Region:Europe

Author(s):Geetanshi

Product Code:KRAD0004

Pages:94

Published On:August 2025

By Type:The market is segmented into Land Systems, Air Systems, Naval Systems, Cyber Defense, Intelligence, Surveillance, and Reconnaissance (ISR), Training and Simulation, Space Systems, Electronic Warfare, Unmanned Systems (UAVs, UGVs, USVs), and Others. Land Systems represent the largest share, reflecting ongoing modernization of armored vehicles and artillery. Air Systems and Naval Systems follow, driven by investments in next-generation aircraft and naval platforms. Cyber Defense and ISR are experiencing rapid growth due to heightened digital threats and the need for real-time situational awareness. Space Systems are the fastest-growing segment, propelled by satellite and anti-satellite capabilities .

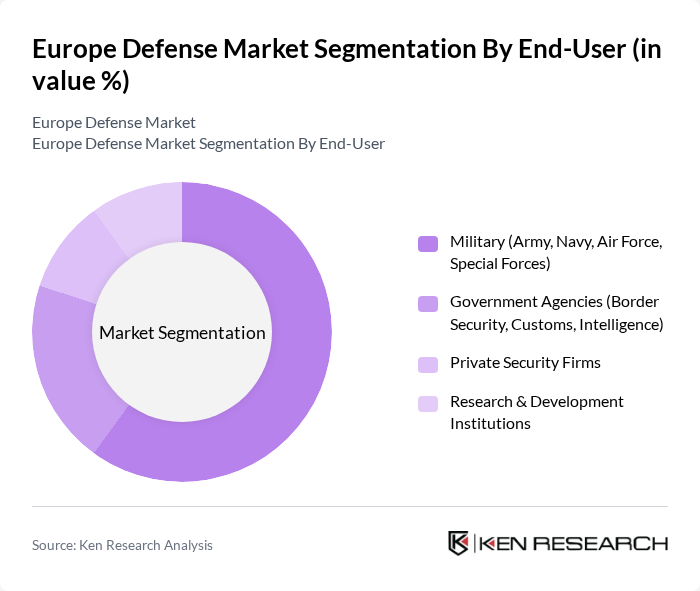

By End-User:The end-user segmentation includes Military (Army, Navy, Air Force, Special Forces), Government Agencies (Border Security, Customs, Intelligence), Private Security Firms, and Research & Development Institutions. The Military segment accounts for the majority share, reflecting ongoing procurement and modernization programs. Government Agencies are increasingly investing in border security and intelligence, while Private Security Firms and R&D Institutions contribute to specialized solutions and innovation .

The Europe Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as BAE Systems, Thales Group, Leonardo S.p.A., Rheinmetall AG, Airbus Defence and Space, Saab AB, KNDS (Krauss-Maffei Wegmann & Nexter Defence Systems), MBDA, Rolls-Royce Holdings, Indra Sistemas, Elbit Systems, HENSOLDT AG, Kongsberg Gruppen, Naval Group, and Patria Oyj contribute to innovation, geographic expansion, and service delivery in this space. These companies are recognized for their involvement in major defense programs, technological leadership, and robust order backlogs .

The future of the European defense market is poised for significant transformation, driven by a combination of technological innovation and evolving geopolitical dynamics. As nations prioritize defense modernization, investments in cybersecurity and advanced military technologies will become critical. Collaborative efforts among EU member states are expected to enhance operational capabilities, while public-private partnerships will play a vital role in fostering innovation. The focus on sustainability will also shape procurement strategies, ensuring that defense initiatives align with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Land Systems Air Systems Naval Systems Cyber Defense Intelligence, Surveillance, and Reconnaissance (ISR) Training and Simulation Space Systems Electronic Warfare Unmanned Systems (UAVs, UGVs, USVs) Others |

| By End-User | Military (Army, Navy, Air Force, Special Forces) Government Agencies (Border Security, Customs, Intelligence) Private Security Firms Research & Development Institutions |

| By Application | Defense Operations Homeland Security Peacekeeping Missions Disaster Response Critical Infrastructure Protection |

| By Component | Hardware (Platforms, Weapons, Sensors) Software (Command & Control, Cybersecurity, Simulation) Services (Maintenance, Training, Consulting) |

| By Sales Channel | Direct Government Contracts Defense Contractors/Integrators Distributors |

| By Distribution Mode | Domestic Distribution International Distribution |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Land Defense Systems | 100 | Procurement Officers, Defense Analysts |

| Aerospace and Air Defense | 60 | Program Managers, Aerospace Engineers |

| Naval Defense Technologies | 50 | Naval Architects, Defense Contractors |

| Cybersecurity in Defense | 40 | Cybersecurity Experts, IT Managers |

| Defense Logistics and Supply Chain | 70 | Logistics Managers, Supply Chain Analysts |

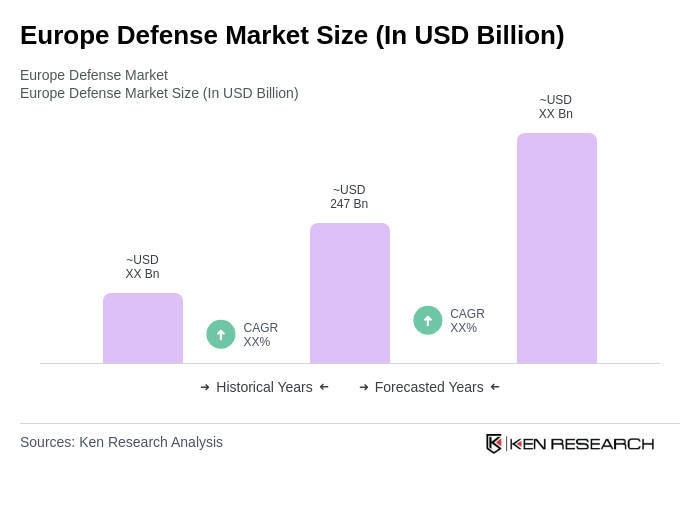

The Europe Defense Market is valued at approximately USD 247 billion, reflecting a significant increase driven by geopolitical tensions, rising defense budgets, and the modernization of military capabilities across various European nations.