Region:Europe

Author(s):Shubham

Product Code:KRAA1824

Pages:80

Published On:August 2025

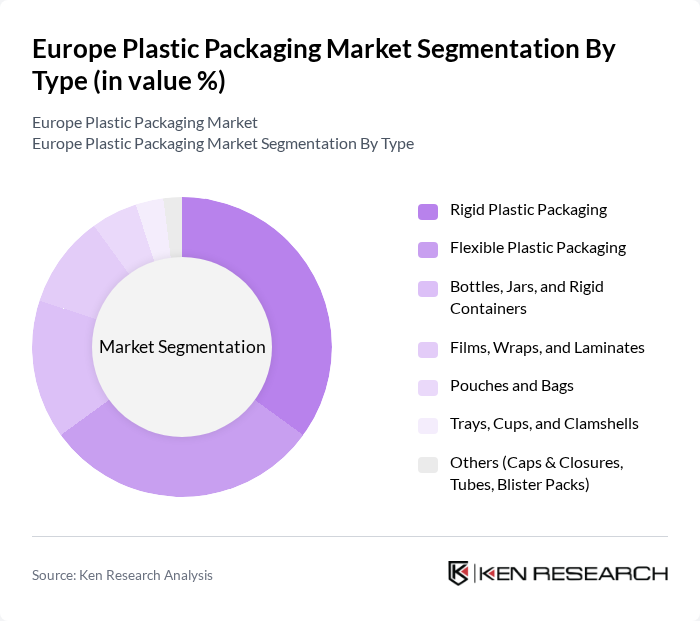

By Type:The market is segmented into various types of plastic packaging, including Rigid Plastic Packaging, Flexible Plastic Packaging, Bottles, Jars, and Rigid Containers, Films, Wraps, and Laminates, Pouches and Bags, Trays, Cups, and Clamshells, and Others (Caps & Closures, Tubes, Blister Packs). Among these, Rigid Plastic Packaging is the leading segment due to its widespread use in food and beverage packaging, driven by consumer demand for durability and safety. Flexible Plastic Packaging is also gaining traction, particularly in the snack and convenience food sectors, as it offers lightweight and space-saving solutions.

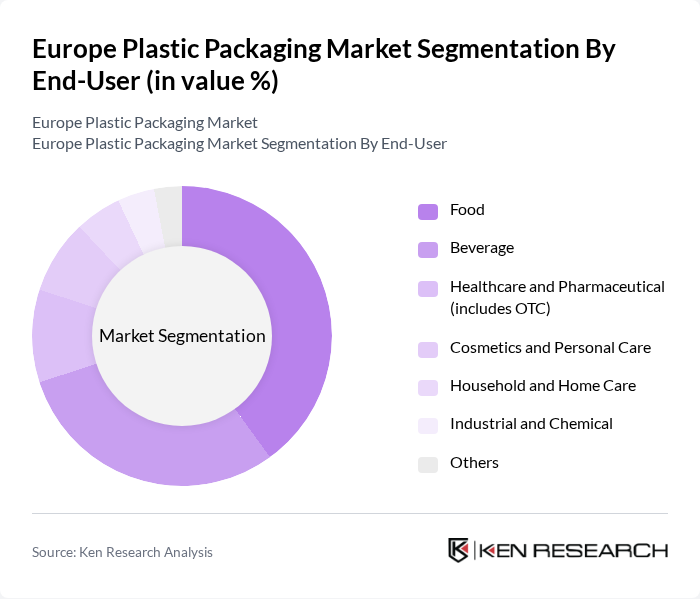

By End-User:The end-user segmentation includes Food, Beverage, Healthcare and Pharmaceutical (includes OTC), Cosmetics and Personal Care, Household and Home Care, Industrial and Chemical, and Others. The Food segment is the largest end-user, driven by the increasing demand for packaged food products and the need for longer shelf life. The Beverage segment follows closely, with a growing preference for bottled drinks and ready-to-drink products, which require effective packaging solutions to maintain quality and safety.

The Europe Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global Group, Inc., Sealed Air Corporation (SEE), Mondi plc, Constantia Flexibles, Huhtamaki Oyj, Klöckner Pentaplast Group, Greiner Packaging International GmbH, Coveris Group, ProAmpac LLC, Plastipak Holdings, Inc., Alpla Werke Alwin Lehner GmbH & Co KG (ALPLA), DS Smith Plastics (historical; RPC/Promens assets now within Berry Global), RPC Group plc (now part of Berry Global), Linpac Packaging (now part of Klöckner Pentaplast) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European plastic packaging market is poised for transformation, driven by sustainability and technological advancements. As the circular economy gains traction, companies are expected to invest heavily in recycling technologies and biodegradable materials. Additionally, the integration of smart packaging solutions will enhance product tracking and consumer engagement. With increasing regulatory pressures, businesses that adapt to these trends will likely thrive, positioning themselves as leaders in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Plastic Packaging Flexible Plastic Packaging Bottles, Jars, and Rigid Containers Films, Wraps, and Laminates Pouches and Bags Trays, Cups, and Clamshells Others (Caps & Closures, Tubes, Blister Packs) |

| By End-User | Food Beverage Healthcare and Pharmaceutical (includes OTC) Cosmetics and Personal Care Household and Home Care Industrial and Chemical Others |

| By Material Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polyethylene Terephthalate (PET) Polystyrene (PS) and EPS Polyamide (PA) and EVOH Bio-based and Compostable Plastics (PLA, PHA, etc.) Others |

| By Application | Food Packaging Beverage Packaging Pharmaceutical and Medical Packaging Cosmetic and Personal Care Packaging Industrial and Chemical Packaging E-commerce and Logistics Packaging Others |

| By Distribution Channel | Direct to Brand Owners (B2B) Distributors and Converters Online Procurement Platforms Retail/Wholesale for SMBs Others |

| By Region | United Kingdom Germany France Italy Spain Netherlands Poland Rest of Europe |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 140 | Packaging Managers, Quality Assurance Specialists |

| Healthcare Packaging Solutions | 100 | Regulatory Affairs Managers, Product Development Leads |

| Consumer Goods Packaging | 120 | Brand Managers, Supply Chain Coordinators |

| Recycling and Sustainability Initiatives | 80 | Sustainability Managers, Environmental Compliance Officers |

| Industrial Packaging Applications | 90 | Operations Managers, Procurement Specialists |

The Europe Plastic Packaging Market is valued at approximately USD 25 billion, reflecting a significant growth driven by the demand for sustainable packaging solutions and innovations in material technology, alongside the rising consumption of packaged goods across various sectors.