Region:Europe

Author(s):Dev

Product Code:KRAC0448

Pages:97

Published On:August 2025

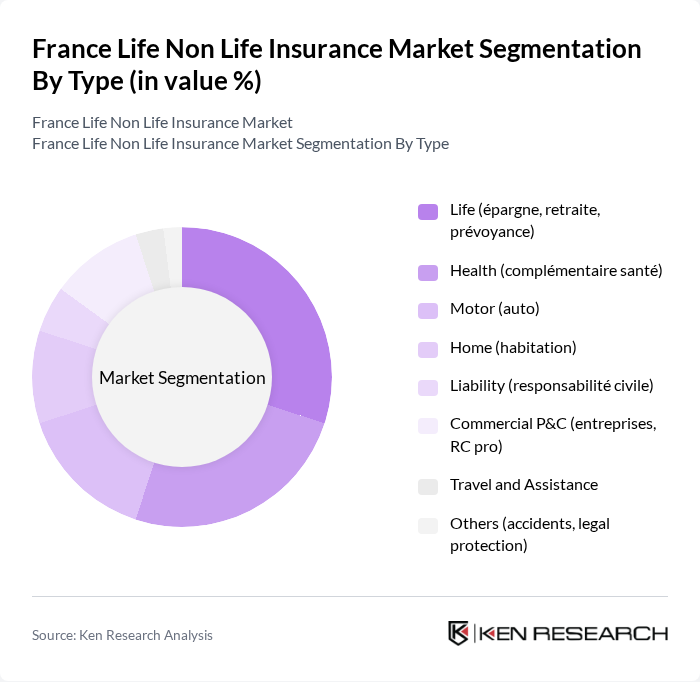

By Type:The market is segmented into various types, including Life (épargne, retraite, prévoyance), Health (complémentaire santé), Motor (auto), Home (habitation), Liability (responsabilité civile), Commercial P&C (entreprises, RC pro), Travel and Assistance, and Others (accidents, legal protection). Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of insurance products available in France. Recent dynamics include resilient demand for life savings and unit-linked products, and firm pricing in P&C segments such as motor and property to offset higher claims costs, supporting stable penetration in mature lines.

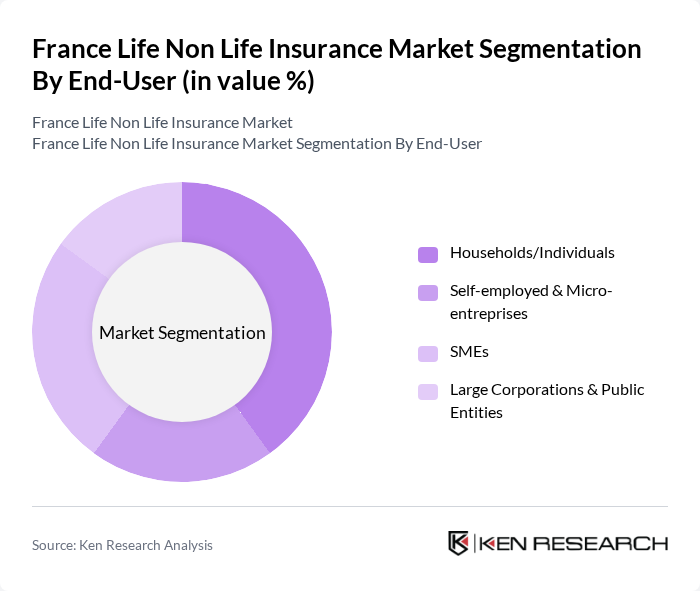

By End-User:The end-user segmentation includes Households/Individuals, Self-employed & Micro-entreprises, SMEs, and Large Corporations & Public Entities. Each segment has unique insurance needs, with households focusing on personal insurance and larger entities requiring comprehensive coverage for business risks. Recent trends include customer uptake of usage-based motor insurance and broader adoption of digital channels among households, alongside risk-adjusted pricing and tailored multi-line programs for SMEs and corporates in response to inflationary claims and supply-chain risks.

The France Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AXA S.A., CNP Assurances, Crédit Agricole Assurances (Predica, Pacifica), BNP Paribas Cardif, Société Générale Assurances (Sogécap, Sogessur), Groupama, MAIF, Macif (Aéma Groupe), GMF (Covéa), MMA (Covéa), MAAF (Covéa), Allianz France, Generali France, Swiss Life France, La Banque Postale Assurances contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Life Non Life Insurance market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As insurers increasingly adopt digital platforms, customer engagement is expected to improve significantly. Furthermore, the focus on personalized insurance solutions will likely lead to enhanced customer satisfaction. The market is also anticipated to benefit from the growing trend of sustainability, with insurers developing eco-friendly products that align with consumer values and regulatory expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Life (épargne, retraite, prévoyance) Health (complémentaire santé) Motor (auto) Home (habitation) Liability (responsabilité civile) Commercial P&C (entreprises, RC pro) Travel and Assistance Others (accidents, legal protection) |

| By End-User | Households/Individuals Self-employed & Micro-entreprises SMEs Large Corporations & Public Entities |

| By Distribution Channel | Bancassurance Agents Brokers Direct & Digital (insurer websites, insurtech) |

| By Policy Type (Life) | Term Life (décès) Whole Life Endowment/Savings (assurance-vie en euros) Unit-linked (unités de compte) Pension/Retirement (PER) |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | Young Adults Families Seniors High Net Worth Individuals |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Products | 120 | Insurance Product Managers, Actuaries |

| Health Insurance Market | 110 | Healthcare Underwriters, Claims Adjusters |

| Property Insurance Sector | 100 | Risk Managers, Policy Analysts |

| Casualty Insurance Insights | 80 | Loss Control Specialists, Compliance Officers |

| Consumer Behavior in Insurance | 140 | Policyholders, Insurance Advisors |

The France Life Non Life Insurance Market is valued at approximately USD 265 billion, reflecting a robust growth trajectory driven by life savings products and property and casualty insurance. This valuation aligns with industry estimates of around EUR 244 billion in recent years.