Region:Asia

Author(s):Shubham

Product Code:KRAE0481

Pages:87

Published On:December 2025

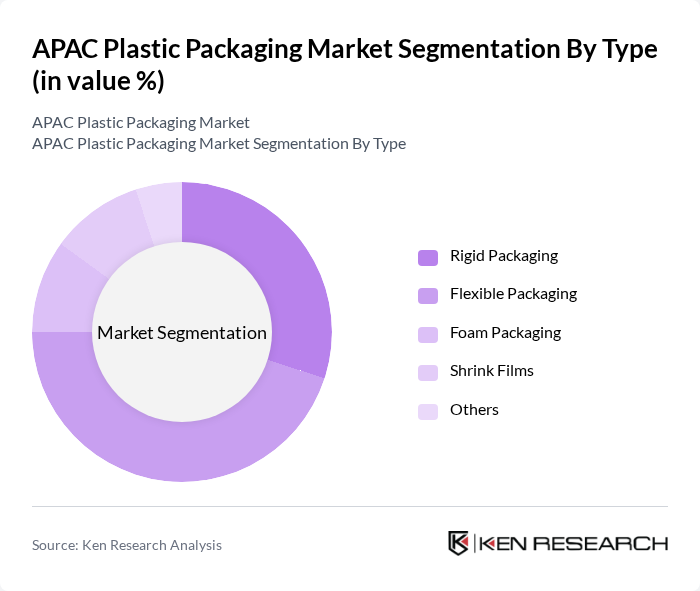

By Type:The plastic packaging market is segmented into various types, including rigid packaging, flexible packaging, foam packaging, shrink films, and others. Among these, flexible packaging is currently dominating the market due to its versatility, lightweight nature, and cost-effectiveness. The growing demand for convenience foods and e-commerce packaging solutions has significantly contributed to the rise of flexible packaging. Rigid packaging also holds a substantial share, particularly in sectors like food and beverage, where durability and protection are paramount.

By End-User:The end-user segmentation of the plastic packaging market includes food and beverage, healthcare, personal care, industrial, and others. The food and beverage sector is the largest consumer of plastic packaging, driven by the increasing demand for packaged food products and beverages. The healthcare sector is also witnessing significant growth due to the rising need for safe and hygienic packaging solutions for pharmaceuticals and medical devices. Personal care and industrial segments are growing steadily, supported by innovations in packaging design and functionality.

The APAC Plastic Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Huhtamaki Oyj, Smurfit Kappa Group, Constantia Flexibles, DS Smith Plc, Winpak Ltd., INDEVCO Group, Novolex Holdings, LLC, ProAmpac LLC, RPC Group Plc, Clondalkin Group, Coveris Holdings S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC plastic packaging market is poised for transformative growth, driven by innovations in sustainable materials and the increasing integration of technology in packaging solutions. As consumer preferences shift towards eco-friendly options, companies are likely to invest heavily in research and development to create biodegradable and recyclable products. Additionally, the rise of smart packaging technologies, which enhance user experience and product safety, will further shape the market landscape, fostering a competitive environment that prioritizes sustainability and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Packaging Flexible Packaging Foam Packaging Shrink Films Others |

| By End-User | Food and Beverage Healthcare Personal Care Industrial Others |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Others |

| By Application | Packaging for Food Products Packaging for Non-Food Products Packaging for Pharmaceuticals Packaging for Electronics Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | North Asia Southeast Asia South Asia Oceania Others |

| By Sustainability Initiatives | Recyclable Packaging Biodegradable Packaging Reusable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 150 | Packaging Managers, Product Development Leads |

| Pharmaceutical Packaging Solutions | 100 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging Trends | 120 | Brand Managers, Marketing Directors |

| Sustainable Packaging Initiatives | 80 | Sustainability Officers, R&D Managers |

| Industrial Packaging Applications | 90 | Operations Managers, Supply Chain Coordinators |

The APAC Plastic Packaging Market is valued at approximately USD 141 billion, driven by the growth of e-commerce, organized retail, and convenience food sectors, alongside consumer demand for sustainable and durable packaging solutions.