Region:Africa

Author(s):Dev

Product Code:KRAA1602

Pages:94

Published On:August 2025

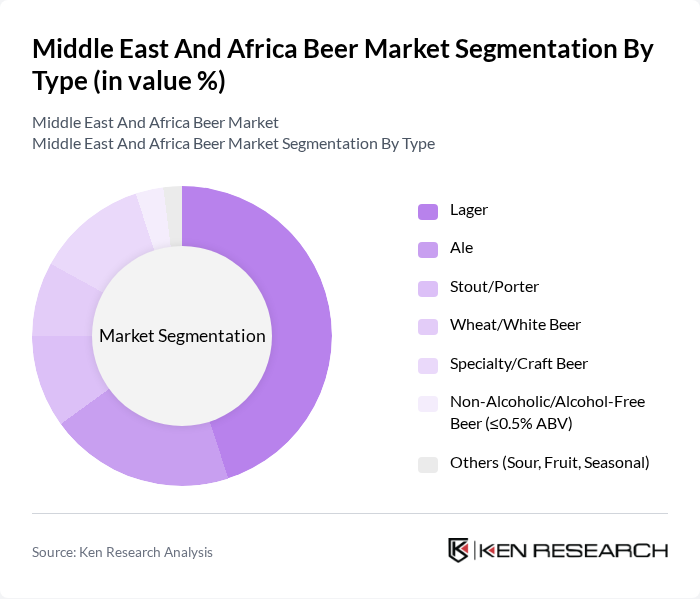

By Type:The beer market in the Middle East and Africa is segmented into various types, including Lager, Ale, Stout/Porter, Wheat/White Beer, Specialty/Craft Beer, Non-Alcoholic/Alcohol-Free Beer (?0.5% ABV), and Others (Sour, Fruit, Seasonal). Among these, Lager is the most popular type in mainstream retail and hospitality channels across MEA, reflecting global-style preferences and affordability in core markets like South Africa and Nigeria . Craft and specialty styles are gaining traction from a low base, supported by premiumization and consumer interest in unique flavors, while non-alcoholic beer is expanding quickly as health- and religion-compliant choices broaden assortments, especially in Gulf markets .

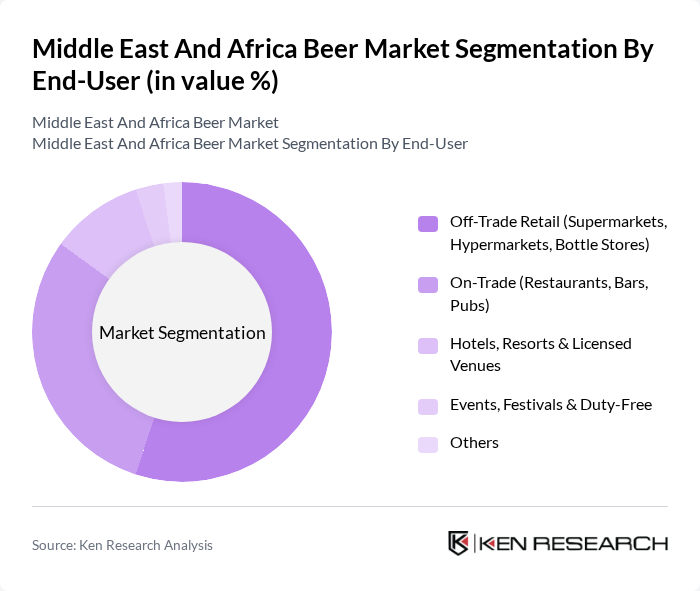

By End-User:The end-user segmentation includes Off-Trade Retail (Supermarkets, Hypermarkets, Bottle Stores), On-Trade (Restaurants, Bars, Pubs), Hotels, Resorts & Licensed Venues, Events, Festivals & Duty-Free, and Others. Off-Trade Retail is the leading segment across MEA, with supermarkets, hypermarkets, and bottle stores accounting for the majority of volume; online ordering is growing from a small base in select markets . On-trade remains significant in urban hubs and tourism-driven Gulf markets, particularly for premium and import brands .

The Middle East and Africa Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anheuser-Busch InBev (AB InBev), Heineken N.V., Carlsberg Group, Diageo plc (Guinness, EABL), The South African Breweries (SAB), a subsidiary of AB InBev, Société des Brasseries et Glacières Internationales (Castel Group), Al Ahram Beverages Company (AB InBev Egypt), East African Breweries PLC (EABL), Namibia Breweries Limited (NBL), part of Heineken Beverages, Heineken Beverages (formerly Heineken South Africa), Nigerian Breweries Plc (Heineken), Distell Group Holdings Ltd. (part of Heineken Beverages), United National Breweries (sorghum/opaque beer, South Africa), Zamalek/Almaza Brewery (Brasserie Almaza SAL, Lebanon), BGI Ethiopia (part of Castel Group) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East and Africa beer market appears promising, driven by evolving consumer preferences and increasing urbanization. As disposable incomes rise, consumers are likely to seek premium and craft beer options, enhancing market dynamics. Additionally, the growth of e-commerce platforms is expected to facilitate wider distribution and accessibility. However, navigating regulatory landscapes and cultural sensitivities will remain critical for brands aiming to capitalize on these emerging trends in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout/Porter Wheat/White Beer Specialty/Craft Beer Non-Alcoholic/Alcohol-Free Beer (?0.5% ABV) Others (Sour, Fruit, Seasonal) |

| By End-User | Off-Trade Retail (Supermarkets, Hypermarkets, Bottle Stores) On-Trade (Restaurants, Bars, Pubs) Hotels, Resorts & Licensed Venues Events, Festivals & Duty-Free Others |

| By Distribution Channel | Off-Trade: Supermarkets/Hypermarkets Off-Trade: Convenience & Liquor Stores E-commerce/Online (where permitted) On-Trade: HoReCa Direct-to-Consumer & Specialty Retail |

| By Packaging Type | Cans Bottles Kegs & Draught Others (Multipacks, Growlers) |

| By Alcohol Content | Non/Low Alcohol (0.0–3.5% ABV) Regular (3.6–5.5% ABV) High/Strong (>5.5% ABV) Others |

| By Price Range | Economy Mainstream Premium Super Premium |

| By Region | South Africa Nigeria Kenya & East Africa North Africa (Egypt, Morocco, Tunisia) GCC & Levant (UAE, Saudi Arabia, Lebanon, Jordan) Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Beer | 150 | Regular Beer Consumers, Occasional Drinkers |

| Retail Distribution Channels | 100 | Retail Managers, Beverage Distributors |

| Craft Beer Market Insights | 80 | Craft Brewery Owners, Industry Experts |

| Impact of Regulations on Beer Sales | 70 | Regulators, Regulatory Compliance Officers |

| Trends in Beer Consumption | 120 | Market Analysts, Consumer Behavior Researchers |

The Middle East and Africa beer market is valued at approximately USD 49 billion, reflecting a steady growth trend driven by urbanization, rising disposable incomes, and increased retail availability across key markets.