Region:Asia

Author(s):Dev

Product Code:KRAB0345

Pages:80

Published On:August 2025

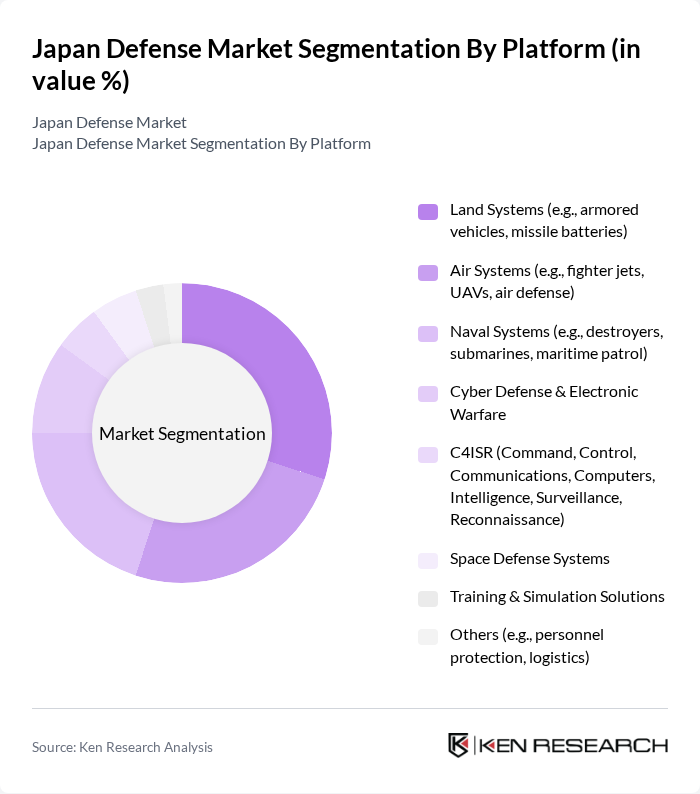

By Platform:The segmentation by platform includes Land Systems, Air Systems, Naval Systems, Cyber Defense & Electronic Warfare, C4ISR, Space Defense Systems, Training & Simulation Solutions, and Others. Land Systems and Air Systems are particularly significant due to Japan's focus on enhancing ground and aerial capabilities in response to regional threats. The demand for advanced armored vehicles, missile batteries, and next-generation fighter jets is driven by the need for modernized and resilient defense solutions. Naval Systems are also a priority, with ongoing investments in destroyers, submarines, and maritime patrol assets to secure territorial waters and sea lanes. Cyber Defense & Electronic Warfare and C4ISR are gaining importance as Japan addresses emerging threats in the digital and information domains. Space Defense Systems are expanding rapidly, with investments in missile-warning satellites and space situational awareness infrastructure .

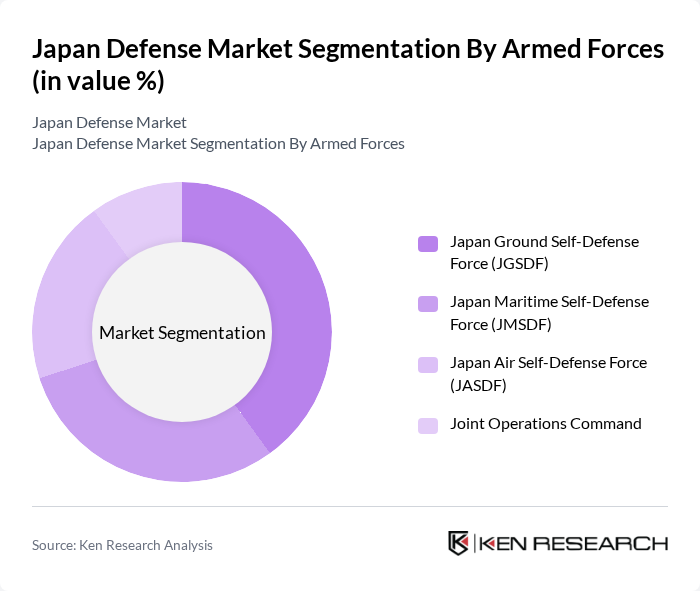

By Armed Forces:The segmentation by armed forces includes the Japan Ground Self-Defense Force (JGSDF), Japan Maritime Self-Defense Force (JMSDF), Japan Air Self-Defense Force (JASDF), and Joint Operations Command. The JGSDF remains the largest segment, reflecting Japan's focus on land-based defense capabilities in response to regional threats, particularly from North Korea and China. The JMSDF and JASDF are critical for maritime and aerial defense, supporting Japan's strategic priorities of protecting territorial integrity and maintaining air and sea superiority. Joint Operations Command plays a growing role in integrating multi-domain operations and enhancing interoperability among the branches .

The Japan Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., NEC Corporation, Fujitsu Limited, IHI Corporation, Japan Radio Co., Ltd., Hitachi, Ltd., Toshiba Corporation, NTT Data Corporation, Sumitomo Corporation, ShinMaywa Industries, Ltd., Subaru Corporation (Aerospace Company), Komatsu Ltd., Japan Steel Works, Ltd., Lockheed Martin Japan (subsidiary), BAE Systems Japan (subsidiary), and Boeing Japan (subsidiary) contribute to innovation, geographic expansion, and service delivery in this space .

The Japan defense market is poised for significant transformation as it adapts to evolving security dynamics and technological advancements. With a focus on enhancing cyber defense capabilities and integrating autonomous systems, Japan aims to modernize its military infrastructure. The government's commitment to sustainability in defense operations will also shape future investments. As public-private partnerships gain traction, collaboration with private sector innovators will be crucial in driving efficiency and effectiveness in defense initiatives, ensuring Japan remains resilient against emerging threats.

| Segment | Sub-Segments |

|---|---|

| By Platform | Land Systems (e.g., armored vehicles, missile batteries) Air Systems (e.g., fighter jets, UAVs, air defense) Naval Systems (e.g., destroyers, submarines, maritime patrol) Cyber Defense & Electronic Warfare C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance) Space Defense Systems Training & Simulation Solutions Others (e.g., personnel protection, logistics) |

| By Armed Forces | Japan Ground Self-Defense Force (JGSDF) Japan Maritime Self-Defense Force (JMSDF) Japan Air Self-Defense Force (JASDF) Joint Operations Command |

| By Application | Combat Operations Intelligence & Surveillance Disaster Response & Humanitarian Missions Training & Development |

| By Procurement Type | Domestic Procurement Foreign Procurement Public-Private Partnerships |

| By Funding Source | Government Budget Allocation Supplementary Budget/Defense-Strengthening Packages International Collaboration & Aid |

| By Region | Kanto Region Kansai Region Chubu Region Kyushu/Okinawa Region Others |

| By Technology Domain | Missile Defense Systems Unmanned Systems (UAVs, UGVs, USVs) Advanced Sensors & Radars Artificial Intelligence & Automation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Defense Procurement Officials | 60 | Senior Procurement Managers, Policy Advisors |

| Defense Contractors | 50 | Business Development Managers, Project Leads |

| Military Personnel | 40 | Field Officers, Technical Specialists |

| Defense Technology Experts | 40 | R&D Managers, Systems Engineers |

| Industry Analysts | 40 | Market Researchers, Defense Analysts |

The Japan Defense Market is valued at approximately USD 43 billion, reflecting a significant increase driven by regional security concerns, technological advancements, and government initiatives aimed at enhancing defense capabilities.