Region:Middle East

Author(s):Rebecca

Product Code:KRAC9676

Pages:85

Published On:November 2025

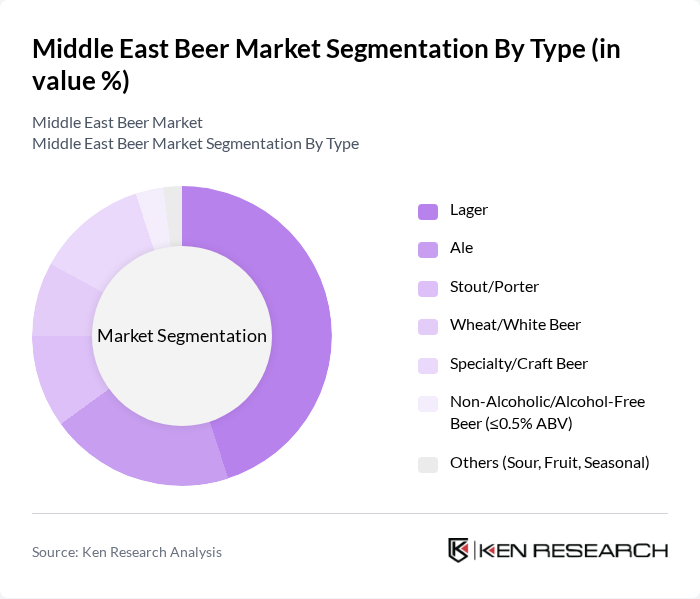

By Type:The beer market is segmented into Lager, Ale, Stout/Porter, Wheat/White Beer, Specialty/Craft Beer, Non-Alcoholic/Alcohol-Free Beer (?0.5% ABV), and Others (Sour, Fruit, Seasonal).Lagerremains the most popular type, favored for its light, refreshing profile and broad appeal across social and hospitality settings. Specialty and craft beers are experiencing accelerated growth as consumers increasingly seek unique flavors, artisanal quality, and premium experiences, reflecting the region’s evolving taste landscape .

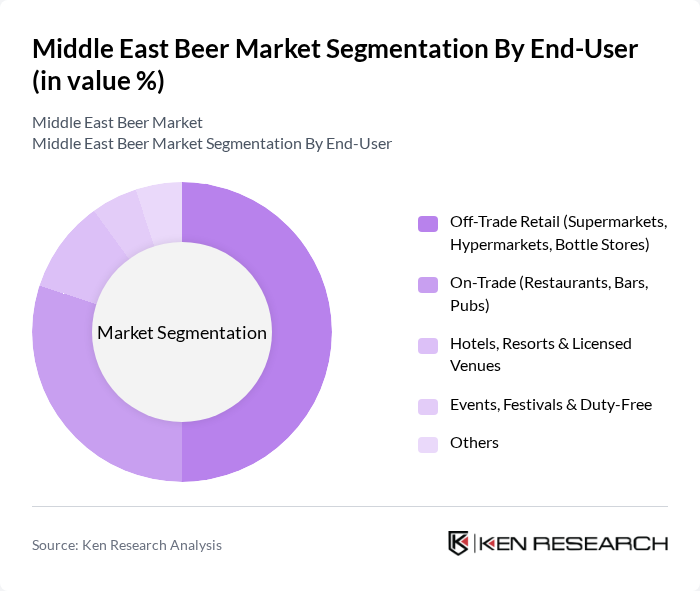

By End-User:The market is also segmented by end-user categories: Off-Trade Retail (Supermarkets, Hypermarkets, Bottle Stores), On-Trade (Restaurants, Bars, Pubs), Hotels, Resorts & Licensed Venues, Events, Festivals & Duty-Free, and Others.Off-Trade Retailleads the market, driven by convenience, expanded retail networks, and rising at-home consumption. On-Trade venues remain vital for premium and experiential consumption, while hotels and licensed venues cater to both tourists and residents seeking curated selections .

The Middle East Beer Market features a dynamic mix of regional and international companies. Leading participants such as Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Anadolu Efes Birac?l?k ve Malt Sanayii A.?., Emirates Brewing Company, Al Ahram Beverages Company (Heineken Egypt), Al-Maza (Brasserie Almaza S.A.L.), Al-Mansour Group (Al-Mansour International Distribution Company), Al-Maha Brewery, Al-Sharkiya Brewery, Al-Fakher Brewery, Al-Jazeera Brewery, Al Ain Brewery, BrewDog (UAE operations), and SABMiller (now part of AB InBev) drive innovation, expand geographic reach, and enhance service delivery. These companies leverage strong distribution networks and adapt their portfolios to cater to both traditional and emerging consumer segments .

The Middle East beer market is poised for transformation as cultural attitudes continue to evolve and economic conditions improve. With increasing disposable incomes and a growing expatriate population, the demand for diverse beer options is expected to rise. Additionally, the craft beer segment is likely to expand, driven by innovative flavors and local brewery development. As e-commerce platforms gain traction, they will provide new avenues for beer sales, further enhancing market accessibility and consumer engagement in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout/Porter Wheat/White Beer Specialty/Craft Beer Non-Alcoholic/Alcohol-Free Beer (?0.5% ABV) Others (Sour, Fruit, Seasonal) |

| By End-User | Off-Trade Retail (Supermarkets, Hypermarkets, Bottle Stores) On-Trade (Restaurants, Bars, Pubs) Hotels, Resorts & Licensed Venues Events, Festivals & Duty-Free Others |

| By Packaging Type | Glass Bottles PET Bottles Metal Cans Kegs Others |

| By Distribution Channel | Offline Retail Online Retail Direct Sales Others |

| By Alcohol Content | Non/Low Alcohol (0.0–3.5% ABV) Regular (3.6–5.5% ABV) High/Strong (>5.5% ABV) Others |

| By Region | GCC Countries (UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain) Levant Region (Lebanon, Jordan, Israel) North Africa (Egypt, Morocco, Tunisia) Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Beer | 120 | Beer Consumers, Age 21-45 |

| Retail Distribution Insights | 90 | Retail Managers, Beverage Buyers |

| Craft Beer Market Trends | 60 | Craft Brewery Owners, Industry Experts |

| On-Trade Consumption Patterns | 50 | Bar Managers, Restaurant Owners |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Affairs Specialists |

The Middle East Beer Market is valued at approximately USD 27 billion, driven by factors such as urbanization, a growing expatriate population, and a shift towards premium and craft beer consumption.