Region:Middle East

Author(s):Shubham

Product Code:KRAB0565

Pages:90

Published On:August 2025

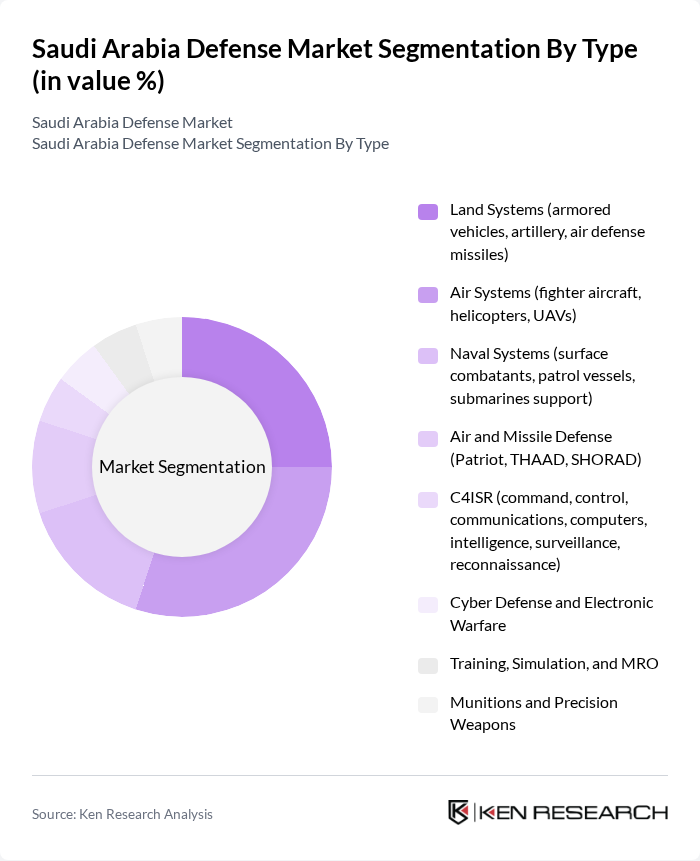

By Type:The defense market can be segmented into various types, including Land Systems, Air Systems, Naval Systems, Air and Missile Defense, C4ISR, Cyber Defense and Electronic Warfare, Training, Simulation, and MRO, and Munitions and Precision Weapons. Each of these segments plays a crucial role in the overall defense strategy of Saudi Arabia, with specific focus areas based on regional threats and technological advancements.

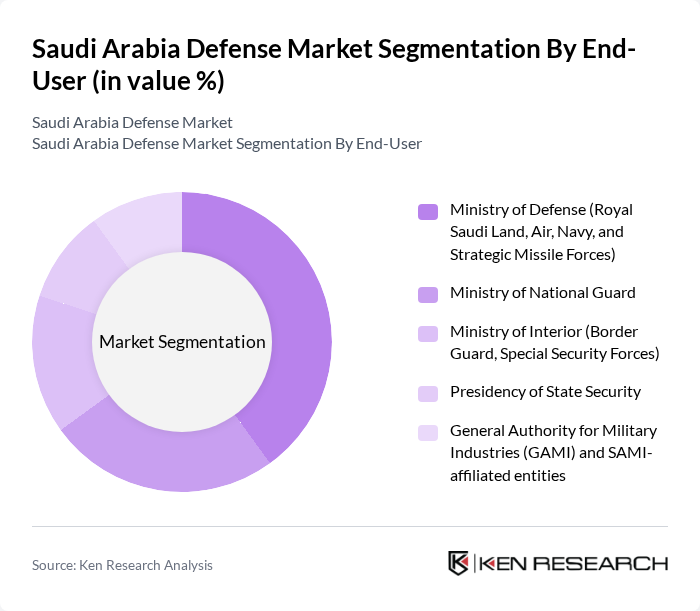

By End-User:The end-user segmentation includes various government entities such as the Ministry of Defense, Ministry of National Guard, Ministry of Interior, Presidency of State Security, and the General Authority for Military Industries (GAMI) and SAMI-affiliated entities. Each of these end-users has distinct requirements and priorities, influencing their procurement strategies and the types of defense systems they invest in.

The Saudi Arabia Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Military Industries (SAMI), General Authority for Military Industries (GAMI), Lockheed Martin Corporation, The Boeing Company (Boeing Defense, Space & Security), Raytheon (RTX Corporation), Northrop Grumman Corporation, BAE Systems plc, Thales Group, Airbus Defence and Space, Leonardo S.p.A., L3Harris Technologies, Inc., General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd., Turkish Aerospace Industries (TAI), EDGE Group (UAE), Navantia S.A., Denel SOC Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia defense market is poised for significant transformation as the Kingdom continues to prioritize military modernization and technological advancements. With a focus on local manufacturing and strategic partnerships, the defense sector is expected to evolve rapidly. The integration of advanced technologies, such as artificial intelligence and cybersecurity measures, will enhance operational capabilities. Furthermore, the ongoing geopolitical landscape will necessitate adaptive strategies, ensuring that Saudi Arabia remains resilient and prepared to address emerging security challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Land Systems (armored vehicles, artillery, air defense missiles) Air Systems (fighter aircraft, helicopters, UAVs) Naval Systems (surface combatants, patrol vessels, submarines support) Air and Missile Defense (Patriot, THAAD, SHORAD) C4ISR (command, control, communications, computers, intelligence, surveillance, reconnaissance) Cyber Defense and Electronic Warfare Training, Simulation, and MRO Munitions and Precision Weapons |

| By End-User | Ministry of Defense (Royal Saudi Land, Air, Navy, and Strategic Missile Forces) Ministry of National Guard Ministry of Interior (Border Guard, Special Security Forces) Presidency of State Security General Authority for Military Industries (GAMI) and SAMI-affiliated entities |

| By Application | Conventional Warfare and Deterrence Border Security and Counter?UAS Maritime Security and Critical Infrastructure Protection Training, Readiness, and Logistics Support Homeland Security and Counter?Terrorism |

| By Procurement Type | Foreign Military Sales (FMS) and Direct Commercial Sales (DCS) Localized Production and Licensed Manufacturing Joint Ventures and Offset Programs Maintenance, Repair, and Overhaul (MRO) Contracts |

| By Technology | Unmanned Systems (UAVs/UGVs/USVs) Missile Defense Systems Cybersecurity and Secure Communications Sensors, Radars, and EO/IR AI, Data Links, and Electronic Warfare |

| By Funding Source | Central Government Budget Sovereign Funds and Specialized Programs International Financing and Export Credit |

| By Policy Support | Vision 2030 Localization and Offset Policies GAMI Licensing and Industrial Participation R&D Incentives and Technology Transfer Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Land Forces Procurement | 100 | Procurement Officers, Military Strategists |

| Aerospace and Defense Technology | 80 | R&D Managers, Aerospace Engineers |

| Naval Defense Systems | 70 | Naval Commanders, Defense Analysts |

| Cybersecurity in Defense | 60 | IT Security Managers, Cyber Defense Experts |

| Logistics and Supply Chain in Defense | 90 | Logistics Coordinators, Supply Chain Managers |

The Saudi Arabia Defense Market is valued at approximately USD 58 billion, driven by ongoing force modernization, regional security dynamics, and significant investments in defense infrastructure as part of the Vision 2030 initiative.