Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1249

Pages:90

Published On:August 2025

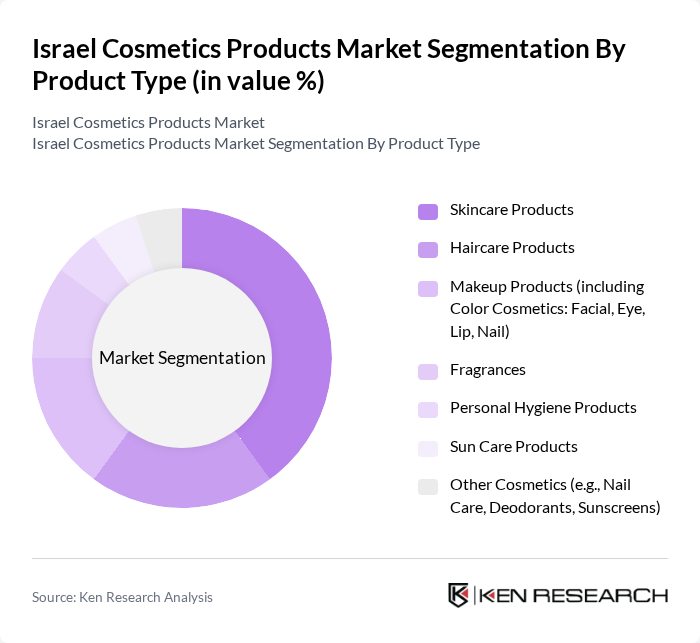

By Product Type:The product type segmentation includes various categories such as skincare products, haircare products, makeup products (including color cosmetics), fragrances, personal hygiene products, sun care products, and other cosmetics. Among these, skincare products dominate the market due to the increasing awareness of skin health and the growing trend of self-care among consumers. The demand for anti-aging creams, moisturizers, and serums has surged, driven by a focus on maintaining youthful skin and the influence of social media beauty trends .

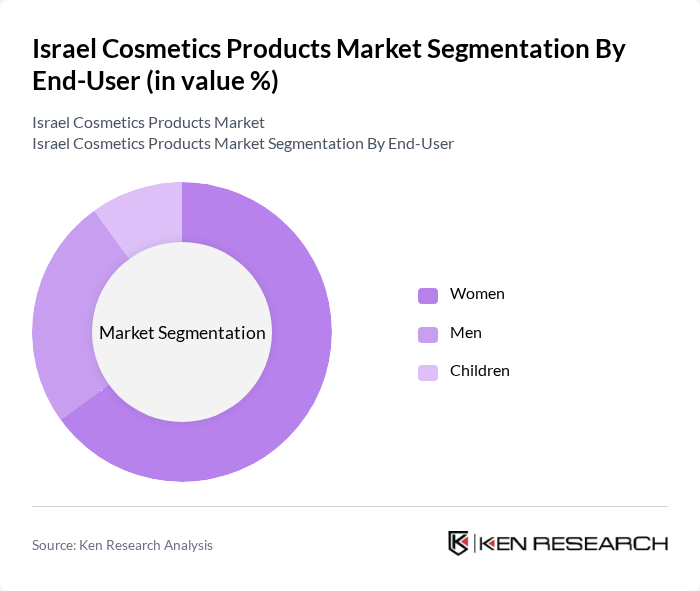

By End-User:The end-user segmentation includes women, men, and children. Women represent the largest segment, driven by their higher engagement with beauty and personal care products. The increasing focus on skincare and makeup among women, influenced by social media and beauty influencers, has led to a significant rise in demand. Men’s grooming products are also gaining traction, reflecting changing societal norms and increasing acceptance of male cosmetics .

The Israel Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Israel Ltd., Estée Lauder Companies Inc., Shiseido Company, Limited, Procter & Gamble Israel, Unilever Israel Ltd., Ahava Dead Sea Laboratories Ltd., Cosmopharm Ltd., Danya Cosmetics Ltd., Moraz Medical Herbs, Olea Essence, Lilit Cosmetics Ltd., Pharma Cosmetics Laboratories Ltd., Revlon Israel, The Body Shop International Limited, FARAN contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Israeli cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for personalized and sustainable products continues to rise, brands are likely to invest in innovative formulations and eco-friendly packaging solutions. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to a diverse range of products, enhancing consumer engagement and driving market growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skincare Products Haircare Products Makeup Products (including Color Cosmetics: Facial, Eye, Lip, Nail) Fragrances Personal Hygiene Products Sun Care Products Other Cosmetics (e.g., Nail Care, Deodorants, Sunscreens) |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Stores Hypermarkets/Supermarkets Specialty Stores Pharmacies and Drugstores Other Distribution Channels |

| By Price Range | Premium Mid-range Budget |

| By Ingredient Type | Natural/Organic Ingredients Synthetic Ingredients |

| By Packaging Type | Bottles and Jars Tubes Pumps & Dispensers Blisters, Strip Packs, Pouches, Aerosol Cans, Sticks, Containers |

| By Brand Type | Local Brands International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Retailers | 100 | Store Managers, Beauty Advisors |

| Makeup Product Distributors | 80 | Sales Representatives, Brand Managers |

| Haircare Product Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Consumer Focus Groups | 50 | Regular Cosmetics Users, Beauty Enthusiasts |

| E-commerce Cosmetics Platforms | 70 | eCommerce Managers, Digital Marketing Specialists |

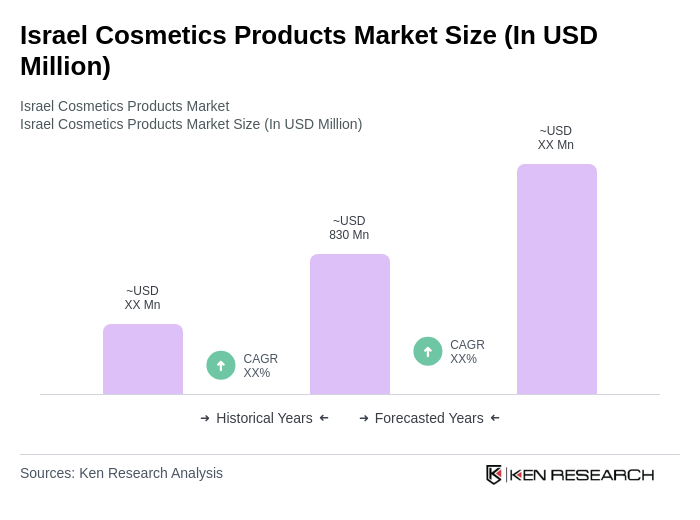

The Israel Cosmetics Products Market is valued at approximately USD 830 million, reflecting a significant growth trend driven by consumer demand for high-quality beauty products and the increasing popularity of natural and organic ingredients.