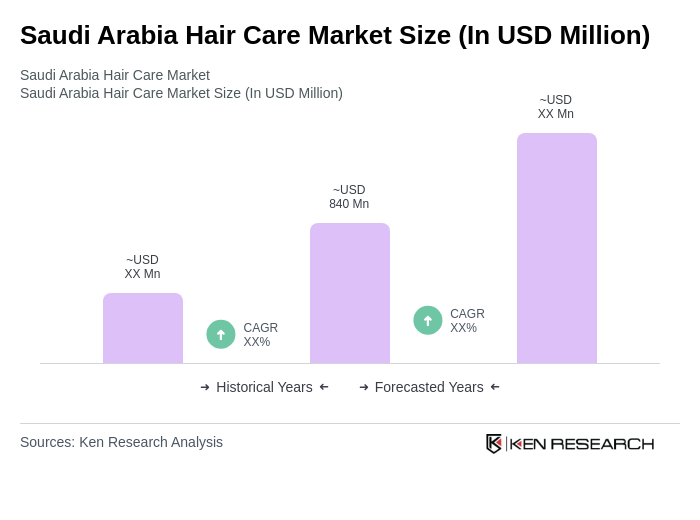

Saudi Arabia Hair Care Market Overview

- The Saudi Arabia Hair Care Market is valued at USD 840 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding personal grooming, the rise of e-commerce platforms, and the growing influence of social media on beauty trends. The market has seen a surge in demand for premium and organic hair care products, reflecting changing consumer preferences towards quality and sustainability .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their large populations and urbanization. These cities are also home to a significant number of beauty salons and retail outlets, making them central hubs for hair care product distribution. The affluent consumer base in these urban areas further drives the demand for high-quality hair care products .

- In 2023, the Saudi government implemented regulations to enhance the safety and quality of cosmetic products, including hair care items. This regulation mandates that all hair care products must undergo rigorous testing for safety and efficacy before being approved for sale in the market. This initiative aims to protect consumers and ensure that only high-quality products are available in the market .

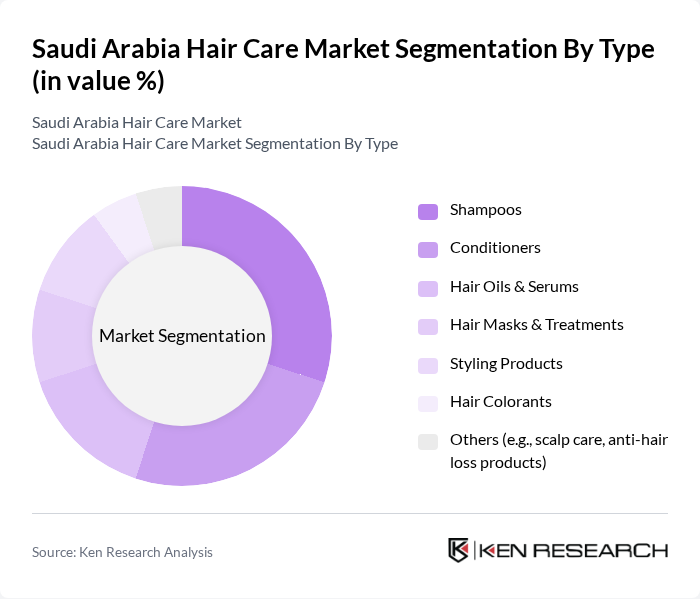

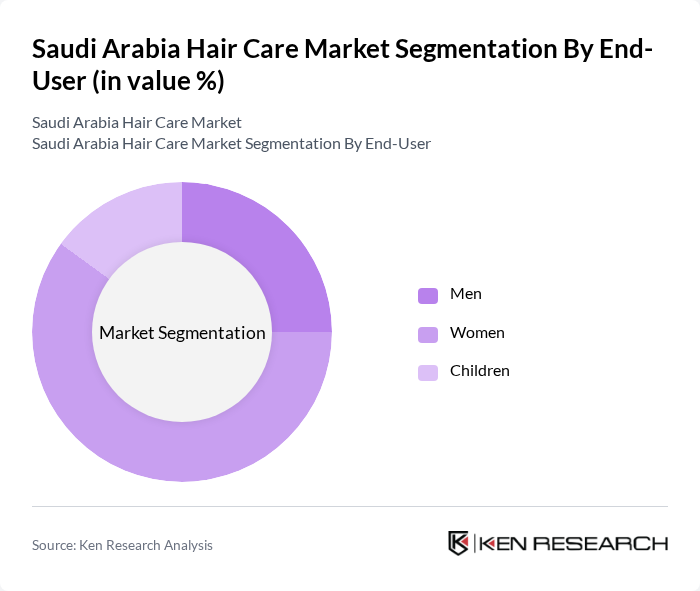

Saudi Arabia Hair Care Market Segmentation

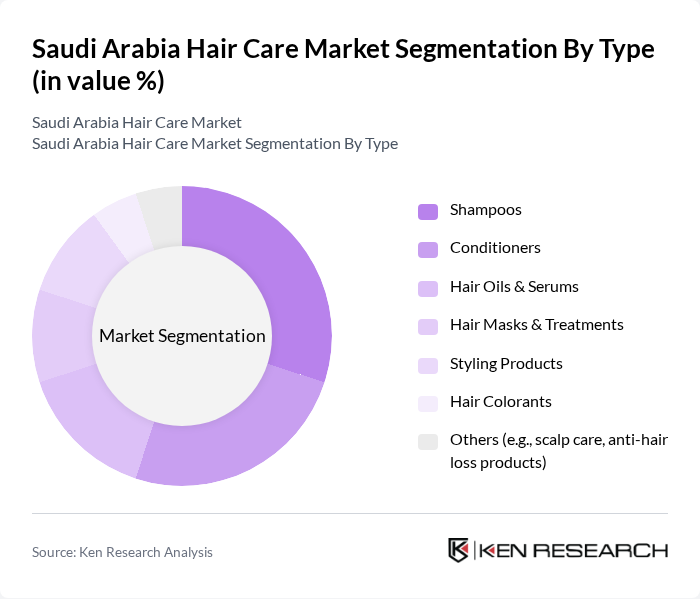

By Type:The hair care market can be segmented into various types, including shampoos, conditioners, hair oils & serums, hair masks & treatments, styling products, hair colorants, and others such as scalp care and anti-hair loss products. Among these, shampoos and conditioners are the most popular due to their essential role in daily hair care routines. The increasing trend towards natural and organic products is also influencing consumer choices, leading to a rise in demand for specialized hair care solutions .

By End-User:The market is segmented based on end-users, including men, women, and children. Women represent the largest segment due to their diverse hair care needs and preferences for various products. The increasing focus on men's grooming and hair care is also notable, with a growing number of products tailored specifically for men. Children’s hair care products are gaining traction as parents become more aware of the importance of gentle and safe formulations for their children .

Saudi Arabia Hair Care Market Competitive Landscape

The Saudi Arabia Hair Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Procter & Gamble Saudi Arabia, Unilever Arabia, Henkel Arabia, Beiersdorf AG, Coty Inc., Shiseido Company, Limited, Estée Lauder Companies Inc., Amway Arabia, Mary Kay Inc., Avon Products, Inc., Revlon, Inc., Oriflame Cosmetics S.A., Argania (Saudi local brand), The Body Shop International Limited, Dabur Saudi Arabia, Alkhuraiji Cosmetics Company, Nazih Group, Himalaya Herbals, Al-Dawaa Pharmacies (Private Label) contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Hair Care Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Hair Health:The Saudi Arabian population is becoming increasingly aware of the importance of hair health, with 65% of consumers actively seeking products that promote hair vitality. This trend is supported by a growing number of beauty salons and hair care specialists, which have increased from 1,200 in the past to over 1,800 in recent years. Additionally, educational campaigns by brands have contributed to a 30% rise in the demand for specialized hair care products, reflecting a shift towards informed consumer choices.

- Rising Disposable Income:The average disposable income in Saudi Arabia is projected to reach SAR 90,000 (approximately USD 23,000) per capita in future, up from SAR 75,000 in recent years. This increase allows consumers to allocate more funds towards personal care, including hair care products. As a result, premium hair care brands have seen a 25% increase in sales, indicating that consumers are willing to invest in higher-quality products that promise better results and align with their lifestyle aspirations.

- Growth in the Beauty and Personal Care Sector:The beauty and personal care sector in Saudi Arabia is expected to grow to SAR 40 billion (approximately USD 10.7 billion) by future, driven by a surge in demand for hair care products. This growth is fueled by the increasing number of beauty influencers and social media campaigns that promote hair care routines. The sector's expansion has led to a 40% increase in new product launches, particularly in the hair care segment, catering to diverse consumer needs and preferences.

Market Challenges

- Intense Competition Among Brands:The Saudi hair care market is characterized by fierce competition, with over 150 brands vying for market share. This saturation has led to aggressive pricing strategies, resulting in a 15% decline in profit margins for many companies. Additionally, established brands are investing heavily in marketing and innovation, making it challenging for new entrants to gain traction. The competitive landscape necessitates continuous product differentiation and strategic marketing to maintain relevance in the market.

- Fluctuating Raw Material Prices:The hair care industry in Saudi Arabia faces challenges due to the volatility of raw material prices, particularly for key ingredients like silicones and natural oils. In future, prices for these materials have shown volatility due to supply chain disruptions and geopolitical factors. This fluctuation impacts production costs and can lead to higher retail prices, potentially reducing consumer demand. Companies must navigate these challenges by optimizing supply chains and exploring alternative sourcing strategies to mitigate risks.

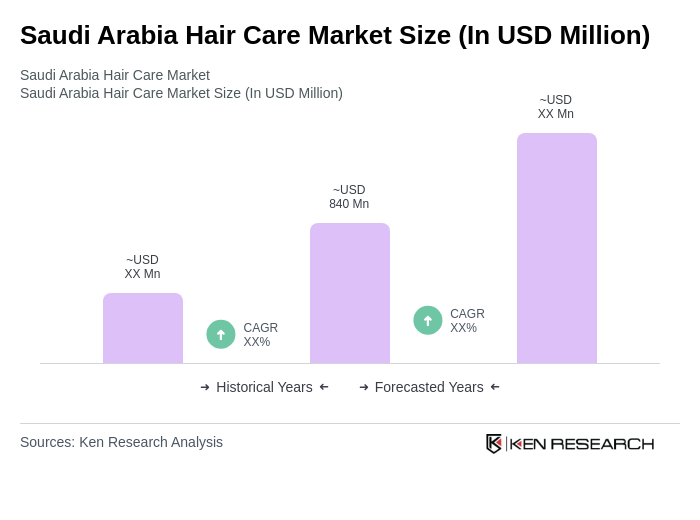

Saudi Arabia Hair Care Market Future Outlook

The future of the Saudi Arabia hair care market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly formulations and packaging. Additionally, the rise of digital platforms will facilitate personalized shopping experiences, allowing consumers to tailor products to their specific hair needs. The market is likely to witness increased investment in research and development, leading to the introduction of cutting-edge products that cater to diverse demographics and preferences.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Saudi Arabia, projected to reach SAR 30 billion (approximately USD 8 billion) by future, presents significant opportunities for hair care brands. Online sales channels allow for broader market reach and targeted marketing strategies, enabling brands to connect with tech-savvy consumers who prefer shopping online. This shift is expected to enhance brand visibility and drive sales growth in the hair care segment.

- Introduction of Organic and Natural Products:The demand for organic and natural hair care products is on the rise, with sales expected to increase by 30% in future. Consumers are increasingly seeking products free from harmful chemicals, leading brands to innovate with natural ingredients. This trend not only aligns with health-conscious consumer behavior but also opens avenues for brands to differentiate themselves in a crowded market, appealing to environmentally aware customers.