Region:Global

Author(s):Rebecca

Product Code:KRAB0181

Pages:88

Published On:August 2025

By Type:The aviation market can be segmented into various types, includingCommercial Aviation,Cargo Aviation,Business Aviation,Military Aviation,Helicopter Services,Maintenance, Repair, and Overhaul (MRO),Urban Air Mobility (UAM) & eVTOL, andOthers. Each of these segments plays a crucial role in the overall market dynamics, catering to different consumer needs and operational requirements. Commercial aviation continues to represent the largest segment, driven by global passenger demand, while cargo aviation has grown significantly due to e-commerce expansion and supply chain optimization. Urban Air Mobility and eVTOL are emerging rapidly, supported by investments in electric propulsion and smart city initiatives .

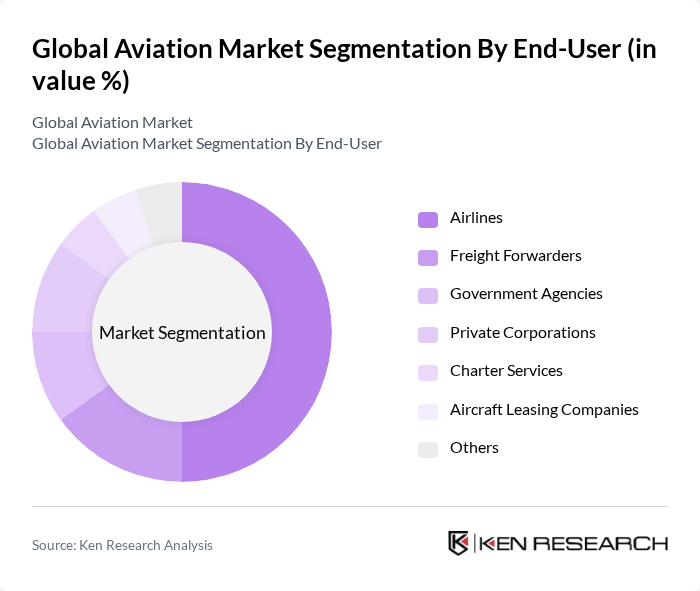

By End-User:The end-user segmentation includesAirlines,Freight Forwarders,Government Agencies,Private Corporations,Charter Services,Aircraft Leasing Companies, andOthers. Each end-user category has distinct requirements and contributes differently to the market, reflecting the diverse applications of aviation services. Airlines account for the largest share, driven by passenger and cargo operations, while freight forwarders and leasing companies are gaining importance due to evolving logistics and fleet management needs .

The Global Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boeing, Airbus, Lockheed Martin, Delta Air Lines, United Airlines, Southwest Airlines, Emirates, Qatar Airways, Lufthansa Group, British Airways, Air France-KLM, Singapore Airlines, ANA Holdings (All Nippon Airways), Ryanair Holdings, Turkish Airlines, China Southern Airlines, IndiGo, Alaska Airlines, JetBlue Airways, Ethiopian Airlines Group contribute to innovation, geographic expansion, and service delivery in this space.

The aviation industry is poised for transformative growth, driven by technological advancements and a renewed focus on sustainability. As airlines adopt digital transformation strategies, operational efficiencies are expected to improve significantly. Furthermore, the shift towards sustainable aviation fuels and electric aircraft will reshape the industry landscape, aligning with global emission reduction targets. The increasing emphasis on passenger experience will also drive innovation, ensuring that airlines remain competitive in a rapidly evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Aviation Cargo Aviation Business Aviation Military Aviation Helicopter Services Maintenance, Repair, and Overhaul (MRO) Urban Air Mobility (UAM) & eVTOL Others |

| By End-User | Airlines Freight Forwarders Government Agencies Private Corporations Charter Services Aircraft Leasing Companies Others |

| By Aircraft Size | Narrow-Body Aircraft Wide-Body Aircraft Regional Aircraft Cargo Aircraft Business Jets Others |

| By Service Type | Scheduled Passenger Services Charter Services Cargo Services MRO Services Ground Handling Services Others |

| By Distribution Channel | Direct Sales Online Travel Agencies Travel Agents Corporate Contracts Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Customer Segment | Leisure Travelers Business Travelers Government Officials Cargo Customers Aircraft Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Operations | 100 | Airline Executives, Operations Managers |

| Aerospace Manufacturing Insights | 60 | Manufacturing Directors, Supply Chain Managers |

| Airport Management Practices | 50 | Airport Authorities, Facility Managers |

| Air Cargo Logistics | 40 | Cargo Operations Managers, Freight Forwarders |

| Regulatory Compliance in Aviation | 40 | Compliance Officers, Legal Advisors |

The Global Aviation Market is valued at approximately USD 1 trillion, reflecting a significant recovery post-pandemic, driven by increasing air travel demand, advancements in aviation technology, and the expansion of low-cost carriers.