Region:Europe

Author(s):Rebecca

Product Code:KRAB0242

Pages:94

Published On:August 2025

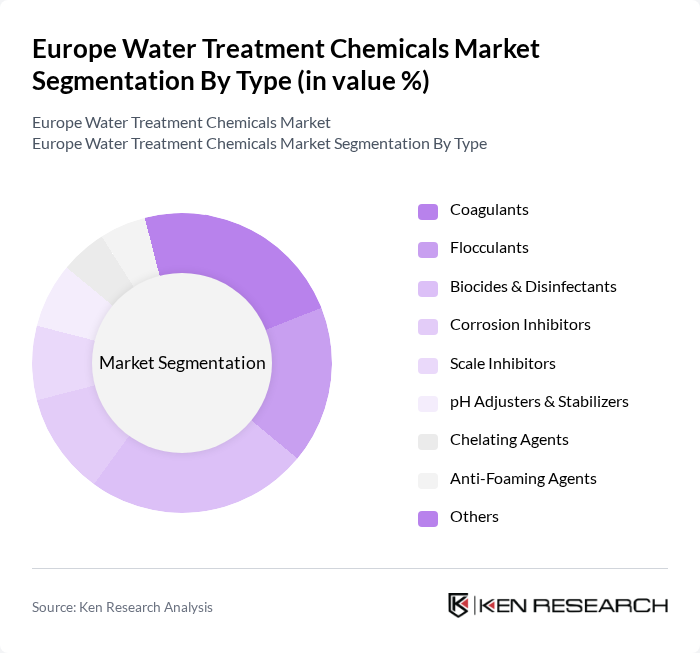

By Type:The market is segmented into various types of water treatment chemicals, including coagulants, flocculants, biocides & disinfectants, corrosion inhibitors, scale inhibitors, pH adjusters & stabilizers, chelating agents, anti-foaming agents, and others. Each of these sub-segments plays a crucial role in ensuring water quality and safety. Coagulants and flocculants are widely used in municipal and industrial water treatment to remove suspended solids, while biocides and disinfectants are essential for microbial control. Corrosion and scale inhibitors are critical in industrial applications to protect equipment and optimize process efficiency .

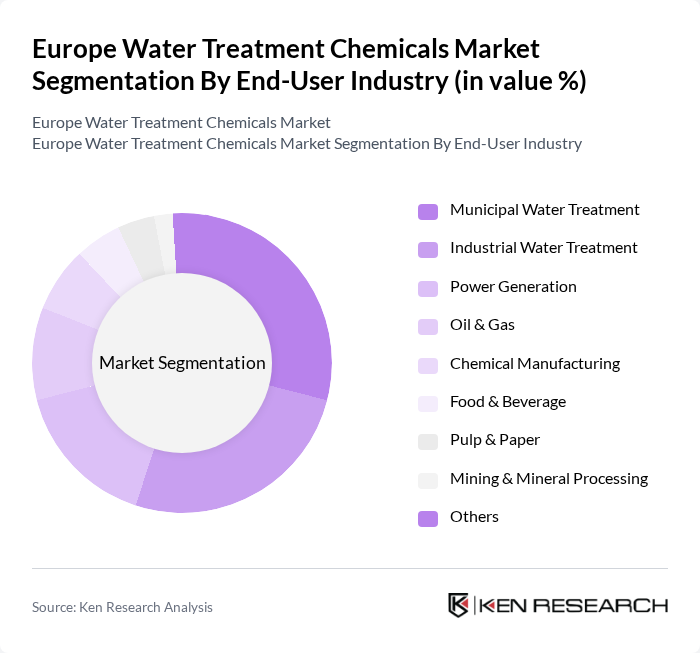

By End-User Industry:The end-user industries for water treatment chemicals include municipal water treatment, industrial water treatment, power generation, oil & gas, chemical manufacturing, food & beverage, pulp & paper, mining & mineral processing, and others. Each industry has specific requirements for water quality and treatment processes. The municipal sector remains the largest consumer, driven by regulatory mandates for potable water and wastewater treatment. Industrial users, especially in power generation and manufacturing, require specialized chemicals to address process-specific challenges such as scaling, corrosion, and microbial contamination .

The Europe Water Treatment Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Ecolab Inc., Kemira Oyj, SNF Group, Solvay S.A., Dow Inc., AkzoNobel N.V., Veolia Environnement S.A., SUEZ S.A., LANXESS AG, Buckman Laboratories International, Inc., Kurita Water Industries Ltd., Solenis LLC, Lonza Group AG, Carus LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe water treatment chemicals market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological integration. As industries adopt eco-friendly practices, the demand for biodegradable and non-toxic treatment chemicals is expected to rise. Additionally, the integration of IoT technologies in water management systems will enhance monitoring and efficiency, creating new avenues for growth. Companies that prioritize innovation and sustainability will likely lead the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Biocides & Disinfectants Corrosion Inhibitors Scale Inhibitors pH Adjusters & Stabilizers Chelating Agents Anti-Foaming Agents Others |

| By End-User Industry | Municipal Water Treatment Industrial Water Treatment Power Generation Oil & Gas Chemical Manufacturing Food & Beverage Pulp & Paper Mining & Mineral Processing Others |

| By Application | Drinking Water Treatment Wastewater Treatment Cooling Water Treatment Process Water Treatment |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Germany United Kingdom France Italy Russia Spain Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe |

| By Price Range | Low Price Medium Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 120 | Plant Managers, Environmental Compliance Officers |

| Industrial Water Treatment Applications | 80 | Procurement Managers, Operations Directors |

| Chemical Suppliers and Distributors | 60 | Sales Managers, Product Development Specialists |

| Research Institutions and Environmental NGOs | 50 | Research Scientists, Policy Analysts |

| Regulatory Bodies and Government Agencies | 40 | Regulatory Affairs Managers, Environmental Inspectors |

The Europe Water Treatment Chemicals Market is valued at approximately USD 11 billion, driven by regulatory pressures for water quality, industrial activities, and the need for sustainable water management solutions.