Region:Europe

Author(s):Shubham

Product Code:KRAC0690

Pages:87

Published On:August 2025

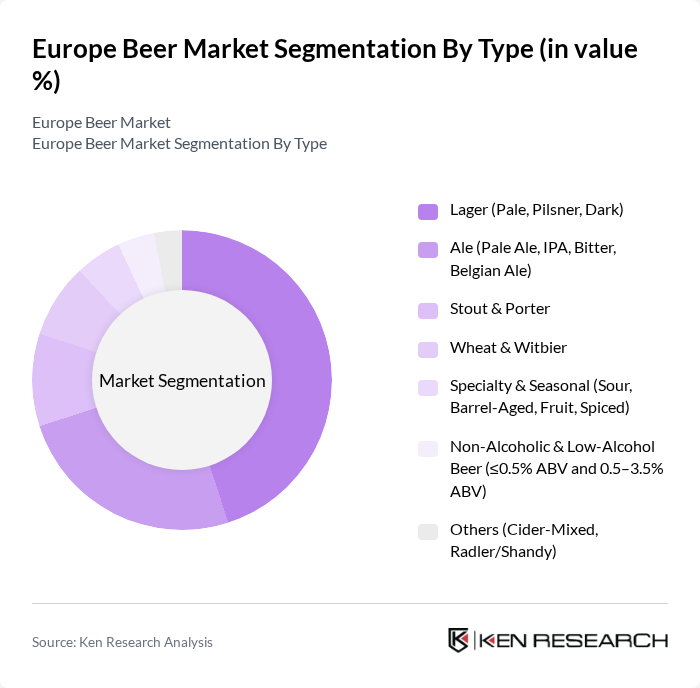

By Type:The beer market is segmented into various types, including Lager, Ale, Stout & Porter, Wheat & Witbier, Specialty & Seasonal, Non-Alcoholic & Low-Alcohol Beer, and Others. Among these, Lager, particularly Pale and Pilsner varieties, dominates packaged beer volumes in Europe due to broad appeal and versatility, while low/no-alcohol beer is the fastest-growing niche as consumers seek moderation without sacrificing taste.

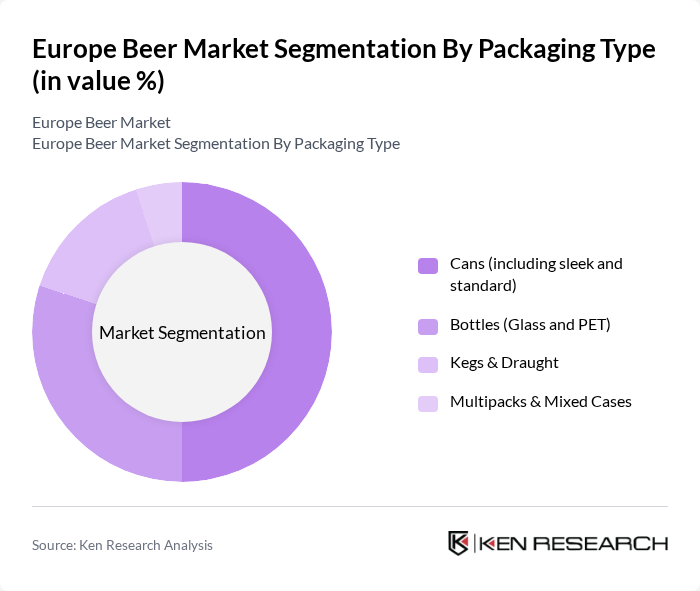

By Packaging Type:This segment includes Cans, Bottles, Kegs & Draught, and Multipacks & Mixed Cases. Cans have gained significant popularity due to convenience, portability, and sustainability attributes (lightweight transport, higher recyclability), making them a leading retail packaging format across several European markets.

The Europe Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as AB InBev (Anheuser-Busch InBev SA/NV), Heineken N.V., Carlsberg Group, Diageo plc, Molson Coors Beverage Company, Asahi Group Holdings, Ltd., Royal Unibrew A/S, Bud?jovický Budvar, N.P. (Budvar National Corporation), BrewDog plc, Beamish & Crawford (Heineken Ireland) — Murphy’s & Beamish brands, Pivovary Staropramen s.r.o. (Molson Coors Europe), Plze?ský Prazdroj, a.s. (Pilsner Urquell, Asahi Europe & International), Asahi Europe & International (subsidiary of Asahi Group), Diageo Ireland (Guinness), Swinkels Family Brewers N.V. (Bavaria) contribute to innovation, geographic expansion, and service delivery in this space.

Notes on key validations and enhancements - Market size: Cross-validated against multiple industry sources indicating the Europe beer market in the USD 150 billion range; updated to USD 150–155 billion wording to reflect converging estimates without projections. - Country leadership: Confirmed leadership in production and consumption metrics for Germany and the UK; Belgium’s artisanal/specialty prominence is industry-recognized. - Growth drivers: Craft/premiumization and no/low-alcohol growth validated; sustainability and packaging innovation emphasized as additional drivers across Europe.

The future of the European beer market appears promising, driven by evolving consumer preferences and innovative brewing practices. The rise of e-commerce and the increasing popularity of non-alcoholic beers are expected to reshape the market landscape. Additionally, sustainability initiatives will likely gain traction, as consumers become more environmentally conscious. Breweries that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet the demands of a diverse consumer base in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager (Pale, Pilsner, Dark) Ale (Pale Ale, IPA, Bitter, Belgian Ale) Stout & Porter Wheat & Witbier Specialty & Seasonal (Sour, Barrel-Aged, Fruit, Spiced) Non-Alcoholic & Low-Alcohol Beer (?0.5% ABV and 0.5–3.5% ABV) Others (Cider-Mixed, Radler/Shandy) |

| By Packaging Type | Cans (including sleek and standard) Bottles (Glass and PET) Kegs & Draught Multipacks & Mixed Cases |

| By Distribution Channel | Supermarkets/Hypermarkets (Off-trade) Convenience & Specialty Stores Online Retail & Direct-to-Consumer Bars, Pubs, and Restaurants (On-trade) Duty-Free & Others |

| By Region | Western Europe (Germany, UK, France, Benelux) Eastern Europe (Poland, Czechia, Hungary, Others) Northern Europe (Nordics, Baltics, Ireland) Southern Europe (Italy, Spain, Portugal, Greece) Central Europe & Others |

| By Alcohol Content | Non-Alcoholic (?0.5% ABV) Low- to Mid-Strength (0.5%–4.5% ABV) Regular (4.6%–6.0% ABV) High-Strength (>6.0% ABV) |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender Income Level |

| By Occasion | Social Gatherings Celebrations & Events Casual/At-home Consumption Sports & Festivals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Beer Producers | 100 | Brewery Owners, Head Brewers |

| Retail Beer Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Regular Beer Consumers, Craft Beer Enthusiasts |

| Distribution Channels | 80 | Logistics Managers, Distribution Coordinators |

| Market Trends Analysis | 100 | Market Analysts, Industry Experts |

The Europe Beer Market is valued at approximately USD 150-155 billion, reflecting a robust growth trend driven by consumer preferences for craft and premium beers, as well as the rising popularity of alcohol-free and low-alcohol options.