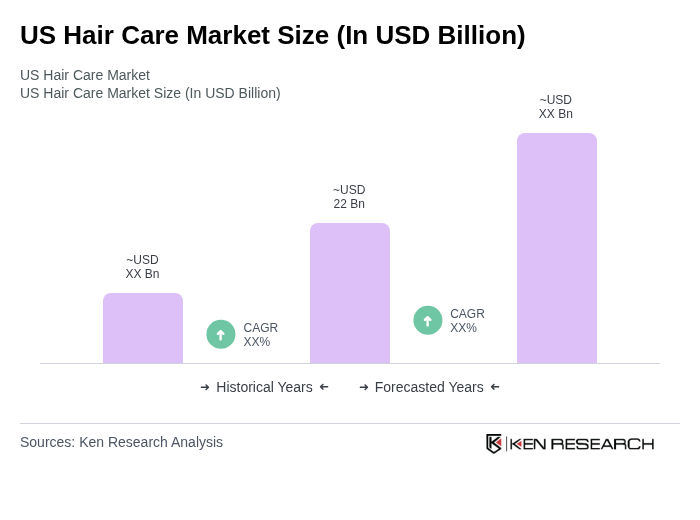

US Hair Care Market Overview

- The US Hair Care Market is valued at USD 22 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding personal grooming, the rise of social media influencers promoting hair care products, and the growing demand for organic and natural hair care solutions. The market has seen a significant shift towards premium products, reflecting changing consumer preferences, with notable traction for vegan, clean-label, and personalized hair care offerings .

- Key demand centers in this market include major cities such as New York, Los Angeles, and Chicago, which dominate due to their large populations, diverse demographics, and high disposable incomes. These urban centers are also hubs for fashion and beauty trends, influencing consumer behavior and driving demand for innovative hair care products .

- The Modernization of Cosmetics Regulation Act of 2022, issued by the US Food and Drug Administration, requires all hair care products marketed in the United States to disclose full ingredient lists and safety substantiation. This regulation, effective from 2023, aims to enhance consumer safety and promote transparency in the beauty industry, ensuring that consumers are informed about the products they use on their hair. The Act mandates manufacturers to register facilities, list products, and report adverse events, with compliance required for all cosmetic and hair care products distributed in the US .

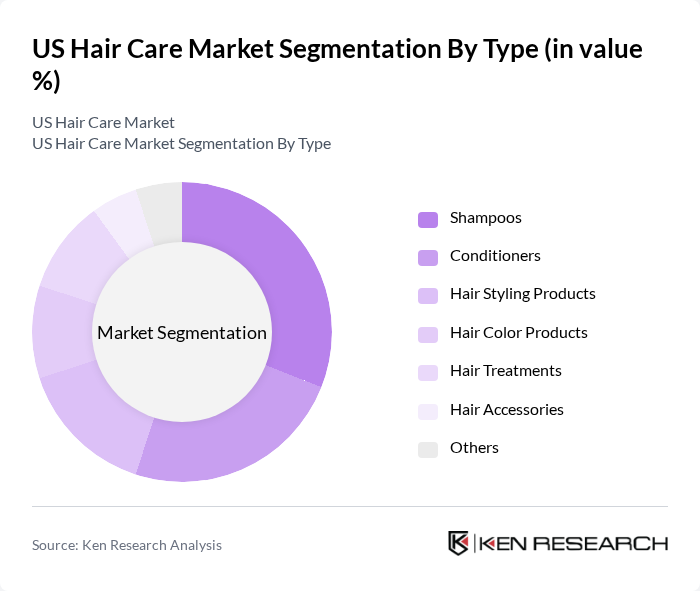

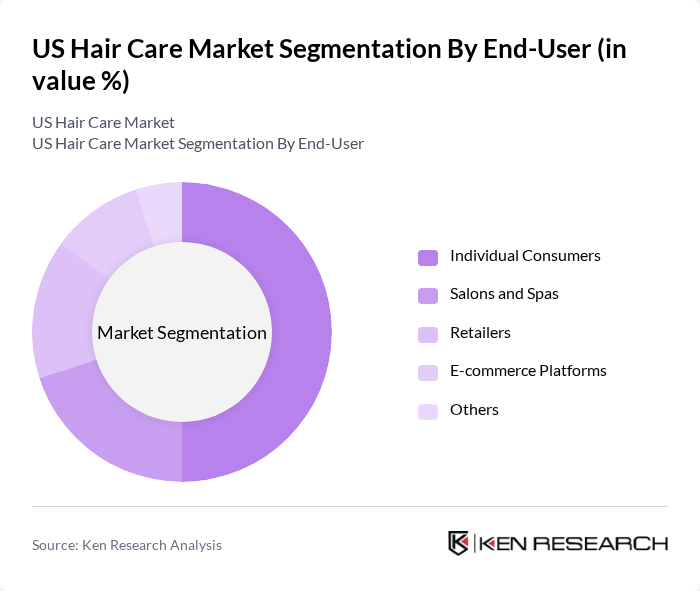

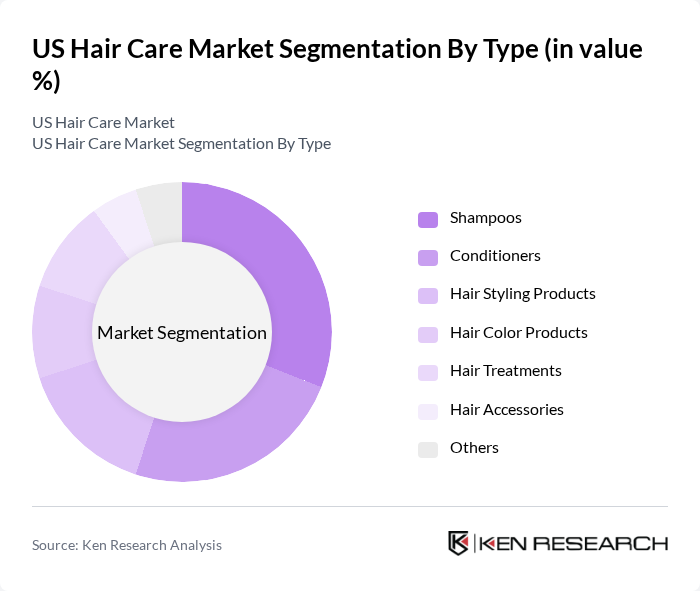

US Hair Care Market Segmentation

By Type:The hair care market is segmented into various types, including shampoos, conditioners, hair styling products, hair color products, hair treatments, hair accessories, and others. Among these, shampoos and conditioners are the most dominant segments, driven by their essential role in daily hair care routines. The increasing trend of personalized hair care solutions has also led to a rise in specialized shampoos and conditioners catering to specific hair types and concerns. The demand for hair loss treatments and scalp care products is also rising, reflecting consumer interest in targeted, performance-driven solutions .

By End-User:The end-user segmentation includes individual consumers, salons and spas, retailers, e-commerce platforms, and others. Individual consumers represent the largest segment, as personal grooming and hair care have become integral to daily routines. The rise of e-commerce has also significantly impacted the market, allowing consumers to access a wider range of products conveniently. Salons and spas are increasingly adopting professional-grade and organic hair care solutions, while retailers and online platforms are expanding their offerings to cater to evolving consumer preferences .

US Hair Care Market Competitive Landscape

The US Hair Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Unilever, L'Oréal USA, Coty Inc., The Estée Lauder Companies, Revlon Consumer Products Corporation, Johnson & Johnson Consumer Inc., Henkel Corporation, Shiseido Company, Limited, Amway Corporation, Mary Kay Inc., Avon Products, Inc., Oribe Hair Care, Ouai Haircare, Bumble and bumble contribute to innovation, geographic expansion, and service delivery in this space.

US Hair Care Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Hair Health:The US hair care market is witnessing a surge in consumer awareness regarding hair health, with 75% of consumers actively seeking products that promote scalp and hair wellness. This trend is supported by a report from the American Academy of Dermatology, which indicates that 80 million Americans are affected by hair-related issues annually. As consumers prioritize hair health, brands are responding with targeted marketing and product development, driving market growth significantly.

- Rise in Demand for Organic and Natural Products:The demand for organic and natural hair care products is escalating, with sales projected to reach $2 billion in future. According to the Organic Trade Association, 55% of consumers prefer products with natural ingredients, reflecting a broader trend towards sustainability. This shift is further supported by a Nielsen report, which found that 50% of consumers are willing to pay a premium for eco-friendly products, thus propelling the market forward.

- Growth of E-commerce Platforms for Hair Care Products:E-commerce sales of hair care products are expected to exceed $4 billion in future, driven by a 30% increase in online shopping habits. The US Census Bureau reported that e-commerce accounted for 20% of total retail sales in 2023, highlighting a significant shift in consumer purchasing behavior. This trend is further enhanced by the convenience and variety offered by online platforms, making them a crucial growth driver in the hair care market.

Market Challenges

- Intense Competition Among Established Brands:The US hair care market is characterized by fierce competition, with over 150 brands vying for market share. Major players like Procter & Gamble and Unilever dominate, holding approximately 45% of the market. This intense rivalry leads to aggressive pricing strategies and marketing campaigns, which can squeeze profit margins for smaller brands. As a result, maintaining brand loyalty and differentiation becomes increasingly challenging in this saturated market.

- Fluctuating Raw Material Prices:The hair care industry faces challenges from fluctuating raw material prices, particularly for key ingredients like natural oils and extracts. In future, the price of coconut oil is projected to rise by 20% due to supply chain disruptions and increased demand. This volatility can significantly impact production costs, forcing brands to either absorb the costs or pass them onto consumers, potentially affecting sales and profitability.

US Hair Care Market Future Outlook

The US hair care market is poised for continued evolution, driven by trends such as the increasing demand for personalized hair care solutions and the rise of sustainable products. As consumers become more discerning, brands that innovate with tailored offerings and eco-friendly practices are likely to thrive. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, ensuring that the market remains dynamic and responsive to changing preferences.

Market Opportunities

- Growth in the Male Grooming Segment:The male grooming segment is projected to reach $1.5 billion in future, reflecting a growing acceptance of hair care among men. This demographic shift presents a significant opportunity for brands to develop targeted products, catering to the unique needs of male consumers, thus expanding their market reach and driving sales growth.

- Increasing Popularity of Subscription Services:Subscription services for hair care products are gaining traction, with an estimated market value of $600 million in future. This model offers convenience and personalized experiences, appealing to busy consumers. Brands that leverage subscription models can enhance customer loyalty and ensure consistent revenue streams, capitalizing on this emerging trend.