Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0035

Pages:89

Published On:August 2025

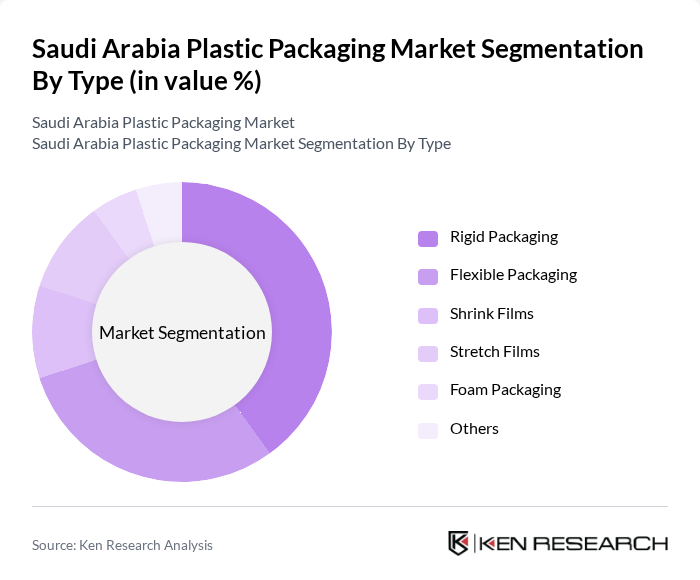

By Type:The market is segmented into various types of plastic packaging, including Rigid Packaging, Flexible Packaging, Shrink Films, Stretch Films, Foam Packaging, and Others. Rigid packaging is the leading segment, widely used in food, beverage, and industrial applications due to its durability and ability to protect products from moisture and contaminants. Flexible packaging is gaining traction, especially in the retail and e-commerce sectors, as it offers lightweight, cost-effective, and customizable solutions. The demand for shrink and stretch films continues to rise, driven by their application in bundling, palletizing, and securing products during transportation .

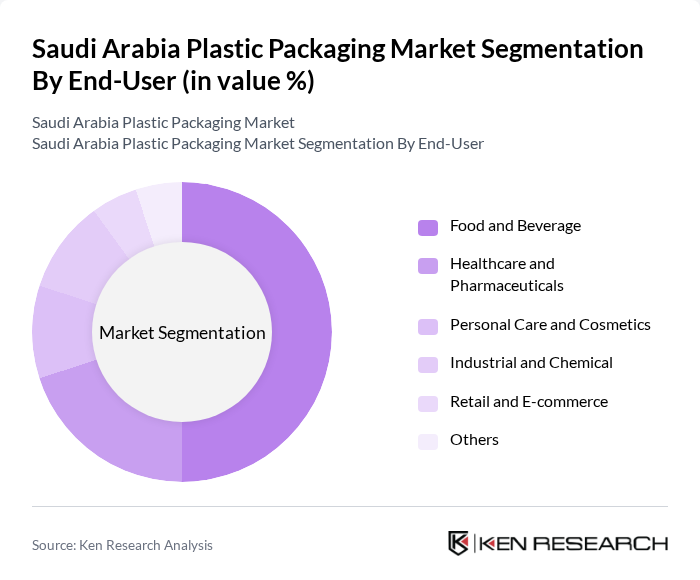

By End-User:The end-user segmentation includes Food and Beverage, Healthcare and Pharmaceuticals, Personal Care and Cosmetics, Industrial and Chemical, Retail and E-commerce, and Others. The Food and Beverage sector is the largest consumer of plastic packaging, driven by the need for safe, hygienic, and extended shelf-life solutions. Healthcare and Pharmaceuticals are significant, with increasing demand for medical packaging that ensures product integrity and safety. Personal care, cosmetics, and retail/e-commerce are rapidly growing segments, reflecting the shift towards online shopping, premiumization, and the need for efficient, attractive packaging solutions .

The Saudi Arabia Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Plastic Factory Company (SPF), Al Watania Plastics, Takween Advanced Industries, Zamil Plastic Industries, Napco National, Arabian Plastic Industrial Company (APICO), Rowad National Plastic Company, Obeikan Investment Group, 3P Gulf Group, ENPI Group, National Plastic Factory (NPF), Al Bayader International, Al-Jazira Factory for Plastic Products, Saudi Arabian Amiantit Company, and Al-Faisal Plastic Factory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian plastic packaging market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in biodegradable materials and smart packaging technologies are expected to reshape the industry landscape. Additionally, the government's commitment to promoting local manufacturing and reducing plastic waste will likely create a conducive environment for growth. As consumer awareness of environmental issues increases, companies that prioritize sustainable practices will gain a competitive edge, positioning themselves favorably in the evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Packaging Flexible Packaging Shrink Films Stretch Films Foam Packaging Others |

| By End-User | Food and Beverage Healthcare and Pharmaceuticals Personal Care and Cosmetics Industrial and Chemical Retail and E-commerce Others |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyethylene Terephthalate (PET) Polyvinyl Chloride (PVC) Polystyrene (PS) Bio-based Plastics Others |

| By Application | Food Packaging Beverage Packaging Medical Packaging Industrial Packaging Personal Care Packaging Retail Packaging Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Offline Retail Others |

| By Region | Central Region (Riyadh) Western Region (Jeddah, Mecca) Eastern Region (Dammam, Khobar) Northern Region Southern Region Others |

| By Sustainability Initiatives | Recyclable Packaging Biodegradable Packaging Reusable Packaging Eco-Friendly Materials Compostable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 60 | Regulatory Affairs Managers, Production Supervisors |

| Consumer Goods Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

| Sustainability Initiatives in Packaging | 40 | Sustainability Managers, Product Development Leads |

The Saudi Arabia Plastic Packaging Market is valued at approximately USD 13.1 billion, reflecting significant growth driven by increasing demand for packaged food and beverages, urbanization, and rising consumer awareness regarding hygiene and convenience.