Region:Middle East

Author(s):Shubham

Product Code:KRAB0755

Pages:90

Published On:August 2025

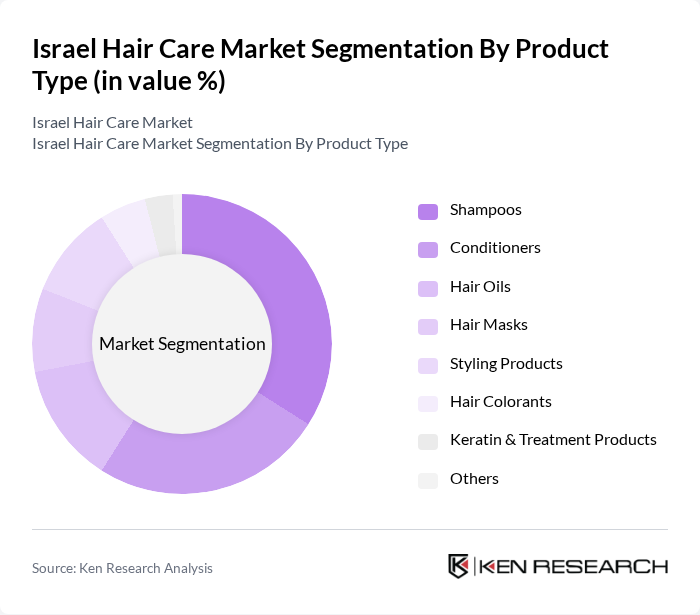

By Product Type:The product type segmentation includes various categories such as shampoos, conditioners, hair oils, hair masks, styling products, hair colorants, keratin & treatment products, and others. Among these, shampoos are the most dominant segment, accounting for over one-third of the market, driven by their essential role in daily hair care routines. Conditioners also hold a substantial share, reflecting evolving consumer needs for moisturizing and detangling solutions. The increasing trend towards natural and organic formulations, as well as multifunctional products that combine treatment and styling benefits, has influenced consumer preferences and led to a rise in demand for specialized products .

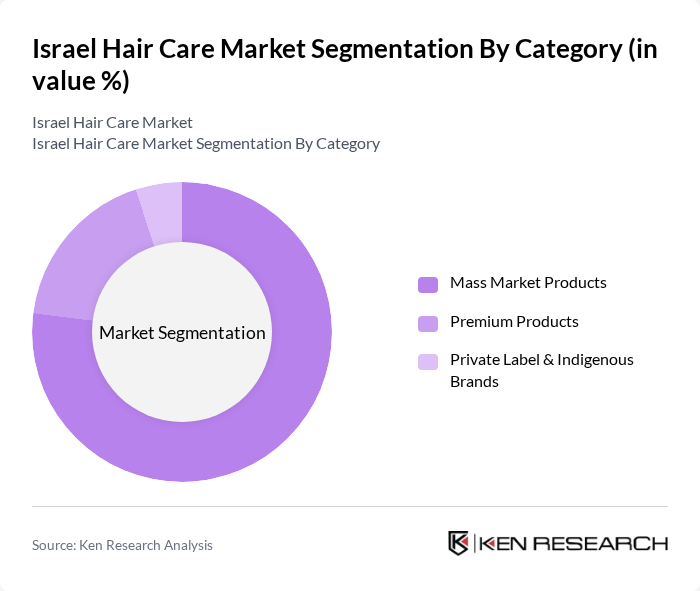

By Category:The category segmentation includes mass market products, premium products, and private label & indigenous brands. The mass market products segment currently leads, reflecting the price sensitivity of the broader Israeli consumer base. However, the premium products segment is experiencing faster growth, driven by a growing consumer inclination towards high-quality, effective hair care solutions and rising disposable incomes. Private label and indigenous brands are also gaining traction, particularly among consumers seeking unique or locally formulated products .

The Israel Hair Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Israel Ltd., Procter & Gamble Israel Ltd., Unilever Israel Ltd., Moroccanoil Israel Ltd., La Beaute Ltd., My Way Cosmetics Ltd., Pro Berry Ltd., Sano-Bruno's Enterprises Ltd., Garnier (L'Oréal Israel), Schwarzkopf Professional (Henkel Israel), Wella Professionals (Coty Israel), TRESemmé (Unilever Israel), Kerastase (L'Oréal Israel), Redken (L'Oréal Israel), Paul Mitchell (Distributed by Hairpro Israel), Aveda (Distributed by Elita Cosmetics), Davines (Distributed by Davines Israel), Oribe (Distributed by Oribe Israel) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Israeli hair care market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly packaging and formulations. Additionally, the rise of personalized hair care solutions, leveraging AI and data analytics, will likely enhance customer engagement and satisfaction. The market is poised for growth as companies adapt to these trends and invest in product development and marketing strategies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shampoos Conditioners Hair Oils Hair Masks Styling Products Hair Colorants Keratin & Treatment Products Others |

| By Category | Mass Market Products Premium Products Private Label & Indigenous Brands |

| By End-User | Men Women Children |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Salons and Spas Pharmacies/Drugstores |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Bottles Tubes Jars Sachets |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Halal-Compliant Ingredients |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche & Specialty Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Care Preferences | 100 | Regular Hair Care Users, Trendsetters |

| Salon Product Usage | 60 | Salon Owners, Hair Stylists |

| Retail Distribution Insights | 40 | Retail Managers, Category Buyers |

| Brand Loyalty and Switching Behavior | 80 | Frequent Hair Care Product Buyers |

| Market Trends and Innovations | 50 | Industry Experts, Market Analysts |

The Israel Hair Care Market is valued at approximately USD 450 million, reflecting a significant growth trend driven by consumer awareness, e-commerce expansion, and a preference for organic and natural products.