Region:Africa

Author(s):Geetanshi

Product Code:KRAA0277

Pages:98

Published On:August 2025

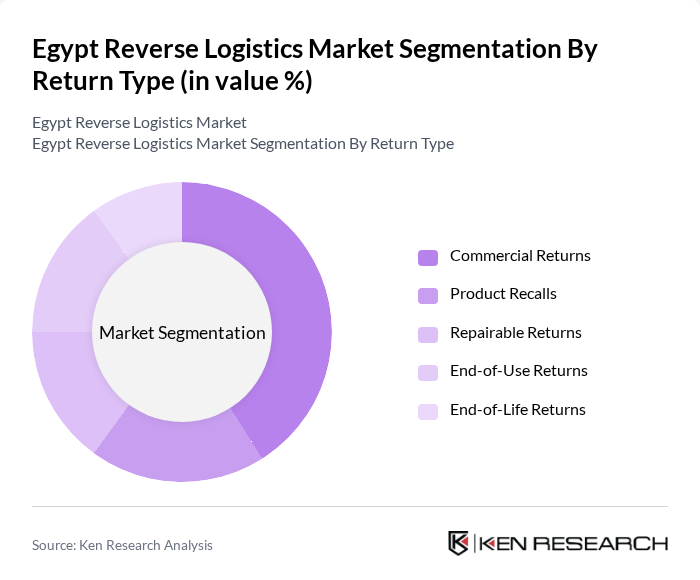

By Return Type:The reverse logistics market can be segmented by return types, including Commercial Returns, Product Recalls, Repairable Returns, End-of-Use Returns, and End-of-Life Returns. Commercial Returns hold the largest share, driven by the surge in e-commerce and the resulting increase in product returns. Consumers frequently return items due to dissatisfaction, incorrect orders, or product defects. The ease of return processes offered by online platforms further supports this trend .

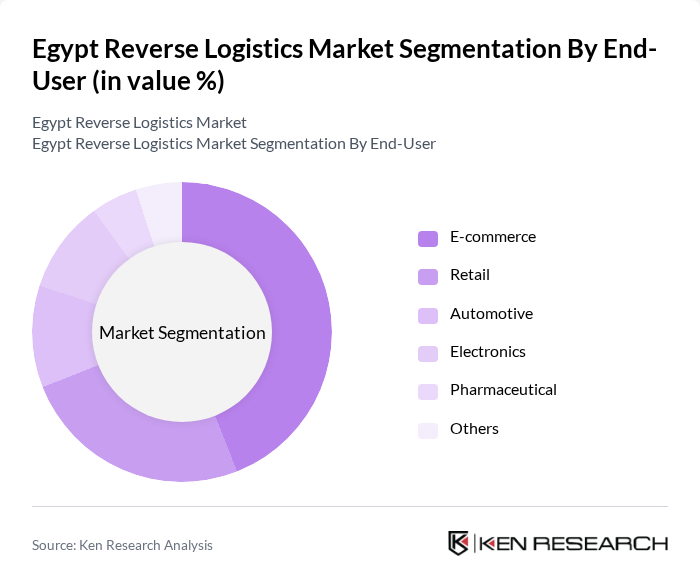

By End-User:End-user segmentation includes E-commerce, Retail, Automotive, Electronics, Pharmaceutical, and Others. The E-commerce sector leads the market, fueled by the rapid growth of online shopping in Egypt. As more consumers purchase online, return volumes have risen, necessitating advanced reverse logistics solutions. Retail remains a key segment, particularly for handling returns from brick-and-mortar stores .

The Egypt Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx Express Egypt, UPS Egypt, Jumia Egypt, Kuehne + Nagel Egypt, DB Schenker Egypt, CEVA Logistics, Agility Logistics Egypt, Rhenus Logistics Egypt, Geodis Egypt, Bolloré Logistics Egypt, Yusen Logistics, DSV Egypt, Egytrans (Egyptian Transport & Commercial Services Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the reverse logistics market in Egypt appears promising, driven by increasing e-commerce activities and a growing emphasis on sustainability. As businesses adapt to consumer demands for efficient return processes, the integration of advanced technologies such as AI and automation will likely enhance operational efficiency. Additionally, the government's commitment to improving waste management infrastructure will further support the growth of reverse logistics, positioning Egypt as a key player in the regional logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Commercial Returns Product Recalls Repairable Returns End-of-Use Returns End-of-Life Returns |

| By End-User | E-commerce Retail Automotive Electronics Pharmaceutical Others |

| By Industry | Manufacturing Healthcare Food and Beverage Others |

| By Service Type | Transportation Warehousing Reselling Replacement Management Recycling Services Others |

| By Logistics Model | Reverse Supply Chain Closed-Loop Logistics Open-Loop Logistics Others |

| By Geographic Distribution | Urban Areas Rural Areas Suburban Areas Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 80 | eCommerce Managers, Fulfillment Center Supervisors |

The Egypt Reverse Logistics Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the expansion of e-commerce, increased consumer awareness of sustainability, and the demand for efficient waste management solutions.