Region:Asia

Author(s):Shubham

Product Code:KRAA3176

Pages:99

Published On:August 2025

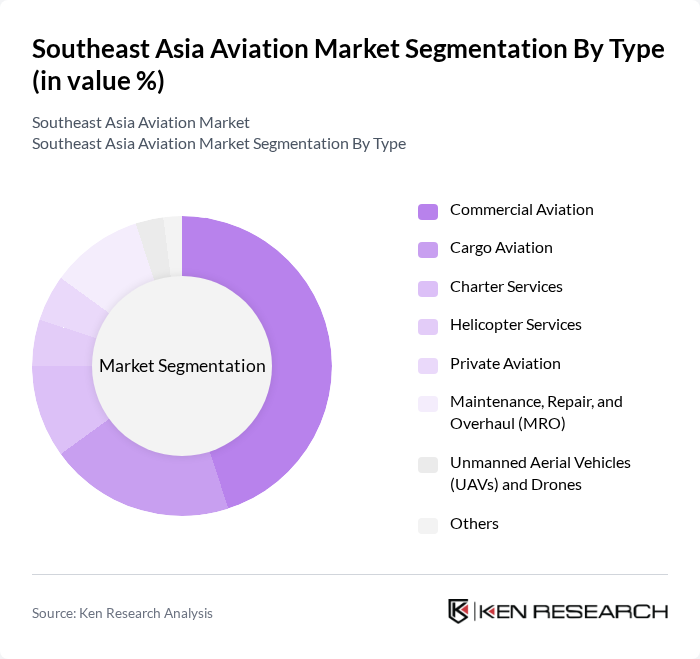

By Type:The aviation market in Southeast Asia can be segmented into various types, including Commercial Aviation, Cargo Aviation, Charter Services, Helicopter Services, Private Aviation, Maintenance, Repair, and Overhaul (MRO), Unmanned Aerial Vehicles (UAVs) and Drones, and Others. Among these, Commercial Aviation is the leading segment, driven by the increasing number of passengers traveling for both business and leisure purposes. The rise of low-cost carriers and increased route connectivity have made air travel more accessible, contributing to the growth of this segment .

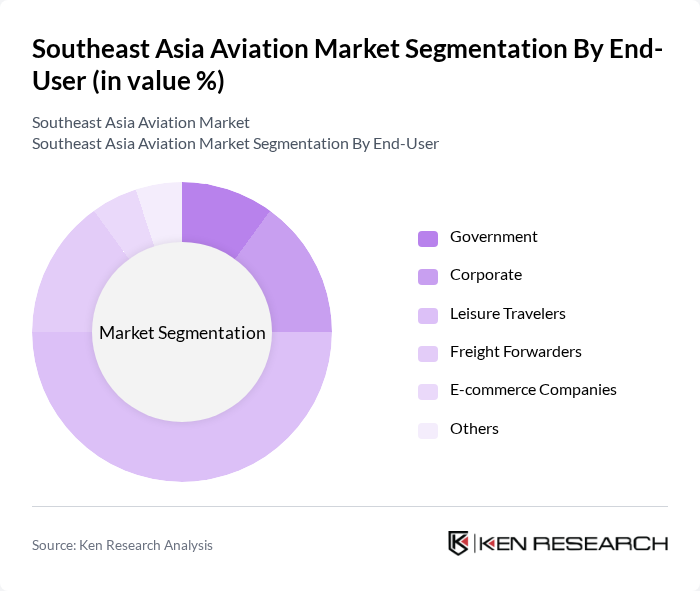

By End-User:The aviation market can also be segmented by end-users, including Government, Corporate, Leisure Travelers, Freight Forwarders, E-commerce Companies, and Others. The Leisure Travelers segment is currently the most dominant, fueled by the growing middle class and increased disposable income, which has led to a surge in travel for leisure purposes. The rise of online travel agencies and digital booking platforms has also made it easier for consumers to book flights, further driving this segment's growth .

The Southeast Asia Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Singapore Airlines, AirAsia Group Berhad, Garuda Indonesia, Vietnam Airlines, Malaysia Airlines Berhad, Philippine Airlines, Thai Airways International Public Co. Ltd., Lion Air, Cebu Pacific Air, Jetstar Asia Airways, Bangkok Airways, VietJet Aviation Joint Stock Company (VietJet Air), Sriwijaya Air, Nok Airlines Public Co. Ltd. (Nok Air), Myanmar National Airlines contribute to innovation, geographic expansion, and service delivery in this space.

The Southeast Asia aviation market is poised for significant growth, driven by increasing air travel demand and ongoing investments in infrastructure. As governments prioritize aviation development, the region is likely to see enhanced connectivity and improved passenger experiences. Additionally, the rise of low-cost carriers will continue to democratize air travel, making it accessible to a broader demographic. However, addressing regulatory compliance and operational cost challenges will be crucial for sustaining this growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Aviation Cargo Aviation Charter Services Helicopter Services Private Aviation Maintenance, Repair, and Overhaul (MRO) Unmanned Aerial Vehicles (UAVs) and Drones Others |

| By End-User | Government Corporate Leisure Travelers Freight Forwarders E-commerce Companies Others |

| By Service Class | Economy Class Business Class First Class Premium Economy Others |

| By Distribution Channel | Direct Sales Online Travel Agencies Travel Agents Corporate Bookings Mobile Applications Others |

| By Aircraft Size | Narrow-Body Aircraft Wide-Body Aircraft Regional Aircraft Cargo Aircraft Business Jets Others |

| By Flight Duration | Short-Haul Flights (<3 hours) Medium-Haul Flights (3–6 hours) Long-Haul Flights (>6 hours) Others |

| By Geographic Coverage | Domestic Flights International Flights Intra-ASEAN Regional Flights Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Airlines | 100 | Airline Executives, Operations Managers |

| Low-Cost Carriers | 80 | Marketing Directors, Revenue Managers |

| Travel Agencies | 60 | Travel Agents, Agency Owners |

| Airport Authorities | 50 | Airport Managers, Infrastructure Planners |

| Ground Service Providers | 40 | Operations Supervisors, Service Managers |

The Southeast Asia Aviation Market is valued at approximately USD 36 billion, driven by increasing air travel demand, rising disposable incomes, and the expansion of low-cost carriers, making air travel more accessible to a broader population.