Region:Europe

Author(s):Geetanshi

Product Code:KRAB2782

Pages:96

Published On:October 2025

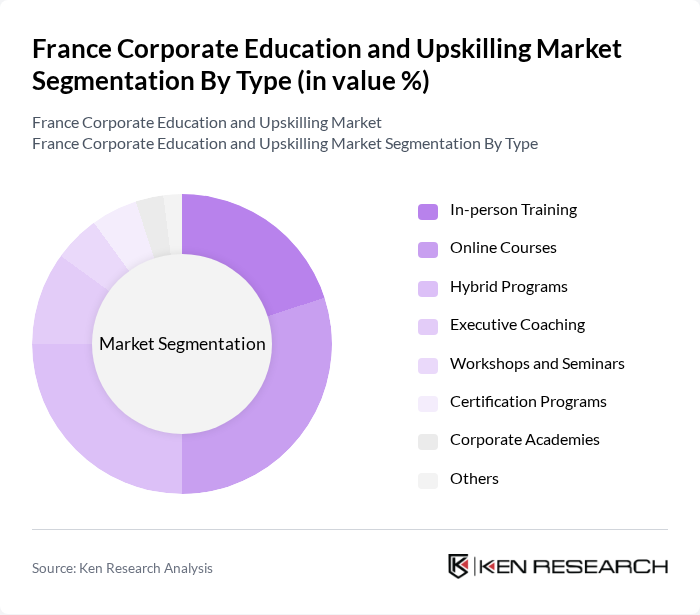

By Type:The market is segmented into various types of educational offerings, including In-person Training, Online Courses, Hybrid Programs, Executive Coaching, Workshops and Seminars, Certification Programs, Corporate Academies, and Others. Each segment addresses distinct learning preferences and organizational objectives. There is a notable trend towards online and hybrid formats, driven by digital transformation, the normalization of remote work, and the need for scalable, flexible learning solutions. Online courses currently represent the largest segment, reflecting the increasing preference for accessible and technology-enabled training among professionals .

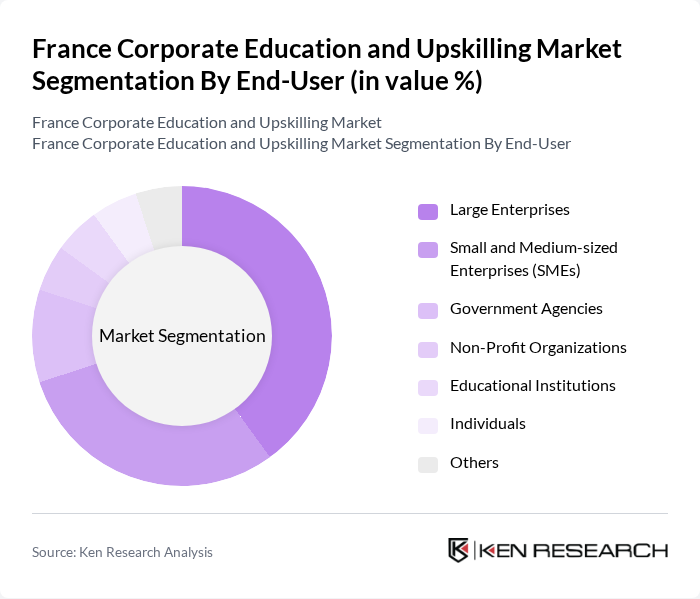

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium-sized Enterprises (SMEs), Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Each segment has unique training priorities and budget constraints. Large enterprises are the leading end-user segment, supported by substantial training budgets and a strategic focus on leadership pipeline development. SMEs and public sector organizations are increasingly investing in digital and modular offerings to maximize impact and efficiency .

The France Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as OpenClassrooms, Skillsoft, Cegos Group, Demos, My Mooc, CrossKnowledge, Talentsoft, LinkedIn Learning, Udemy Business, 360Learning, Learnlight, Edflex, GoFluent, Coorpacademy, Unow, SchoolMouv, Fun Mooc, Educademy, HEC Paris Executive Education, and ESCP Business School Executive Education contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and upskilling market in France appears promising, driven by technological advancements and evolving workforce needs. As companies increasingly adopt digital tools, the integration of AI in training programs is expected to enhance learning experiences. Additionally, the emphasis on soft skills development will likely grow, addressing the need for interpersonal skills in a hybrid work environment. These trends indicate a shift towards more personalized and engaging learning solutions that align with employee aspirations and organizational goals.

| Segment | Sub-Segments |

|---|---|

| By Type | In-person Training Online Courses Hybrid Programs Executive Coaching Workshops and Seminars Certification Programs Corporate Academies (internal company-run academies) Others |

| By End-User | Large Enterprises Small and Medium-sized Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Retail Public Sector Others |

| By Delivery Mode | Online Delivery Face-to-Face Delivery Blended Delivery Mobile Learning Others |

| By Program Duration | Short-Term (less than 1 month) Medium-Term (1-6 months) Long-Term (6 months - 1 year) Executive Programs (1 year and above) Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Micro-Credentials Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Tiered Pricing (by program level) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in Technology | 100 | HR Managers, Training Coordinators |

| Upskilling Initiatives in Finance | 80 | Finance Directors, Learning & Development Specialists |

| Healthcare Sector Training Strategies | 60 | Healthcare Administrators, Compliance Officers |

| Manufacturing Skills Development | 50 | Operations Managers, Training Supervisors |

| Retail Sector Employee Upskilling | 60 | Store Managers, HR Business Partners |

The France Corporate Education and Upskilling Market is valued at approximately USD 4.3 billion, reflecting a significant growth driven by the demand for skilled labor and the need for continuous employee development in a rapidly evolving market.