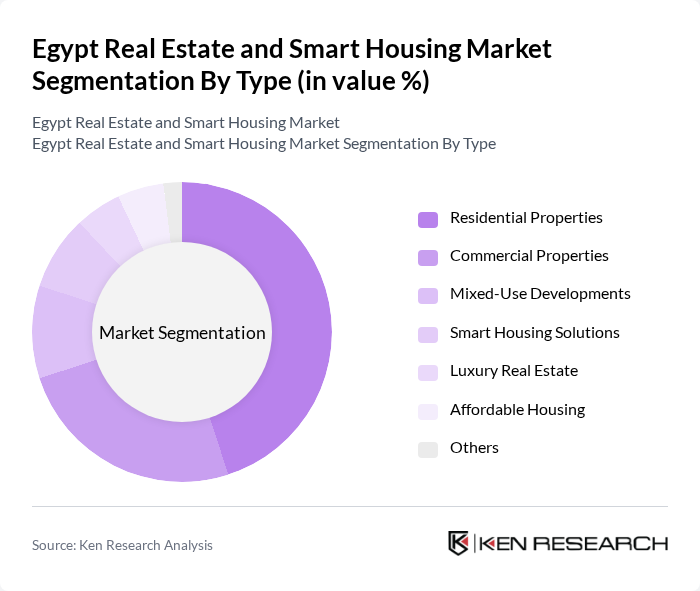

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Mixed-Use Developments, Smart Housing Solutions, Luxury Real Estate, Affordable Housing, and Others. Among these, Residential Properties dominate the market due to the high demand for housing driven by population growth and urbanization. The trend towards smart housing solutions is also gaining traction as consumers seek modern amenities and energy-efficient designs.

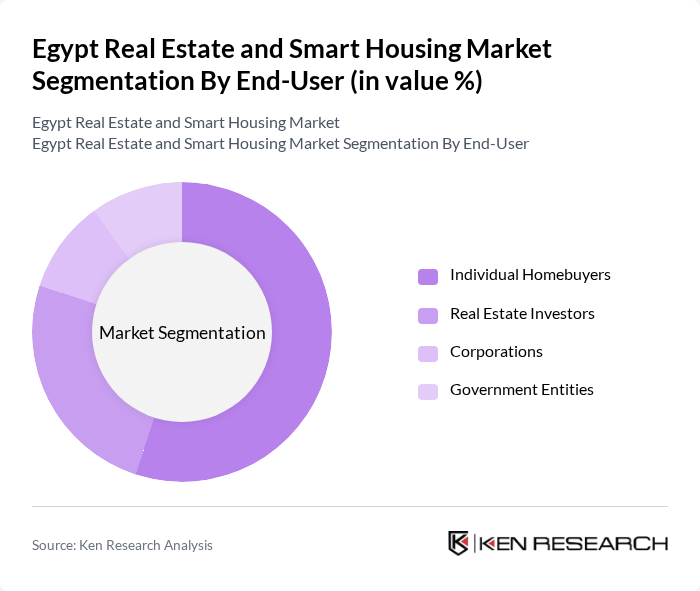

By End-User:The end-user segmentation includes Individual Homebuyers, Real Estate Investors, Corporations, and Government Entities. Individual Homebuyers represent the largest segment, driven by the increasing need for housing among the growing population. Real estate investors are also significant players, attracted by the potential for high returns in the expanding market.

The Egypt Real Estate and Smart Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar Misr, Palm Hills Developments, SODIC, Talaat Moustafa Group, Madinet Nasr for Housing and Development, Orascom Development Holding, New Giza, City Edge Developments, Misr Italia Properties, Al Ahly for Real Estate Development, Arab Developers Holding, Hassan Allam Properties, Mountain View, The Land Developers, ZED East contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's real estate and smart housing market appears promising, driven by urbanization and government initiatives. As the population continues to grow, the demand for affordable and smart housing solutions will increase. Additionally, advancements in technology will enhance the appeal of new developments. However, addressing economic instability and regulatory challenges will be crucial for sustaining growth. The focus on sustainable living and smart city projects will likely shape the market landscape in the coming years, attracting both local and foreign investments.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Mixed-Use Developments Smart Housing Solutions Luxury Real Estate Affordable Housing Others |

| By End-User | Individual Homebuyers Real Estate Investors Corporations Government Entities |

| By Sales Channel | Direct Sales Real Estate Agencies Online Platforms Auctions |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Residential Use Commercial Use Industrial Use Mixed-Use |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Policy Support | Subsidies for Homebuyers Tax Exemptions for Developers Incentives for Sustainable Housing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 150 | First-time Homebuyers, Investors |

| Smart Housing Technology Adoption | 100 | Homeowners, Property Developers |

| Rental Market Insights | 80 | Renters, Property Managers |

| Commercial Real Estate Trends | 70 | Business Owners, Commercial Real Estate Agents |

| Urban Development and Planning | 60 | Urban Planners, Local Government Officials |

The Egypt Real Estate and Smart Housing Market is valued at approximately USD 10 billion, driven by urbanization, population growth, and government initiatives aimed at enhancing housing supply and infrastructure development.