United States Defense Market Overview

- The United States Defense Market is valued at USD 541 billion, based on a five-year historical analysis. This growth is primarily driven by escalating geopolitical tensions, rapid advancements in artificial intelligence and cyber warfare capabilities, and sustained increases in the U.S. defense budget. The demand for advanced weaponry, cybersecurity solutions, and modernization of military assets continues to significantly contribute to the market's expansion, with a particular emphasis on digitalization and autonomous systems .

- Key players in this market include major defense contractors such as Lockheed Martin, Boeing, and Northrop Grumman. These companies dominate the market due to their extensive experience, technological expertise, and strong relationships with government agencies. Their ability to innovate and deliver cutting-edge defense solutions—including AI-enabled systems, advanced missile defense, and integrated C4ISR platforms—has solidified their positions as leaders in the U.S. defense sector .

- In 2023, the U.S. government implemented the National Defense Authorization Act (NDAA), which authorized a defense budget of approximately USD 858 billion. This regulation aims to enhance military readiness, support research and development, and ensure the procurement of advanced defense systems. The NDAA reflects the government's commitment to maintaining a strong defense posture in response to evolving global threats, with a growing focus on cyber resilience and next-generation technologies .

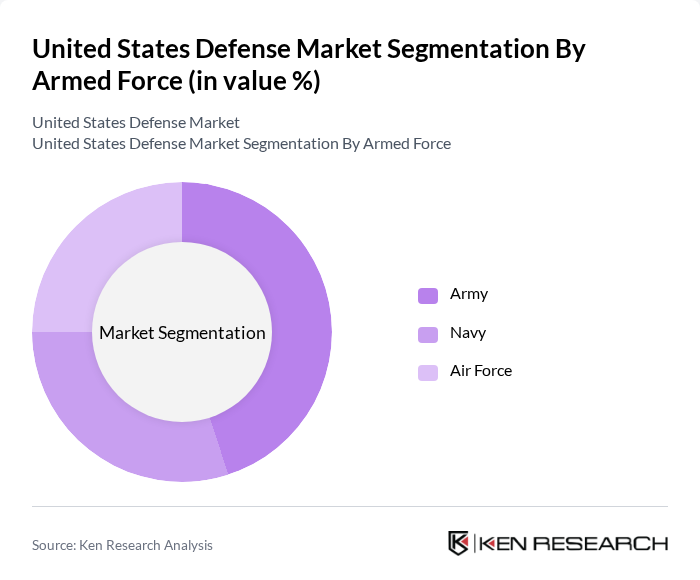

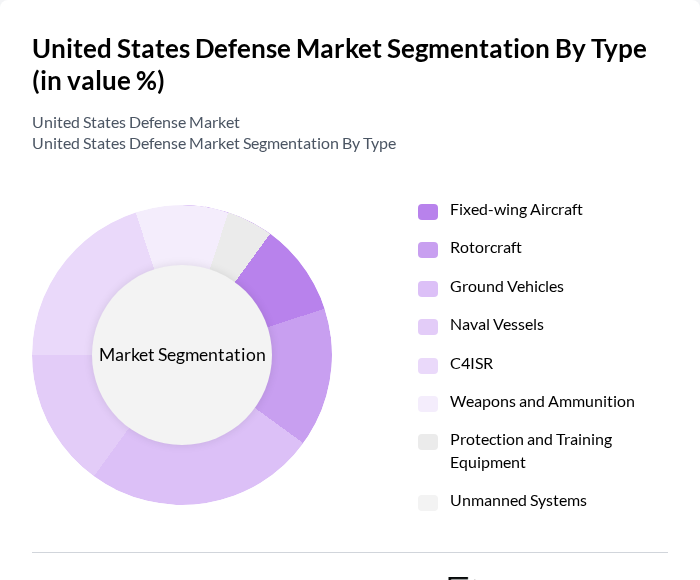

United States Defense Market Segmentation

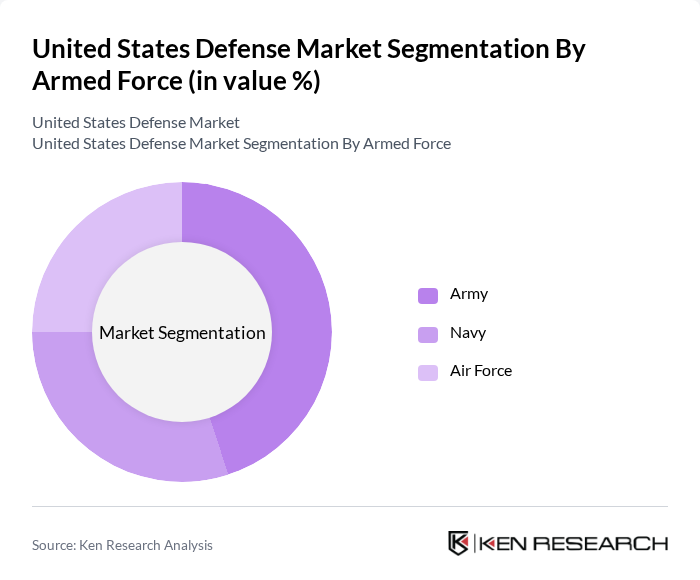

By Armed Force:The U.S. defense market is segmented into three primary armed forces: Army, Navy, and Air Force. Each branch has distinct operational requirements and budget allocations, shaping their procurement strategies. The Army emphasizes modernization of ground-based systems and integrated air defense, the Navy focuses on expanding naval capabilities and fleet readiness, and the Air Force prioritizes aerial superiority and advanced surveillance. The Army remains the dominant segment, driven by ongoing modernization programs and increased funding for ground operations .

By Type:The market is also segmented by type, including Fixed-wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), Weapons and Ammunition, Protection and Training Equipment, and Unmanned Systems. The C4ISR segment is currently leading the market due to the increasing need for advanced communication, integrated intelligence, and real-time situational awareness in modern warfare. There is also strong growth in unmanned systems and AI-enabled platforms as the U.S. military prioritizes automation and network-centric operations .

United States Defense Market Competitive Landscape

The United States Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin, RTX (Raytheon Technologies), Northrop Grumman, Boeing Defense, Space & Security, General Dynamics, BAE Systems Inc. (US Subsidiary), L3Harris Technologies, Huntington Ingalls Industries, Leidos, SAIC (Science Applications International Corporation), Textron Systems, Oshkosh Defense, Elbit Systems of America, Kratos Defense & Security Solutions, AeroVironment contribute to innovation, geographic expansion, and service delivery in this space.

United States Defense Market Industry Analysis

Growth Drivers

- Increased Defense Spending:The U.S. defense budget for fiscal year 2024 is projected to reach approximately $816.7 billion, reflecting a significant increase from $877 billion in 2023. This rise is driven by the need to enhance military capabilities amid rising global tensions. The Department of Defense (DoD) allocates around $276 billion annually for procurement and research, which supports the growth of defense contractors and technology firms, fostering innovation and modernization in defense systems.

- Technological Advancements:The U.S. defense sector is increasingly investing in advanced technologies, with an estimated $145 billion earmarked for research and development in future. This investment focuses on artificial intelligence, autonomous systems, and advanced weaponry. The integration of these technologies is crucial for maintaining a competitive edge, as the U.S. aims to counter threats from nations like China and Russia, which are also ramping up their military capabilities through technological innovations.

- Geopolitical Tensions:Heightened geopolitical tensions, particularly in Eastern Europe and the Indo-Pacific region, have led to increased military readiness and strategic partnerships. The U.S. has committed over $44 billion in military aid to Ukraine since 2022, underscoring its focus on countering aggression. Additionally, the U.S. is strengthening alliances with NATO and other partners, which drives demand for advanced defense systems and capabilities, further propelling market growth in the defense sector.

Market Challenges

- Budget Constraints:Despite increased defense spending, budget constraints remain a significant challenge. The Congressional Budget Office (CBO) projects that the U.S. will face a budget deficit exceeding $1.5 trillion in future, which may lead to cuts in defense spending in future years. This uncertainty can hinder long-term planning and investment in critical defense projects, impacting the overall stability of the defense market and its growth potential.

- Regulatory Compliance:The defense industry is subject to stringent regulations, including ITAR and DFARS, which can complicate operations for contractors. Compliance costs are estimated to exceed $10 billion annually for the industry. These regulations can slow down project timelines and increase operational costs, making it challenging for smaller firms to compete effectively. Navigating this complex regulatory landscape is essential for maintaining competitiveness in the defense market.

United States Defense Market Future Outlook

The future of the U.S. defense market appears robust, driven by ongoing technological advancements and a focus on modernization. As the geopolitical landscape evolves, the demand for innovative defense solutions will likely increase. The integration of artificial intelligence and cybersecurity measures will be pivotal in shaping defense strategies. Additionally, the emphasis on sustainability in defense operations will drive investments in green technologies, ensuring that the U.S. military remains prepared for future challenges while addressing environmental concerns.

Market Opportunities

- Defense Modernization Programs:The U.S. government is investing heavily in defense modernization, with over $90 billion allocated for upgrading existing systems in future. This presents significant opportunities for contractors specializing in advanced technologies, including cyber defense and unmanned systems, to secure lucrative contracts and enhance their market presence.

- Public-Private Partnerships:The U.S. defense sector is increasingly fostering public-private partnerships, with initiatives like the Defense Innovation Unit (DIU) facilitating collaboration. In future, the government aims to allocate substantial funding to support these partnerships, enabling private firms to contribute innovative solutions to defense challenges, thus expanding their market opportunities and driving growth.