Region:North America

Author(s):Dev

Product Code:KRAC0501

Pages:97

Published On:August 2025

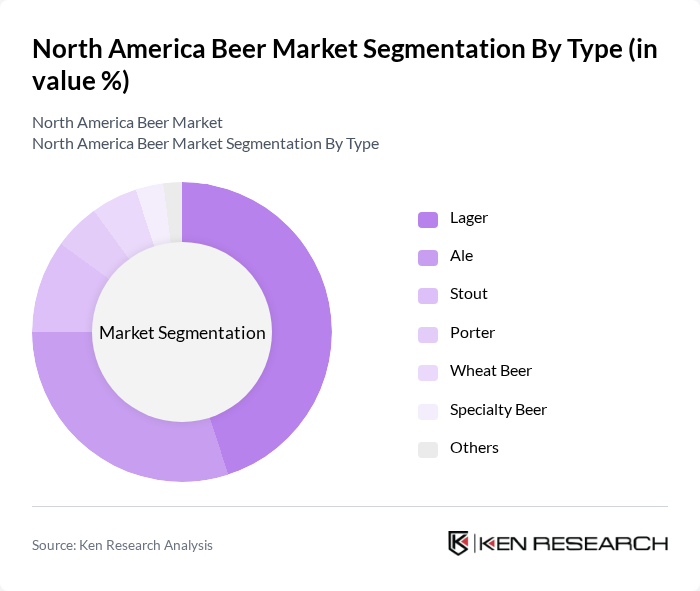

By Type:The beer market can be segmented into various types, including Lager, Ale, Stout, Porter, Wheat Beer, Specialty Beer, and Others. Among these,Lageris the most popular type across North America’s mainstream segment, supported by the scale of leading brands and consumer preference for crisp, sessionable profiles that anchor bar and retail menus .Ale, with its diverse flavor profiles, continues to gain traction within craft-led occasions (IPAs, pale ales, and specialty styles), reinforcing premiumization and variety-seeking behaviors . Specialty and limited-release beers appeal to consumers seeking unique and innovative options, often overlapping with seasonal and small-batch offerings from craft producers .

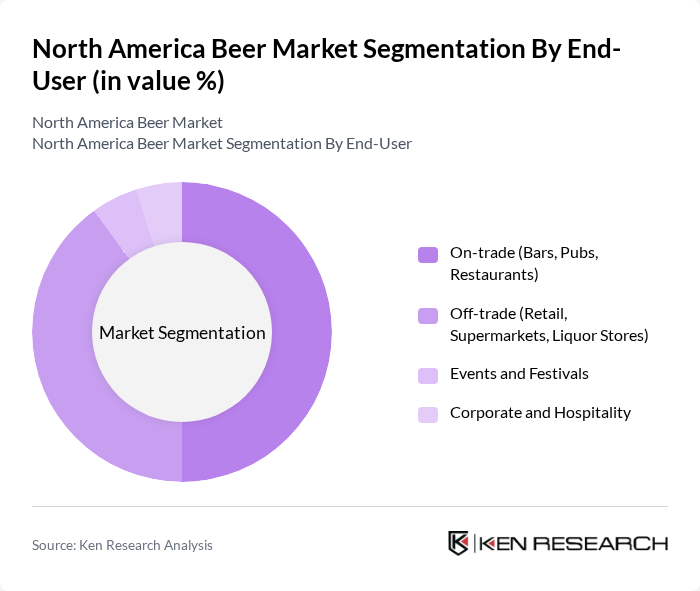

By End-User:The beer market is segmented by end-user categories, including On-trade (Bars, Pubs, Restaurants), Off-trade (Retail, Supermarkets, Liquor Stores), Events and Festivals, and Corporate and Hospitality. TheOn-tradesegment is material to brand building and experiential consumption; however, North America’s beer sales are significantly driven by theOff-tradechannel through supermarkets, liquor stores, and convenience retail, which benefits from broad assortment and price promotions . The On-trade channel remains critical for trial, limited releases, and draft-led experiences, while events and hospitality provide incremental occasion-based demand .

The North America Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anheuser-Busch InBev (AB InBev), Molson Coors Beverage Company, Constellation Brands, Inc., HEINEKEN USA Inc., Diageo North America, The Boston Beer Company, Sierra Nevada Brewing Co., New Belgium Brewing Company, Dogfish Head Craft Brewery, Lagunitas Brewing Company, Stone Brewing, Pabst Brewing Company, D.G. Yuengling & Son, Inc., Founders Brewing Co., Bell’s Brewery, Inc., Grupo Modelo (AB InBev) – North America, Cervecería Cuauhtémoc Moctezuma–Heineken México, Moosehead Breweries Limited, Labatt Brewing Company (AB InBev Canada), Sleeman Breweries Ltd. (Sapporo Breweries) contribute to innovation, geographic expansion, and service delivery in this space .

The North America beer market is poised for dynamic evolution, driven by shifting consumer preferences and innovative brewing practices. The increasing demand for craft and premium products, alongside the rise of e-commerce, will likely reshape distribution channels. Additionally, sustainability initiatives are expected to gain traction, influencing production methods. As breweries adapt to these trends, they will enhance their competitive edge, ensuring resilience in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout Porter Wheat Beer Specialty Beer Others |

| By End-User | On-trade (Bars, Pubs, Restaurants) Off-trade (Retail, Supermarkets, Liquor Stores) Events and Festivals Corporate and Hospitality |

| By Sales Channel | On-trade Off-trade Online (Direct-to-Consumer, Marketplaces) Specialty Beer Retailers |

| By Packaging Type | Bottles Cans Kegs Growlers/Crowlers |

| By Alcohol Content | Non-alcoholic/Alcohol-free (?0.5% ABV) Low Alcohol (0.5%–3.5% ABV) Regular (3.6%–5.5% ABV) High/Strong (>5.5% ABV) |

| By Region | United States Canada Mexico |

| By Price Range | Premium Mid-Range Economy |

| By Category | Craft Non-craft/Mainstream Imported Non-alcoholic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Beer Consumers | 140 | Craft Beer Enthusiasts, Regular Consumers |

| Retail Beer Outlets | 90 | Store Managers, Beverage Buyers |

| Distributors and Wholesalers | 80 | Sales Representatives, Distribution Managers |

| Breweries (Small and Large) | 70 | Owners, Head Brewers, Marketing Managers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The North America Beer Market is valued at approximately USD 185 billion, reflecting a stable consumption pattern and growth driven by craft and premium beer preferences, flavor innovations, and health-conscious options.