Region:Middle East

Author(s):Dev

Product Code:KRAC1968

Pages:90

Published On:October 2025

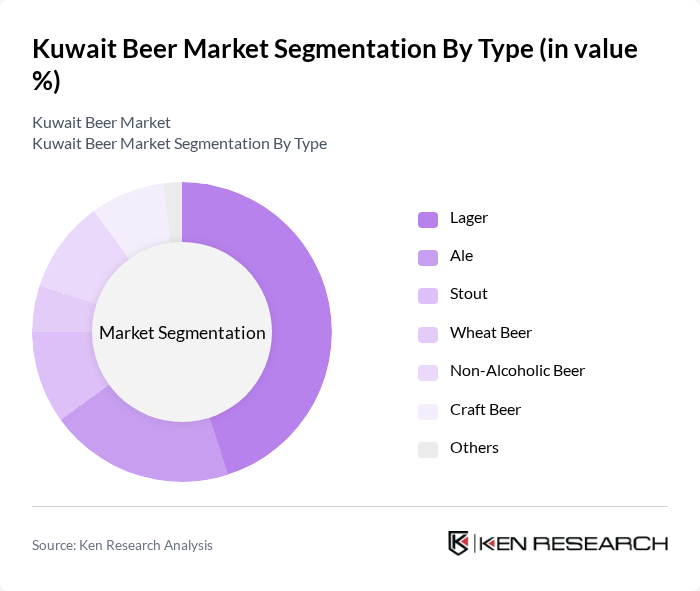

By Type:The market is segmented into various types of beer, including Lager, Ale, Stout, Wheat Beer, Non-Alcoholic Beer, Craft Beer, and Others. Lager continues to be the most popular type, favored for its refreshing taste and versatility. Craft Beer is gaining traction, driven by a growing interest in unique flavors and local brewing traditions, though its market share remains modest compared to mass-produced lagers. Non-alcoholic beer is also seeing increased demand, in line with broader health and wellness trends.

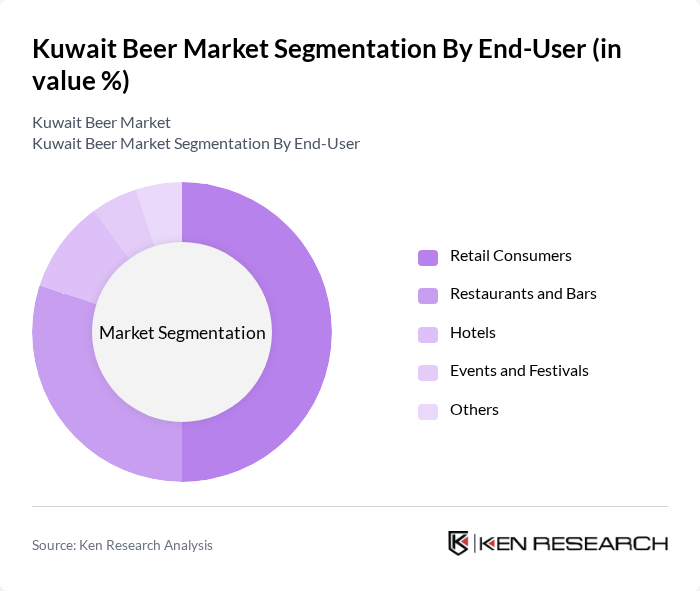

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Bars, Hotels, Events and Festivals, and Others. Retail Consumers dominate the market, driven by the increasing availability of beer in supermarkets and convenience stores, while Restaurants and Bars also play a significant role in driving sales through social gatherings and events. The hotel sector and event organizers contribute to the remaining demand.

The Kuwait Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carlsberg Group, Heineken N.V., Anheuser-Busch InBev, Molson Coors Beverage Company, Asahi Group Holdings, Diageo plc, SABMiller (now part of AB InBev), Constellation Brands, Brooklyn Brewery, BrewDog, Stone Brewing, Dogfish Head Craft Brewery, Al Azzawi Group (Distributor, Kuwait), AlMansour International Distribution Company (Kuwait), ABYAT (Non-Alcoholic Beer, Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait beer market appears promising, driven by evolving consumer preferences and increasing expatriate engagement. As disposable incomes rise, there is a notable shift towards premium and craft beer options, reflecting a broader global trend. Additionally, the anticipated growth in tourism will likely enhance market visibility and accessibility, allowing for innovative marketing strategies. Companies that adapt to these trends and navigate regulatory challenges effectively will be well-positioned to capitalize on emerging opportunities in this unique market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout Wheat Beer Non-Alcoholic Beer Craft Beer Others |

| By End-User | Retail Consumers Restaurants and Bars Hotels Events and Festivals Others |

| By Distribution Channel | On-Trade (Hotels, Restaurants, Bars) Off-Trade (Supermarkets, Convenience Stores, Specialty Stores) Online Retail Others |

| By Price Range | Premium Mid-Priced Economy/Mass Others |

| By Packaging Type | Glass Bottles Aluminum Cans Plastic Bottles Kegs Others |

| By Occasion | Social Gatherings Celebrations Casual Drinking Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Beer Types | 120 | Regular Beer Drinkers, Occasional Consumers |

| Distribution Channel Insights | 80 | Retail Managers, Wholesalers |

| Impact of Tourism on Beer Sales | 60 | Hotel Managers, Tour Operators |

| Regulatory Impact Assessment | 40 | Legal Advisors, Industry Regulators |

| Market Entry Strategies for New Brands | 50 | Marketing Managers, Brand Strategists |

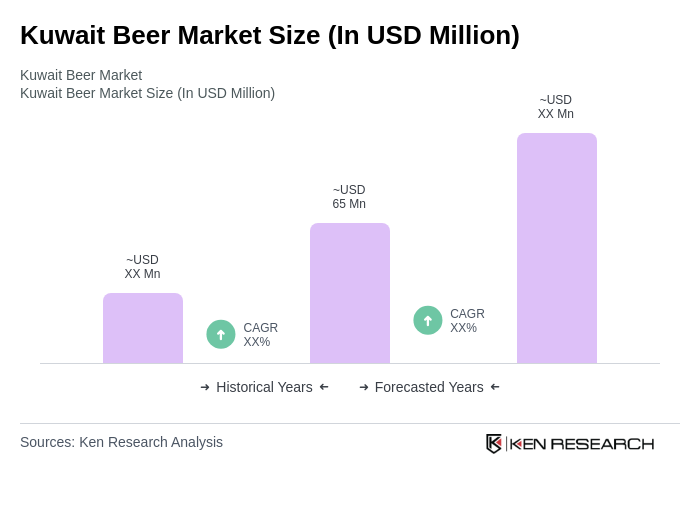

The Kuwait Beer Market is valued at approximately USD 65 million, reflecting the total revenues of producers and importers. This figure does not include logistics, retail marketing, or retailer margins, and is based on a five-year historical analysis.