Region:Global

Author(s):Shubham

Product Code:KRAC0636

Pages:94

Published On:August 2025

By Type:The hair care market is segmented into various types, including shampoos, conditioners, hair oils, hair styling products, hair colorants, treatments and masks, and serums and leave-in treatments. Among these, shampoos and conditioners are the most dominant segments, driven by their essential role in daily hair care routines. The increasing demand for specialized products, such as sulfate-free, silicone-free, and organic options, as well as scalp-care and bond-repair treatments, is shaping consumer preferences .

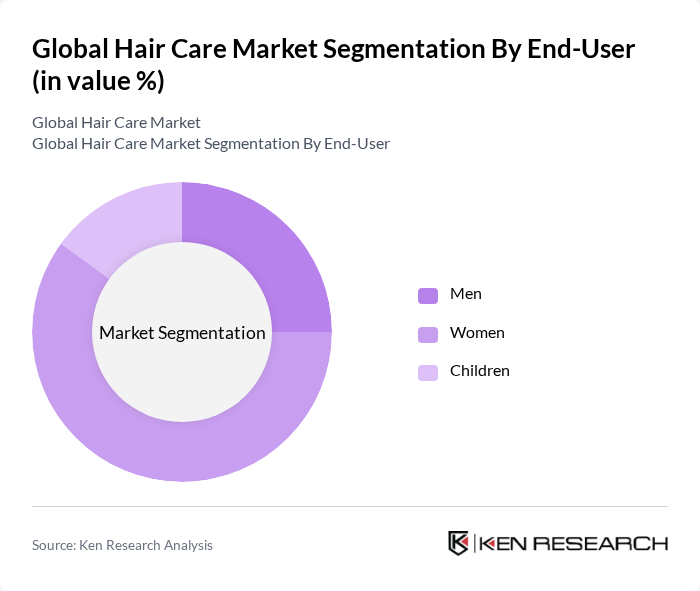

By End-User:The market is segmented by end-user into men, women, and children. Women represent the largest segment, driven by a higher inclination towards hair care products and a wider variety of available options. Men’s grooming is also on the rise, with increasing awareness and acceptance of hair care products tailored specifically for them. The children’s segment is growing steadily, influenced by parents' preferences for gentle and safe products .

The Global Hair Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co. (Pantene, Head & Shoulders, Herbal Essences), Unilever PLC (Dove, TRESemmé, Sunsilk), L’Oréal S.A. (L’Oréal Paris, Kérastase, Redken), Coty Inc. (Wella Company stake divested; retains select styling/color brands), The Estée Lauder Companies Inc. (Aveda, Bumble and bumble), Henkel AG & Co. KGaA (Schwarzkopf, Syoss), Revlon, Inc. (Revlon, American Crew), Shiseido Company, Limited (Shiseido Professional), Kao Corporation (John Frieda, Goldwell), Amway Corporation (Satinique), Mary Kay Inc. (Hair care accessories and limited hair products), Avon Products, Inc. (Avon Hair Care), Johnson & Johnson (OGX brand via Vogue International acquisition), PZ Cussons plc (Original Source, Cussons Baby), Beiersdorf AG (NIVEA Hair Care), Wella Company (Wella Professionals, Clairol, Nioxin), Moroccanoil Israel Ltd. (Moroccanoil), Lush Cosmetics Ltd. (Lush hair care), Mandom Corporation (Gatsby), Godrej Consumer Products Limited (Godrej Expert, BBLUNT) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hair care market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to invest in eco-friendly packaging and formulations. Additionally, the integration of artificial intelligence in product personalization will likely enhance customer experiences. Companies that adapt to these trends and focus on innovation will be well-positioned to capture market share and meet the demands of a more conscious consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Shampoos Conditioners Hair Oils Hair Styling Products Hair Colorants Treatments and Masks Serums and Leave-in Treatments |

| By End-User | Men Women Children |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Salons and Spas Pharmacy & Drug Stores |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Bottles Tubes Jars Sachets |

| By Ingredient Type | Natural Synthetic Organic Sulfate-free/Paraben-free |

| By Product Formulation | Sulfate-free Paraben-free Color-safe Hair Type-Specific (Curly, Wavy, Straight, Coily) |

| By End Use | Individual/At-Home Professional/Salon |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Care Preferences | 150 | Regular Hair Care Users, Beauty Enthusiasts |

| Salon Product Usage | 100 | Salon Owners, Hair Stylists |

| Market Trends in Natural Hair Care | 80 | Eco-conscious Consumers, Organic Product Advocates |

| Impact of Social Media on Hair Care Choices | 120 | Social Media Influencers, Digital Marketing Managers |

| Retail Distribution Insights | 90 | Retail Managers, Supply Chain Managers |

The Global Hair Care Market is valued at approximately USD 105108 billion, driven by increasing consumer awareness of personal grooming, the rise of e-commerce, and a growing demand for organic and natural hair care products.