Region:Global

Author(s):Rebecca

Product Code:KRAD1477

Pages:89

Published On:November 2025

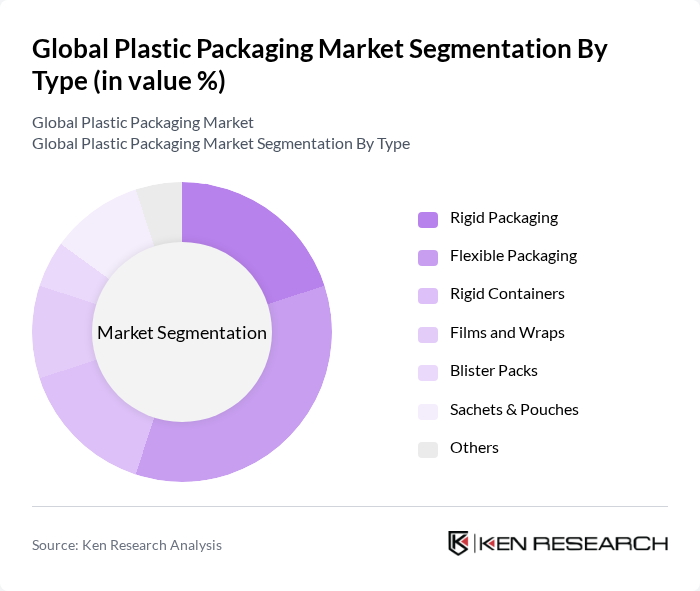

By Type:The plastic packaging market is segmented into various types, including Rigid Packaging, Flexible Packaging, Rigid Containers, Films and Wraps, Blister Packs, Sachets & Pouches, and Others. Among these, Flexible Packaging is currently the leading sub-segment due to its lightweight nature, cost-effectiveness, and versatility in packaging various products. The growing trend of on-the-go consumption and the need for longer shelf life in food products have further propelled the demand for flexible packaging solutions.

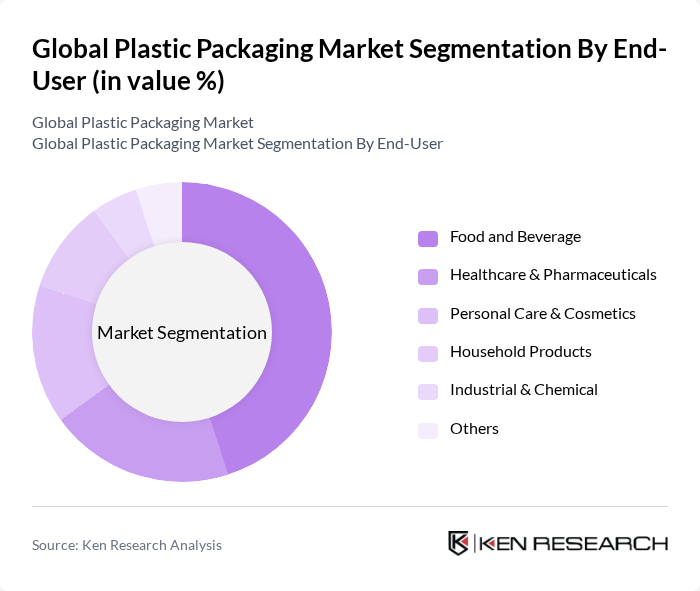

By End-User:The end-user segmentation of the plastic packaging market includes Food and Beverage, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Household Products, Industrial & Chemical, and Others. The Food and Beverage sector is the dominant segment, driven by the increasing demand for packaged food products and beverages. The convenience of ready-to-eat meals and the growing trend of online grocery shopping have significantly contributed to the expansion of this segment.

The Global Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Crown Holdings, Inc., Sonoco Products Company, Smurfit Kappa Group, WestRock Company, Huhtamaki Oyj, Coveris Holdings S.A., Constantia Flexibles Group GmbH, Clondalkin Group, AptarGroup, Inc., Winpak Ltd., and DS Smith Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plastic packaging industry is poised for transformation, driven by sustainability and technological advancements. As consumer preferences shift towards eco-friendly solutions, companies are expected to invest in biodegradable materials and innovative recycling processes. Furthermore, the integration of smart technologies will enhance product safety and consumer engagement. With emerging markets expanding their e-commerce capabilities, the demand for efficient and sustainable packaging solutions will continue to rise, shaping the industry's trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Packaging Flexible Packaging Rigid Containers Films and Wraps Blister Packs Sachets & Pouches Others |

| By End-User | Food and Beverage Healthcare & Pharmaceuticals Personal Care & Cosmetics Household Products Industrial & Chemical Others |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Others |

| By Application | Food Packaging Beverage Packaging Pharmaceutical Packaging Industrial Packaging Personal Care Packaging Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Convenience Stores Direct Sales Distributors/Wholesalers Others |

| By Geography | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East and Africa (GCC, South Africa, Rest of MEA) |

| By Sustainability Initiatives | Recyclable Packaging Biodegradable Packaging Reduced Plastic Usage Eco-friendly Materials Compostable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Packaging Managers, Product Development Leads |

| Healthcare Packaging Solutions | 90 | Quality Assurance Officers, Regulatory Affairs Specialists |

| Consumer Goods Packaging Trends | 100 | Brand Managers, Marketing Directors |

| Sustainable Packaging Innovations | 60 | Sustainability Managers, R&D Scientists |

| Industrial Packaging Applications | 70 | Operations Managers, Supply Chain Analysts |

The Global Plastic Packaging Market is valued at approximately USD 465 billion, driven by increasing demand for packaged food and beverages, e-commerce growth, and a shift towards sustainable packaging solutions.