Region:Europe

Author(s):Geetanshi

Product Code:KRAD0109

Pages:98

Published On:August 2025

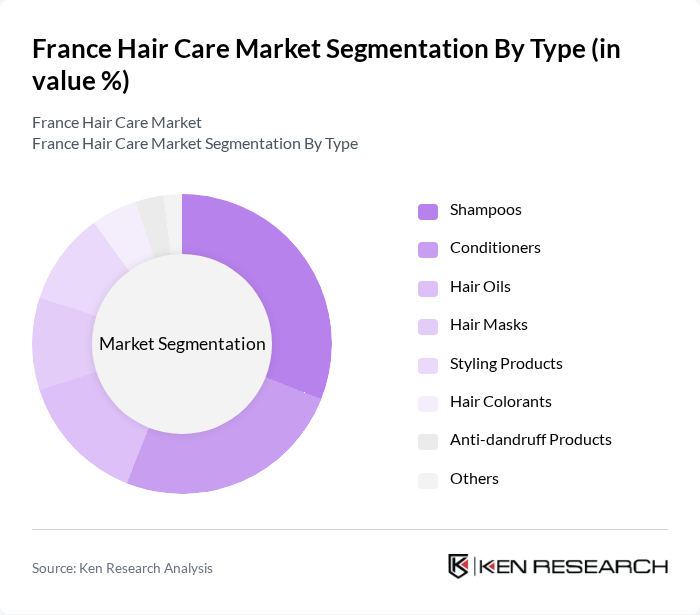

By Type:The hair care market can be segmented into various types, including shampoos, conditioners, hair oils, hair masks, styling products, hair colorants, anti-dandruff products, and others. Among these, shampoos and conditioners are the most dominant segments, driven by their essential role in daily hair care routines. The increasing demand for specialized products, such as organic and sulfate-free options, is also notable. Shampoo leads the market, accounting for the largest share, followed by conditioners .

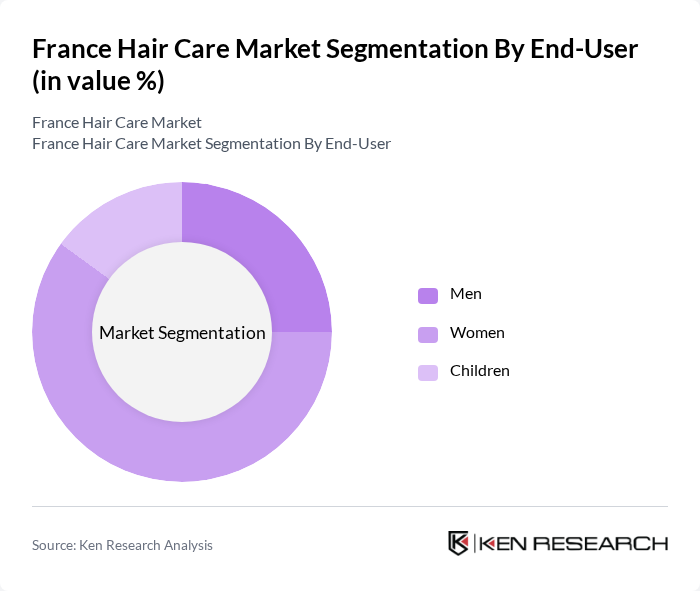

By End-User:The market is segmented based on end-users, including men, women, and children. Women represent the largest consumer group, driven by a higher emphasis on hair care and styling. Men’s grooming is also on the rise, with increasing awareness and acceptance of hair care products tailored for male consumers. Children’s products are gaining traction as parents seek safe and gentle formulations for their kids .

The France Hair Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A., Procter & Gamble Co., Unilever PLC, Coty Inc., Henkel AG & Co. KGaA, Pierre Fabre S.A., Eugène Perma France, Revlon Inc., Kao Corporation, Beiersdorf AG, Laboratoires Klorane (Pierre Fabre Group), Phyto (Laboratoires Phytosolba), Schwarzkopf Professional (Henkel AG & Co. KGaA), Garnier (L'Oréal S.A.), Wella Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France hair care market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands are likely to invest in eco-friendly packaging and formulations. Additionally, the integration of AI and personalized solutions in product development is expected to enhance customer experiences. The market will continue to adapt to these trends, fostering innovation and growth opportunities for both established and emerging brands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Shampoos Conditioners Hair Oils Hair Masks Styling Products Hair Colorants Anti-dandruff Products Others |

| By End-User | Men Women Children |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Pharmacies/Drugstores Salons and Spas |

| By Price Range | Premium Mid-range Economy |

| By Product Formulation | Organic Conventional |

| By Packaging Type | Bottles Tubes Jars Sachets |

| By Brand Loyalty | Brand-loyal Consumers Price-sensitive Consumers Trend-driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Care Preferences | 120 | Regular Hair Care Users, Trendsetters |

| Salon Product Usage | 60 | Salon Owners, Hair Stylists |

| Retail Distribution Insights | 50 | Retail Managers, Category Buyers |

| Market Trends in Organic Products | 40 | Eco-conscious Consumers, Health & Wellness Advocates |

| Brand Loyalty and Switching Behavior | 70 | Brand Loyalists, Occasional Users |

The France Hair Care Market is valued at approximately USD 2.8 billion, reflecting a significant growth trend driven by consumer awareness of personal grooming and the demand for organic and natural products.